Question: 1a. Compute and interpret the predetermined overhead rate 1b. Prepare journal entries to record january transactions and post the entries to general ledger t-accounts given

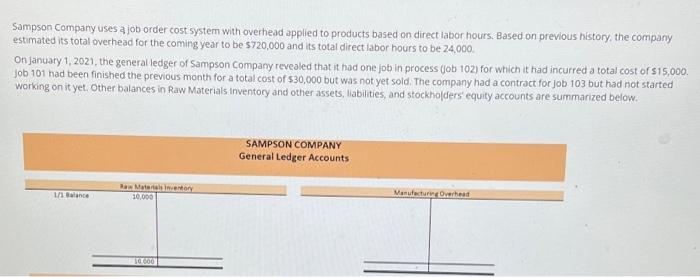

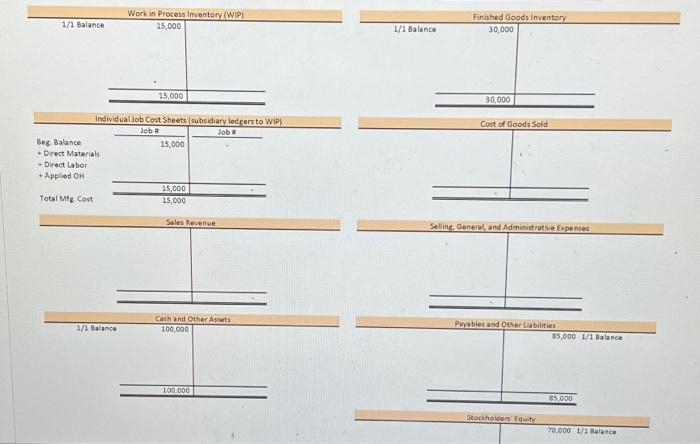

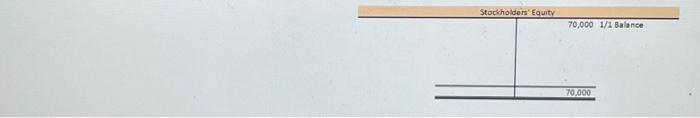

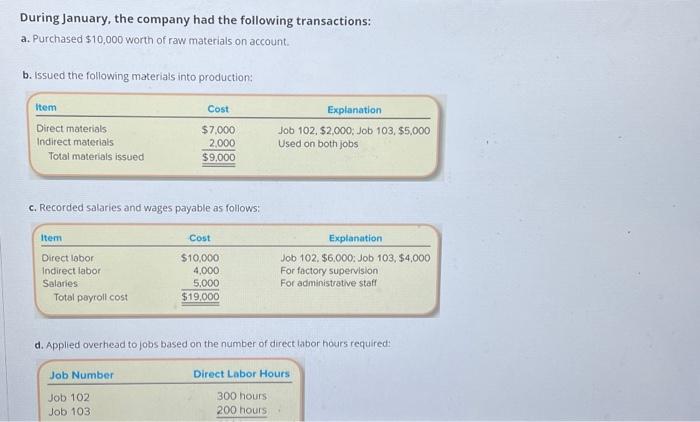

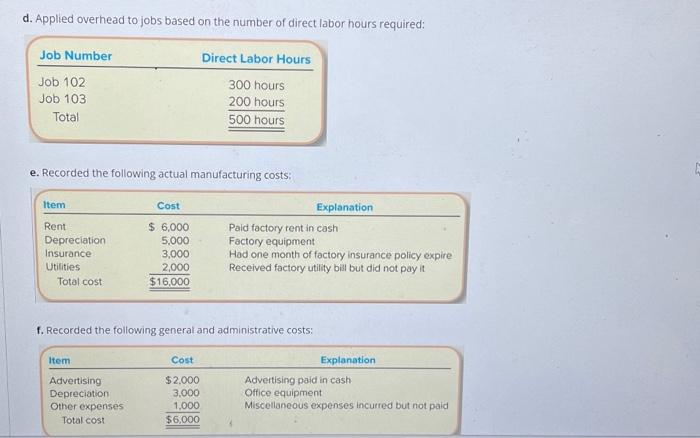

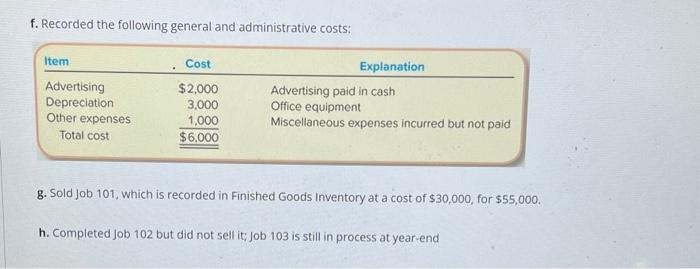

During January, the company had the following transactions: a. Purchased $10,000 worth of raw materials on account. b. Issued the following materials into production: c. Recorded salaries and wages payable as follows: d. Applied overhead to jobs based on the number of direct labor hours required: f. Recorded the following general and administrative costs: g. Sold Job 101, which is recorded in Finished Goods Inventory at a cost of $30,000, for $55,000. h. Completed Job 102 but did not sell it; Job 103 is still in process at year-end \begin{tabular}{|c|c|} \hline \multicolumn{2}{c}{ Stockholden' Equity } \\ \hline & 70,0001/1 Balance \\ & \\ \hline & 70,000 \\ \hline \end{tabular} d. Applied overhead to jobs based on the number of direct labor hours required: e. Recorded the following actual manufacturing costs: f. Recorded the following general and administrative costs: Sampson company uses a job order cost system with overhead applied to products based on direct labor hours. Based on previous history, the company estimated its total overhead for the coming year to be $720,000 and its total direct labor hours to be 24,000 . On january 1, 2021, the general ledger of Sampson Company revealed that it had one job in process (job 102) for which it had incurred a total cost of $15,000. job 101 had been finished the previous month for a total cost of $30,000 but was not yet sold. The company had a contract for job 103 but had not started working on it yet. Other balances in Raw Materials inventory and other assets, liabilities, and stockho|ders equity accounts are summarized below

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts