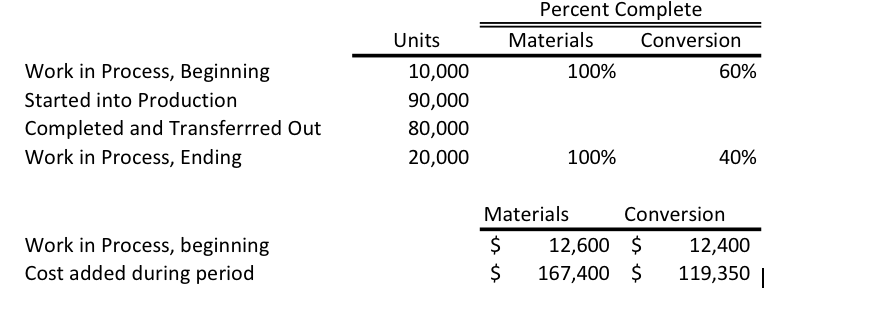

Question: 1.Assume that Concrete Creations uses the weighted-average method for cost allocation. Determine the equivalent units of production for the Forming Department for the month of

1.Assume that Concrete Creations uses the weighted-average method for cost allocation.

Determine the equivalent units of production for the Forming Department for the month of May.

2.Assume that Concrete Creations uses the weighted-average method for cost allocation. Compute the cost per equivalent units of production for the Forming Department

3.Assume that Concrete Creations uses the weighted-average method for cost allocation.

Calculate the total cost of ending work in process inventory as well as total cost of units transferred out for May.

4.Assume that Concrete Creations uses the weighted-average method for cost allocation. Prepare cost reconciliation report for the Forming Department for May.

5.Assume that Concrete Creations used the FIFO method rather than the weighted average method in its process costing system. Deteminemine the equivalent units of production for the Forming Department for the month of May.

6.Assume that Concrete Creations used the FIFO method rather than the weighted average method in its process costing system. Compute the cost per equivalent units of production for the Forming Department.

Percent Complete Units Materials Conversion Work in Process, Beginning 10,000 100% 60% Started into Production 90,000 Completed and Transferrred Out 80,000 Work in Process, Ending 20,000 100% 40% Materials Conversion Work in Process, beginning 12,600 12,400 Cost added during period 167,400 $ 119,350 |

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts