Question: 1a) ONLY 2 PARTS STATED i)The bond manager wished to construct his bond portfolio using the Barbell strategy. The desired modified duration of this portfolio

1a) ONLY 2 PARTS STATED

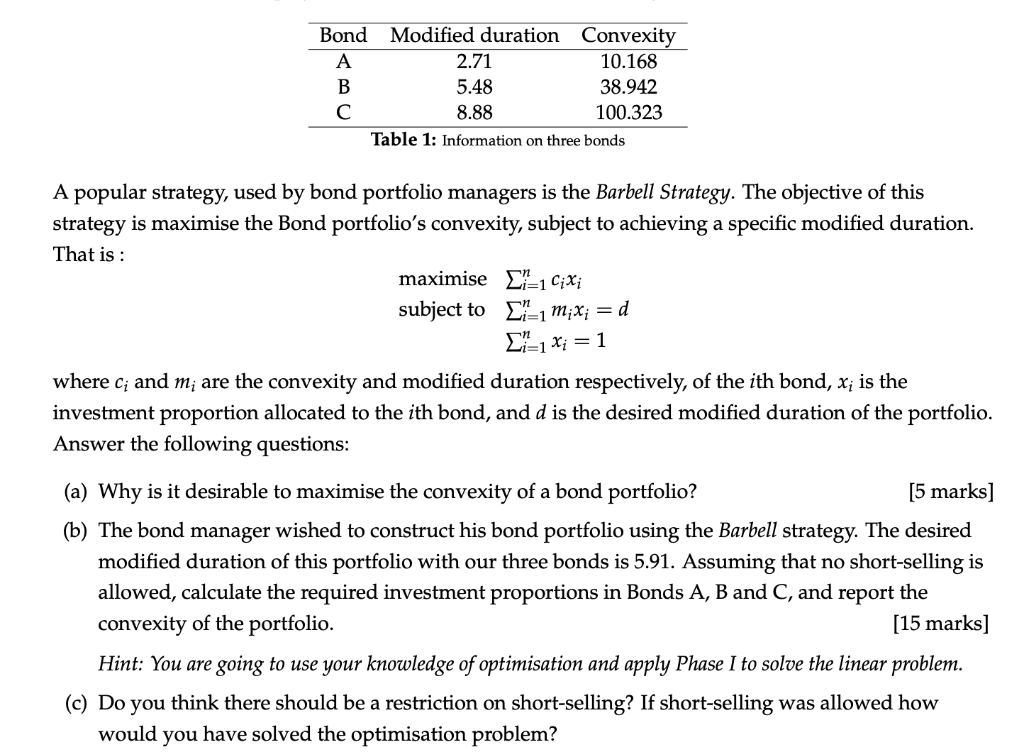

i)The bond manager wished to construct his bond portfolio using the Barbell strategy. The desired modified duration of this portfolio with our three bonds is 5.91. Assuming that no short-selling is allowed, calculate the required investment proportions in Bonds A, B and C, and report the convexity of the portfolio.

ii)Do you think there should be a restriction on short-selling? If short-selling was allowed how would you have solved the optimisation problem?

Bond Modified duration Convexity 2.71 10.168 5.48 38.942 8.88 100.323 Table 1: Information on three bonds A popular strategy, used by bond portfolio managers is the Barbell Strategy. The objective of this strategy is maximise the Bond portfolio's convexity, subject to achieving a specific modified duration. That is : maximise 21-1 Cixi subject to 2-1 m;X; = d. 2-1 Xi = 1 where c; and m; are the convexity and modified duration respectively, of the ith bond, x; is the investment proportion allocated to the ith bond, and d is the desired modified duration of the portfolio. Answer the following questions: (a) Why is it desirable to maximise the convexity of a bond portfolio? [5 marks] (b) The bond manager wished to construct his bond portfolio using the Barbell strategy. The desired modified duration of this portfolio with our three bonds is 5.91. Assuming that no short-selling is allowed, calculate the required investment proportions in Bonds A, B and C, and report the convexity of the portfolio. [15 marks] Hint: You are going to use your knowledge of optimisation and apply Phase I to solve the linear problem. (c) Do you think there should be a restriction on short-selling? If short-selling was allowed how would you have solved the optimisation problem? Bond Modified duration Convexity 2.71 10.168 5.48 38.942 8.88 100.323 Table 1: Information on three bonds A popular strategy, used by bond portfolio managers is the Barbell Strategy. The objective of this strategy is maximise the Bond portfolio's convexity, subject to achieving a specific modified duration. That is : maximise 21-1 Cixi subject to 2-1 m;X; = d. 2-1 Xi = 1 where c; and m; are the convexity and modified duration respectively, of the ith bond, x; is the investment proportion allocated to the ith bond, and d is the desired modified duration of the portfolio. Answer the following questions: (a) Why is it desirable to maximise the convexity of a bond portfolio? [5 marks] (b) The bond manager wished to construct his bond portfolio using the Barbell strategy. The desired modified duration of this portfolio with our three bonds is 5.91. Assuming that no short-selling is allowed, calculate the required investment proportions in Bonds A, B and C, and report the convexity of the portfolio. [15 marks] Hint: You are going to use your knowledge of optimisation and apply Phase I to solve the linear problem. (c) Do you think there should be a restriction on short-selling? If short-selling was allowed how would you have solved the optimisation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts