Question: 19-1 please try to write the answer on the picture , so it will be easy for me to do not confuse. The weekly time

19-1

please try to write the answer on the picture , so it will be easy for me to do not confuse.

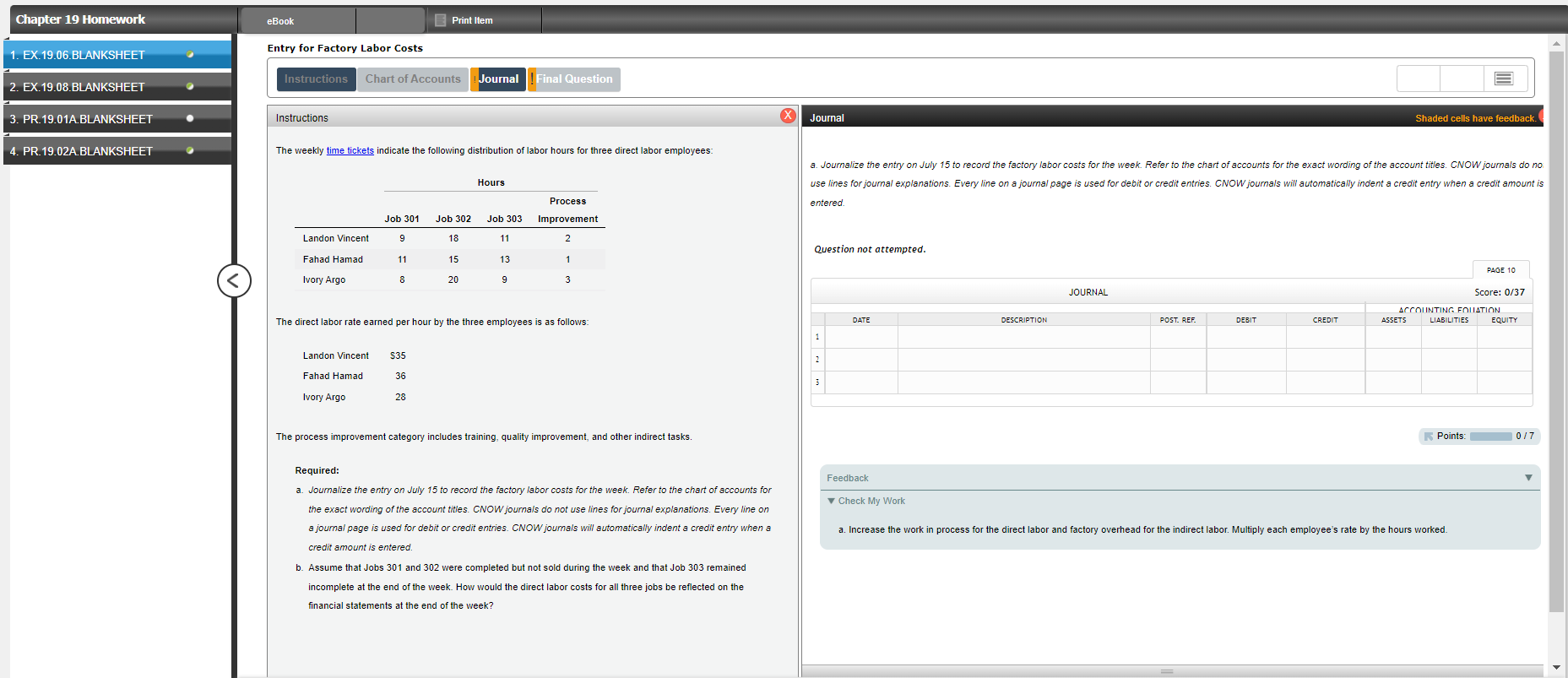

The weekly time tickets indicate the following distribution of labor hours for three direct labor employees: Hours a. Journalize the entry on July 15 to record the factory labor costs for the week. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do no use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. The direct labor rate earned per hour by the three employees is as follows: Question not attempted. The process improvement category includes training, quality improvement, and other indirect tasks. Required: a. Journalize the entry on July 15 to record the factory labor costs for the week. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. b. Assume that Jobs 301 and 302 were completed but not sold during the week and that Job 303 remained at the end of the week. How would the direct labor costs for all three jobs be reflected on the financial statements at the end of the week? Feedback Vheck My Work a. Increase the work in process for the direct labor and factory overhead for the indirect labor. Multiply each employee's rate by the hours worked

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts