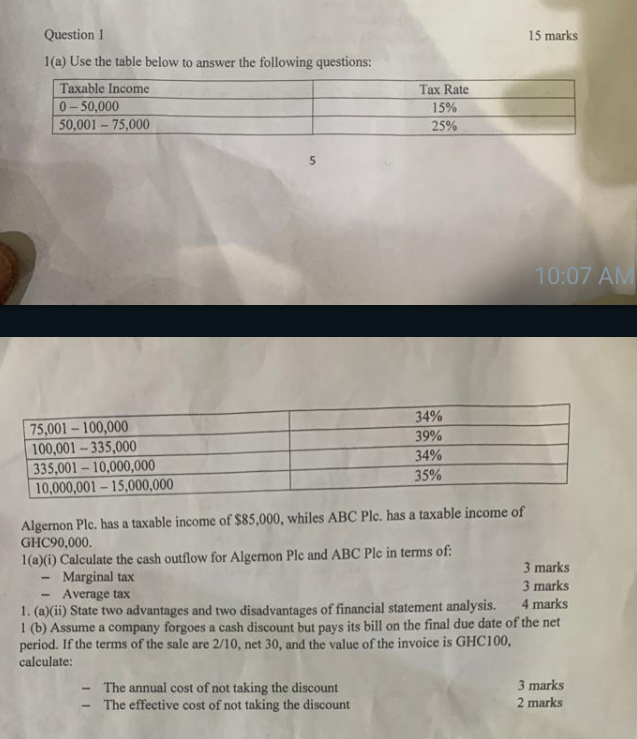

Question: 1(a) Use the table below to answer the following questions: 5 Algernon Plc. has a taxable income of $85,000, whiles ABC Plc. has a taxable

1(a) Use the table below to answer the following questions: 5 Algernon Plc. has a taxable income of $85,000, whiles ABC Plc. has a taxable income of GHC90,000. 1(a)(i) Calculate the cash outflow for Algernon Plc and ABC Plc in terms of: - Marginal tax - Average tax 1 (b) Assume a company forgoes a cash discount but pays its bill on the final due date of the net period. If the terms of the sale are 2/10, net 30 , and the value of the invoice is GHC100. calculate: - The annual cost of not taking the discount - The effective cost of not taking the discount 3 marks 2 marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock