Question: 19. Which capital structure should we consider when calculating the WACC for a subsidiary valuation: the one that is reasonable according to the risk

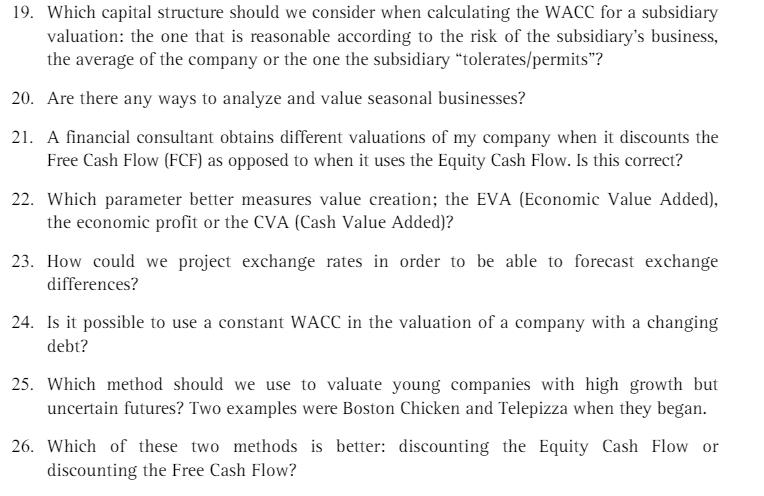

19. Which capital structure should we consider when calculating the WACC for a subsidiary valuation: the one that is reasonable according to the risk of the subsidiary's business, the average of the company or the one the subsidiary "tolerates/permits"? 20. Are there any ways to analyze and value seasonal businesses? 21. A financial consultant obtains different valuations of my company when it discounts the Free Cash Flow (FCF) as opposed to when it uses the Equity Cash Flow. Is this correct? 22. Which parameter better measures value creation; the EVA (Economic Value Added), the economic profit or the CVA (Cash Value Added)? 23. How could we project exchange rates in order to be able to forecast exchange differences? 24. Is it possible to use a constant WACC in the valuation of a company with a changing debt? 25. Which method should we use to valuate young companies with high growth but uncertain futures? Two examples were Boston Chicken and Telepizza when they began. 26. Which of these two methods is better: discounting the Equity Cash Flow or discounting the Free Cash Flow?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts