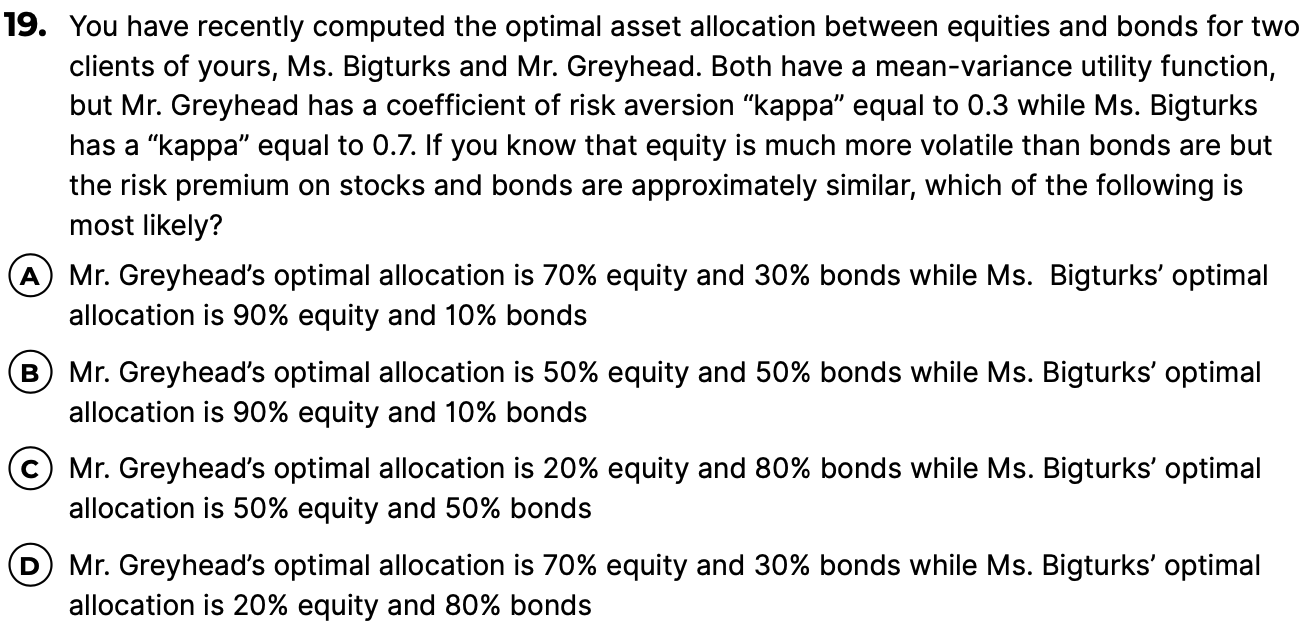

Question: 19. You have recently computed the optimal asset allocation between equities and bonds for twc clients of yours, Ms. Bigturks and Mr. Greyhead. Both have

19. You have recently computed the optimal asset allocation between equities and bonds for twc clients of yours, Ms. Bigturks and Mr. Greyhead. Both have a mean-variance utility function, but Mr. Greyhead has a coefficient of risk aversion "kappa" equal to 0.3 while Ms. Bigturks has a "kappa" equal to 0.7. If you know that equity is much more volatile than bonds are but the risk premium on stocks and bonds are approximately similar, which of the following is most likely? A Mr. Greyhead's optimal allocation is 70% equity and 30% bonds while Ms. Bigturks' optimal allocation is 90% equity and 10% bonds (B) Mr. Greyhead's optimal allocation is 50% equity and 50% bonds while Ms. Bigturks' optimal allocation is 90% equity and 10% bonds (C) Mr. Greyhead's optimal allocation is 20% equity and 80% bonds while Ms. Bigturks' optimal allocation is 50% equity and 50% bonds D Mr. Greyhead's optimal allocation is 70% equity and 30% bonds while Ms. Bigturks' optimal allocation is 20% equity and 80% bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts