Question: 1)A firm considers buying a new machine whose expected lifetime is 6 years. The cost of the machine is $ 3000000 which is paid in

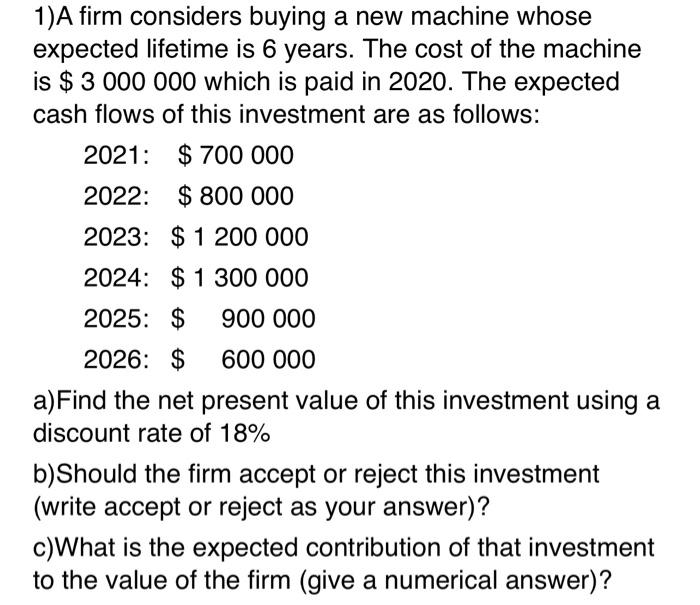

1)A firm considers buying a new machine whose expected lifetime is 6 years. The cost of the machine is \$ 3000000 which is paid in 2020 . The expected cash flows of this investment are as follows: a)Find the net present value of this investment using a discount rate of 18% b) Should the firm accept or reject this investment (write accept or reject as your answer)? c)What is the expected contribution of that investment to the value of the firm (give a numerical answer)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts