Question: 1a. Using the information above, create five separate calendar spreads, short front month long back month. (Example: 5/19/23 short call, 1/17/24 long month). Then provide

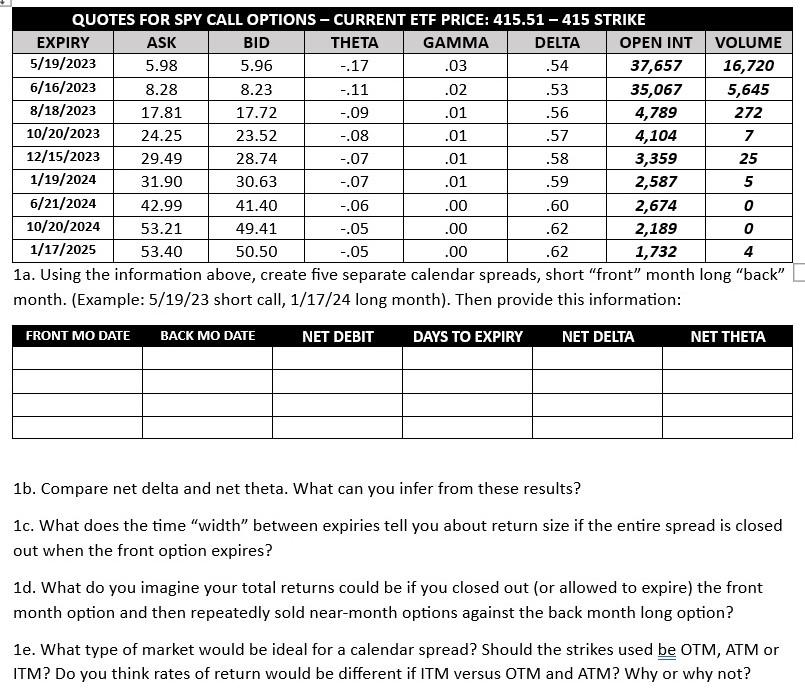

1a. Using the information above, create five separate calendar spreads, short "front" month long "back" month. (Example: 5/19/23 short call, 1/17/24 long month). Then provide this information: 1b. Compare net delta and net theta. What can you infer from these results? 1c. What does the time "width" between expiries tell you about return size if the entire spread is closed out when the front option expires? 1d. What do you imagine your total returns could be if you closed out (or allowed to expire) the front month option and then repeatedly sold near-month options against the back month long option? 1e. What type of market would be ideal for a calendar spread? Should the strikes used be OTM, ATM or ITM? Do you think rates of return would be different if ITM versus OTM and ATM? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts