Question: 1a. 1b. 1c. please answer questions completely. Use the table for the question(s) below. Consider the following list of projects: Project Investment NPV A 135,000

1a.

1b.

1c.

please answer questions completely.

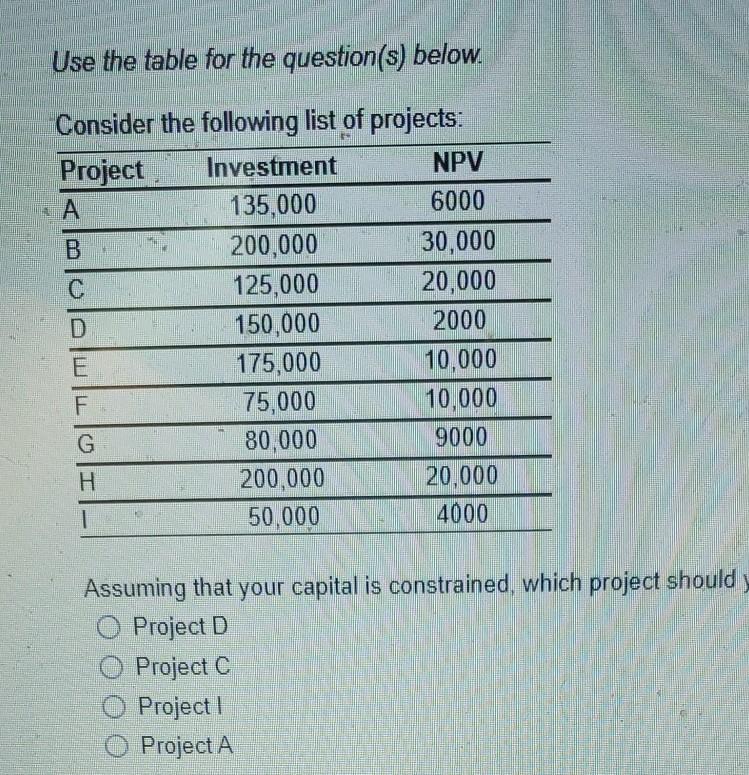

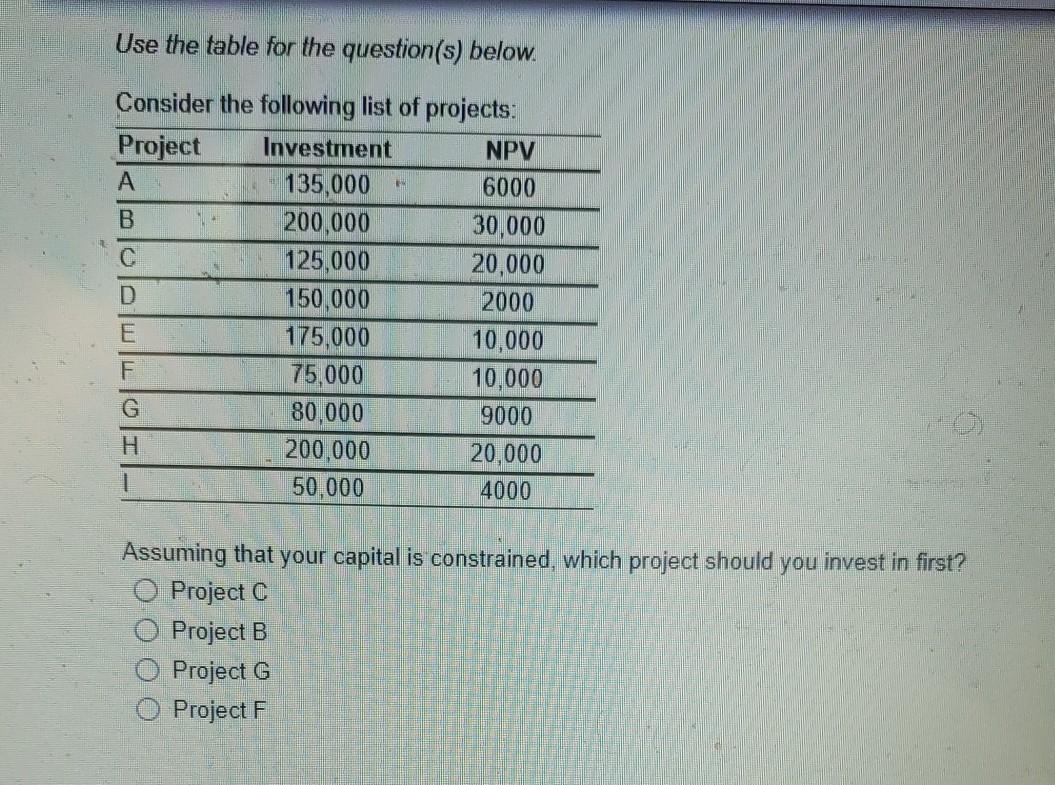

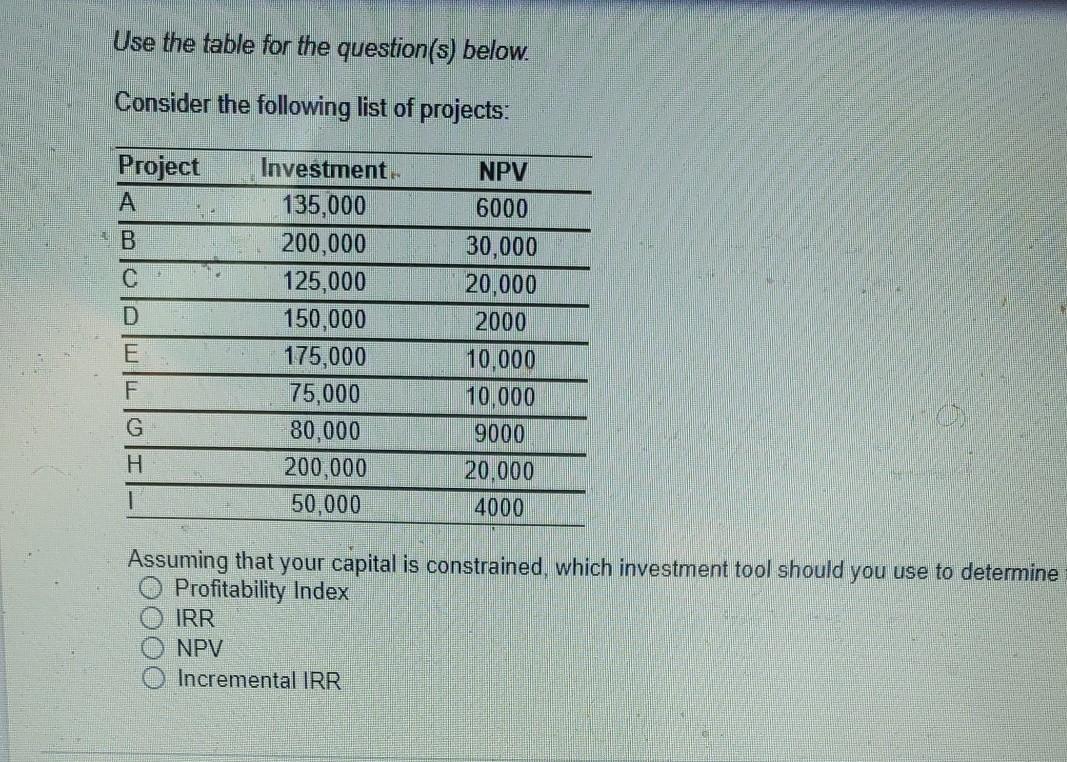

Use the table for the question(s) below. Consider the following list of projects: Project Investment NPV A 135,000 6000 200,000 30,000 125,000 20,000 150,000 2000 E 175,000 10,000 F 75,000 10,000 G 80,000 9000 H 200,000 20,000 50,000 4000 Assuming that your capital is constrained, which project should O Project D Project C Project! Project A Use the table for the question(s) below. Consider the following list of projects: Project Investment NPV 135,000 6000 B 200,000 30,000 125,000 20,000 150,000 2000 175,000 10,000 F 75,000 10,000 80,000 9000 H 200,000 20,000 | 50,000 4000 Assuming that your capital is constrained, which project should you invest in first? Project C Project B Project G Project F OOO Use the table for the question(s) below. Consider the following list of projects: Project B D Investment 135,000 200,000 125,000 150,000 175,000 75,000 80,000 200,000 50,000 NPV 6000 30,000 20,000 2000 10,000 10,000 9000 20,000 4000 E F G H T Assuming that your capital is constrained, which investment tool should you use to determine Profitability Index IRR NPV Incremental IRR oooo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts