Question: 19. You are analyzing whether the difference in returns on stocks of a particular country can be explained by two common factors, with a

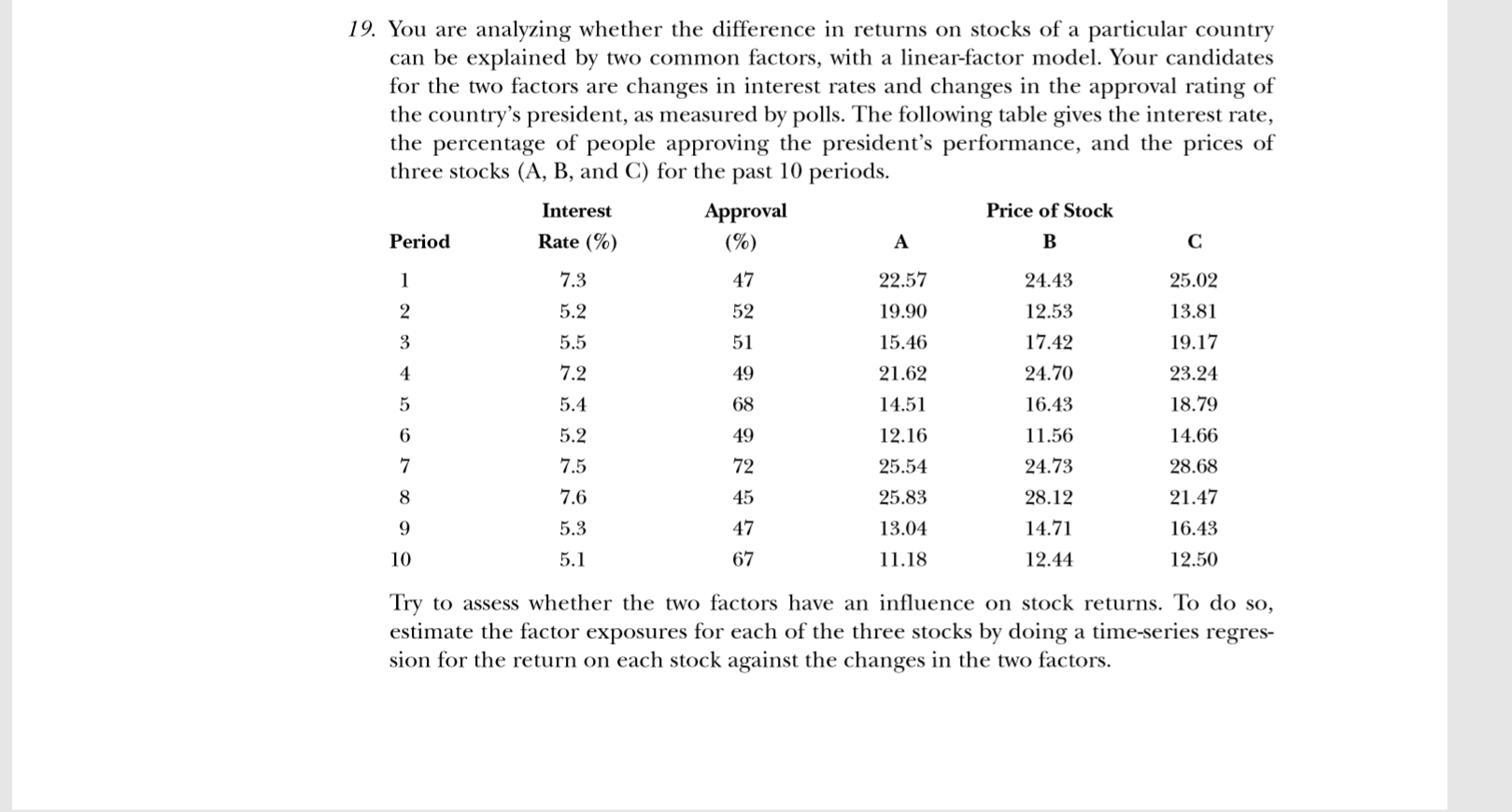

19. You are analyzing whether the difference in returns on stocks of a particular country can be explained by two common factors, with a linear-factor model. Your candidates for the two factors are changes in interest rates and changes in the approval rating of the country's president, as measured by polls. The following table gives the interest rate, the percentage of people approving the president's performance, and the prices of three stocks (A, B, and C) for the past 10 periods. Period Interest Rate (%) Approval (%) Price of Stock A B C 1 7.3 47 22.57 24.43 25.02 2 5.2 52 19.90 12.53 13.81 3 5.5 51 15.46 17.42 19.17 4 7.2 49 21.62 24.70 23.24 5 5.4 68 14.51 16.43 18.79 6 5.2 49 12.16 11.56 14.66 7 7.5 72 25.54 24.73 28.68 8 7.6 45 25.83 28.12 21.47 9 5.3 47 13.04 14.71 16.43 10 5.1 67 11.18 12.44 12.50 Try to assess whether the two factors have an influence on stock returns. To do so, estimate the factor exposures for each of the three stocks by doing a time-series regres- sion for the return on each stock against the changes in the two factors.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts