Question: ( $ 197,000 ). It being depreciated using MACRS and a 5-year recovery period (see the table 1. A new computer systern will cost (

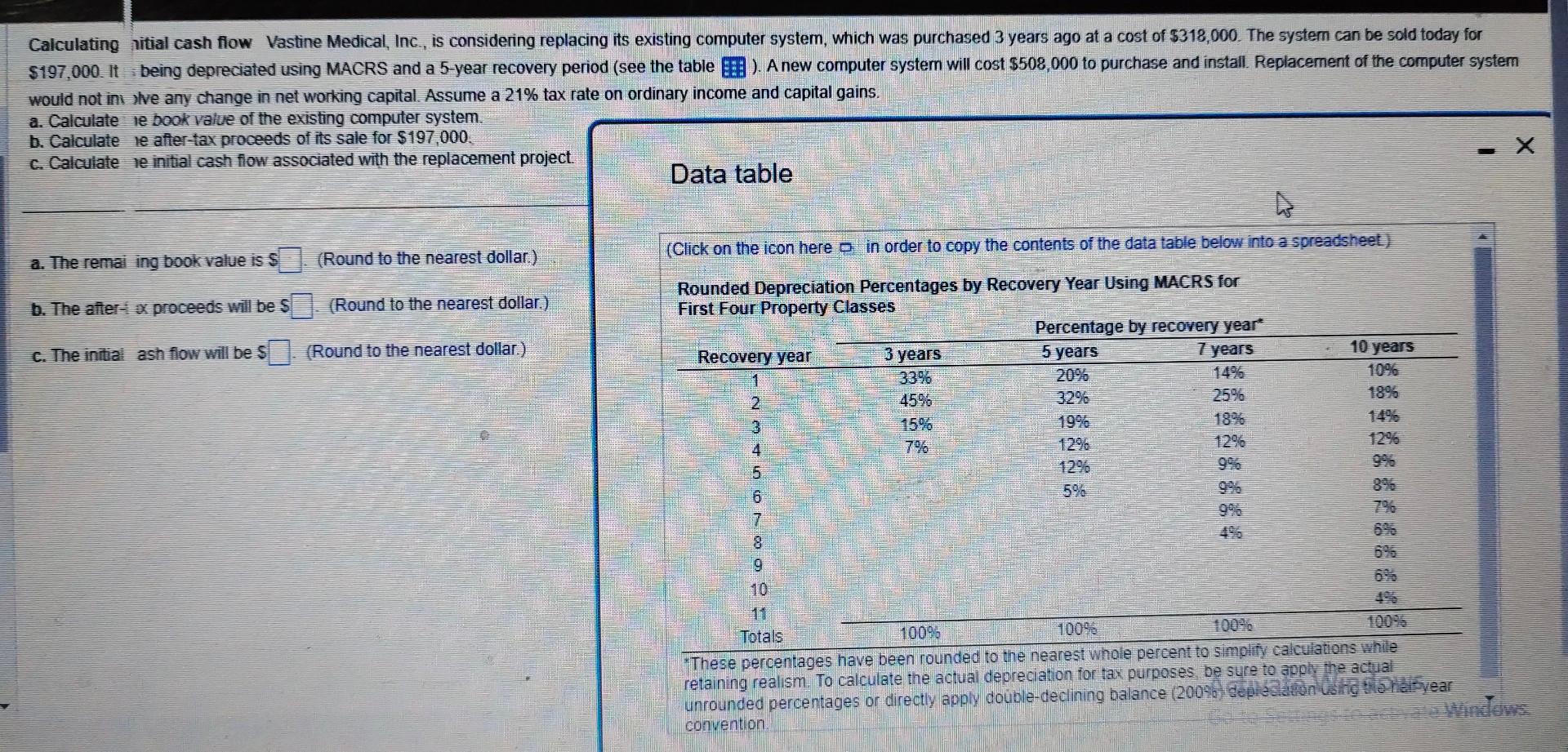

\\( \\$ 197,000 \\). It being depreciated using MACRS and a 5-year recovery period (see the table 1. A new computer systern will cost \\( \\$ 508,000 \\) to purchase and install. Replacement of the computer system would not in Ive any change in net working capital. Assume a \21 tax rate on ordinary income and capital gains. a. Calculate le book value of the existing computer system. b. Calculate le after-tax proceeds of its sale for \\( \\$ 197,000 \\). c. Calculate re initial cash flow associated with the replacement project. Data table a. The remai ing book value is \\( \\mathrm{s} \\square \\). (Round to the nearest dollar.) b. The after- \\( x \\) proceeds will be \\( \\$ \\square \\). (Round to the nearest dollar.) c. The initial ash flow will be s (Round to the nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts