Question: 1a. 1b. Before purchasing a used car, Cody Lind checked www.kbb.com to learn what he should offer for the used car he wanted to buy.

1a.

1b.

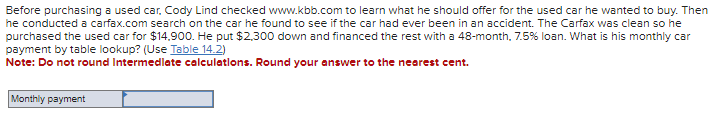

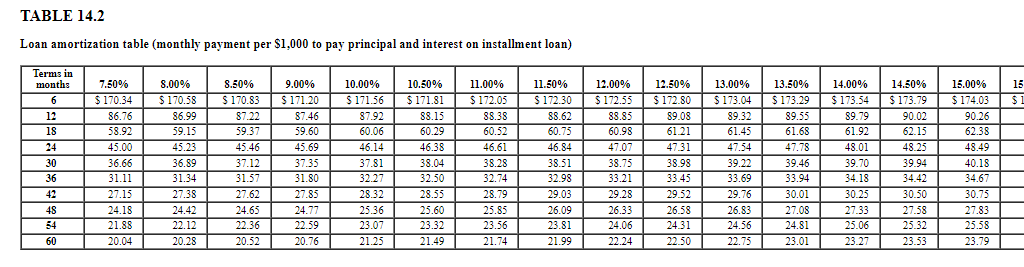

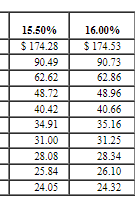

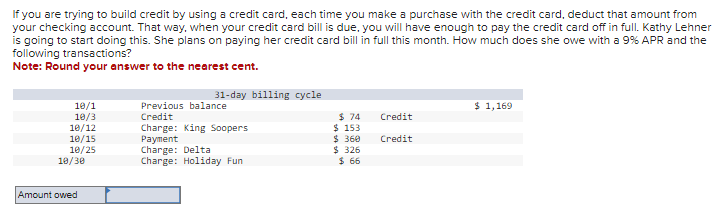

Before purchasing a used car, Cody Lind checked www.kbb.com to learn what he should offer for the used car he wanted to buy. Then he conducted a carfax.com search on the car he found to see if the car had ever been in an accident. The Carfax was clean so he purchased the used car for $14,900. He put $2,300 down and financed the rest with a 48 -month, 7.5% loan. What is his monthly car payment by table lookup? (Use Table 14.2) Note: Do not round Intermedlate calculatlons. Round your answer to the nearest cent. Loan amortization table (monthly payment per $1,000 to pay principal and interest on installment loan) \begin{tabular}{|r|r|} \hline 15.50% & 16.00% \\ \hline$174.28 & $174.53 \\ \hline 90.49 & 90.73 \\ \hline 62.62 & 62.86 \\ \hline 48.72 & 48.96 \\ \hline 40.42 & 40.66 \\ \hline 34.91 & 35.16 \\ \hline 31.00 & 31.25 \\ \hline 28.08 & 28.34 \\ \hline 25.84 & 26.10 \\ \hline 24.05 & 24.32 \\ \hline \end{tabular} If you are trying to build credit by using a credit card, each time you make a purchase with the credit card, deduct that amount from your checking account. That way, when your credit card bill is due, you will have enough to pay the credit card off in full. Kathy Lehner is going to start doing this. She plans on paying her credit card bill in full this month. How much does she owe with a 9% APR and the following transactions? Note: Round your answer to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts