Question: 1a-1c using the Starbucks consolidated statements Ch7 Case Study Assignment - Part 1 (Income Statement Analysis) 1a: Provide the Total (Net) Revenues, Gross Profit, and

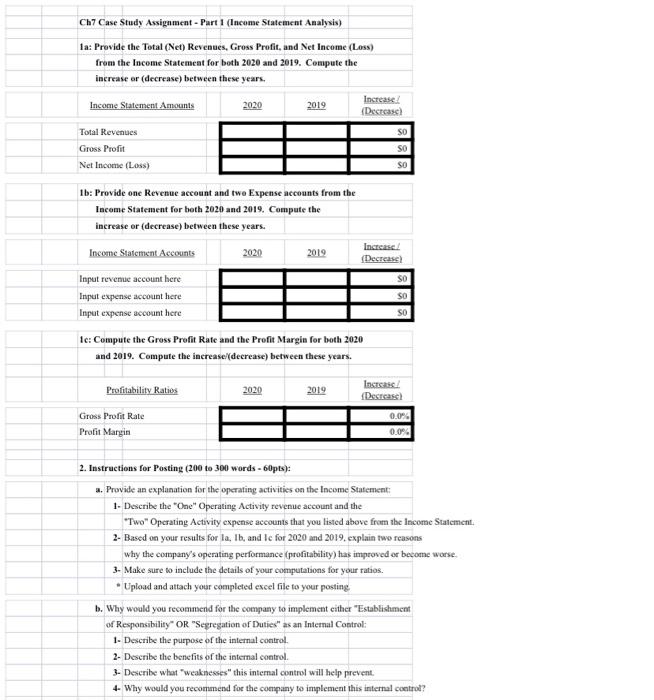

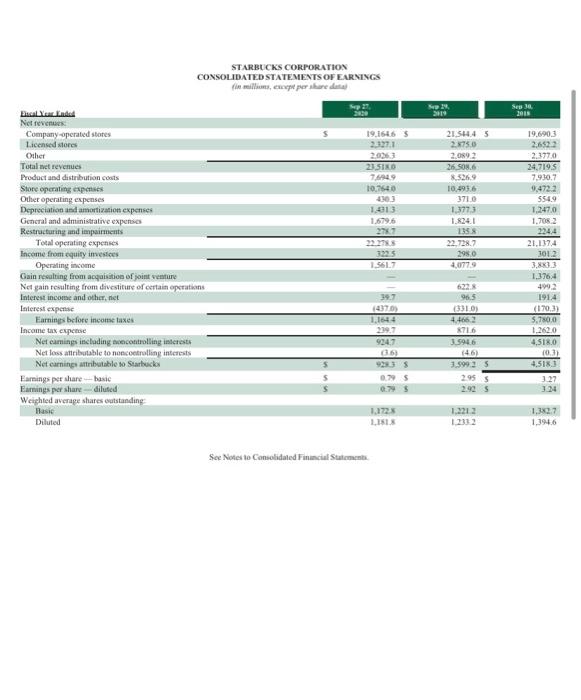

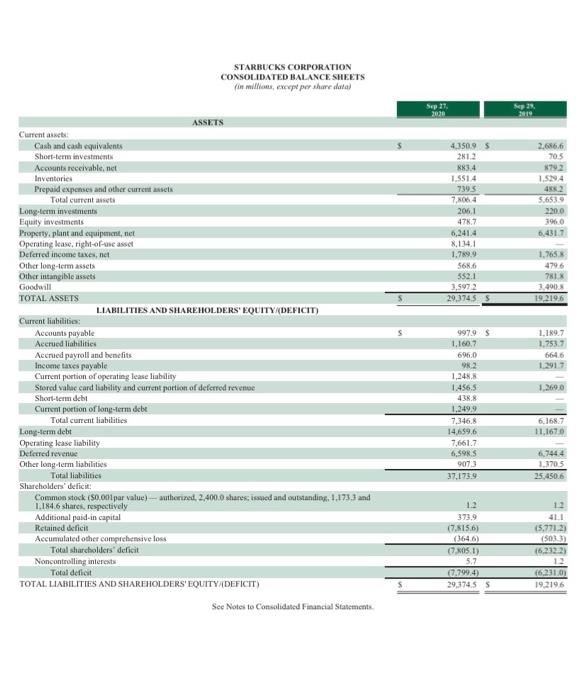

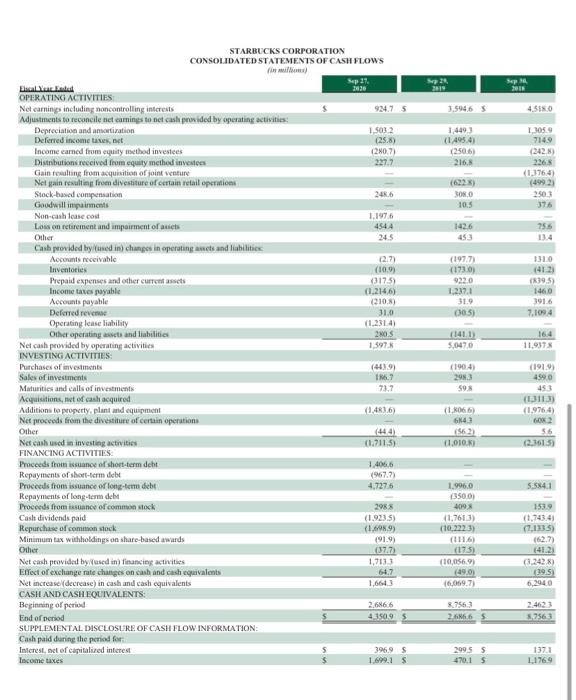

Ch7 Case Study Assignment - Part 1 (Income Statement Analysis) 1a: Provide the Total (Net) Revenues, Gross Profit, and Net Income (Loss) from the Income Statement for both 2020 and 2019. Compute the inerease or decrease) between these years, Income Statement Amounts 2020 2019 Increase Decrease Total Revenues SO Gross Profit so Net Income (Loss) SO 1b: Provide one Revenue account and two Expense accounts from the Income Statement for both 2020 and 2019. Compute the increase or decrease) between these years. Increased Income Statement Accounts 2020 2019 (Decrease Input revenue account here SO Input expense account here SO Input expense account here SO 1c: Compute the Gross Profit Rate and the Profit Margin for both 2020 and 2019. Compute the increase(decrease) between these years. Profitability Ratios 2020 2019 Insts (Descas Gross Profit Rate Profit Margin 0.0% 0.0% 2. Instructions for Posting (200 to 300 words - 60pts): a. Provide an explanation for the operating activities on the Income Statement: 1. Describe the "One" Operating Activity revenue account and the "Two" Operating Activity expense accounts that you listed above from the income Statement. 2. Based on your results for la, Ib, and Ic for 2020 and 2019, explain two reasons Why the company's operating performance (profitability) has improved or become worse. 3- Make sure to include the details of your computations for your ratios. Upload and attach your completed excel file to your posting b. Why would you recommend for the company to implement either "Establishment of Responsibility" OR "Segregation of Duties as an Internal Control: 1- Describe the purpose of the internal control. 2- Describe the benefits of the internal control 3- Describe what'weaknesses this internal control will help prevent 4- Why would you recommend for the company to implement this internal control? . STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF EARNINGS inceper shared 2 119 Sep 30 2011 19.16765 19.6903 2023 20. SED 10.7640 4303 1.013 21.544.45 2.750 2.0892 26.08.6 83269 10.493.6 371.0 1,3773 1.824.1 1958 22.7287 2980 4,0779 Escalucinded Neteve Company operated States Licensed stores Other Total revenues Product and distribution costs Store operating expenses Other operating expenses Depreciation and amortization expenses General and administrative expenses Restructuring and impairments Total operating expenses Income from equity investes Operating income Gain resulting from acquisition of joint venture Net gain resulting from divestiture of certain operations Interest income and other net Interest expense Earnings before income taxes Income tax expense Net camnings including no controlling interest Netloss attributable to noncontrolling interests Net caring attributable to Starbucks Earnings por share basic Earnings per share diluted Weighted average shares outstanding Basic Diluted 2.377,0 24,7195 7.930,7 9,4722 5549 1.247.0 1.7083 2244 21.1374 2012 3.83.3 1.3764 3325 1.5617 6233 4992 96.5 (3310 39.7 (4370) 1.1644 239.7 924.7 6) 9223 0795 716 3.5946 (46) 3.5995 2.955 2.935 191.4 (170,3) 5.780.0 1.262.0 4,518.0 10.13 4.5181 5 3.27 3:24 1.1725 1.2212 12332 1.394,6 See Notes to Consolidated Financial Statement STARBUCKS CORPORATION CONSOLIDATED BALANCE SHEETS fin millions, except per share data) Sep 11 2020 Sep 2 415095 2012 8834 1.5514 7395 7.2004 206,1 476.7 6,241.4 8.134.1 1.789.9 5686 352.1 3.5972 29.37453 70.5 792 1.5994 46.2 53653 2200 390 6,4317 1,765 4796 781 2.490.5 19 2196 ASSETS Current Cash and cash equivalents Short-term investments Accounts receivable, net Inventories Prepaid expenses and other current asset Total current set Long-term investments Equity investments Property, plant and equipment, net Operating kase, right-of-se asset Deferred income taxes, net Other long-term assets Other intangible assets Goodwill TOTAL ASSETS LIABILITIES AND SHAREHOLDERS' EQUITY/DEFICIT) Current liabilities: Accounts payable Accrued liabilities Accrued payroll and benefits Income taxes payable Current portion of operating lease liability Stored value card liability and current portion of deferred revenue Short-term debt Current portion of long-term debe Total current liabilities Long-term debt Operating lease liability Deferred revenue Other long-term liabilities Total liabilities Shareholders' deficit: Common stock (50.001 par value) - authorized 2,400.0 shares, issued and outstanding. 1.173.3 and 1.184.6 shares, respectively Additional paid in capital Retained defien Accumulated other comprehensive loss Total shareholders' deficit Noncontrolling interests Total deficit TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY DEFICIT) See Notes to Consolidated Financial Statements 1.189.7 1,753.7 6646 1.2917 9979 $ 1.160.7 6960 2 1.2458 1.456.5 438.8 1.349.9 7.346.8 14.659.6 7,661.7 6,5985 9073 37.175.9 6.168.7 11.1670 6,7444 1.370.5 25,450.6 1.2 373,9 (7.815.6) (3646) (7.05.1) 5.7 (7.799.4) 29,37455 12 411 (5,771.23 SOL 16.212.23 12 (6.231.03 19.2196 STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS Sep 17 21 2012 Sep 200 924.75 3.59465 4.555.0 1.5032 (25.8) (2807) 227.7 14193 (14954) (2506) 216. 13059 7149 (342) 2363 (1.376,4) (499.23 2503 248.6 (622) SONO 10.5 376 1.1976 4544 245 142.6 453 755 13.4 1310 2.7) (10.99 (3173) (1.2146) (210) 31.0 (1.2314) (197.7 (1730) 9220 1.237.1 31.9 005 (39.5 1460 3916 7,1094 2NOS (1411) 5,047.0 164 11.9373 1597 Escalucted OPERATING ACTIVITIES Net carnings including noncontrolling interests Adjustments to reconcile net camins to net cash provided by operating activities Depreciation and amortization Deferred income taxes et Income earned from equity method investees Distributions received from equity method investes Gain resulting from acquisition of joint venture Net gain resulting from divestiture of certain retail operation Stock-based compensation Goodwill impairments Non-cash loane cost Los on retirement and impairment of aniet Other Cash provided by used in changes in operating nets and liabilities Accounts receivable Inventories Prepaid expenses and other current assets Income taxes payable Accounts payable Deferred revenue Operating lease liability Othat operating site and liabilities Net cash provided by operating activities INVESTING ACTIVITIES: Purchases of investments Sales of investments Maturities and calls of investments Acquisitions, net of cash acquired Additions to property, plant and equipment Net proceeds from the divestiture of certain operations Other Net cash used in investing activities FINANCING ACTIVITIES Proceeds from issuance of short-term deht Repayments of short-term debe Proceeds from issuance of longlom det Repayments of long-term del Proceeds from issone of common stock Cash dividends paid Repurchase of common stock Minimum lax withholdings on share based awards Other Net cash provided by used in financing activities Effect of exchange rate changes on cash and cash equivalents Net increase(decrease) in cash and cash equivalents CASH AND CASH EQUIVALENTS: Beginning of period End of period SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: Cash prid during the period for Interest, set of capitalized interest Income taxes (449) 16. 73.7 (1904) 293 503 (1.461.6 (1.066) 643 (1919) 4590 453 (113) (1.9764) GO 56 (2.3613 (444) (1.711.5) (1,010.) 1.406,6 (967. 4.7276 5.584.1 298 (1.921.5) (1.67989) 91.9) 07.7 1,701 64.7 1,6643 1.996.0 (3500 409 (1,7613) (10.2223) (1116) (175 (10,056,93 (490) 16.069.7) 1539 (1,743,41 (7,1335) 162.7) 1412 (3.242.8) 39.5 6,2940 2.686.6 4 1509 8.7563 2.66.6 3.2563 396,9 1.699.1 S 29955 470.15 1371 1.1769

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts