Question: 1b. Suppose EIN co. issues $1,000 face value, 5 year zero coupon bond. The initial price is $508.35. Using semiannual periods, verify that the

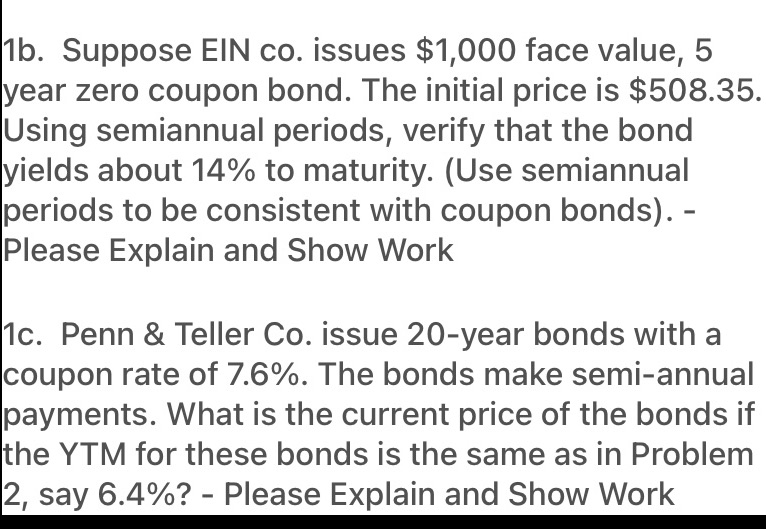

1b. Suppose EIN co. issues $1,000 face value, 5 year zero coupon bond. The initial price is $508.35. Using semiannual periods, verify that the bond yields about 14% to maturity. (Use semiannual periods to be consistent with coupon bonds). - Please Explain and Show Work 1c. Penn & Teller Co. issue 20-year bonds with a coupon rate of 7.6%. The bonds make semi-annual payments. What is the current price of the bonds if the YTM for these bonds is the same as in Problem 2, say 6.4%? - Please Explain and Show Work

Step by Step Solution

3.50 Rating (150 Votes )

There are 3 Steps involved in it

1b EIN Co Zero Coupon Bond Given Face value 1000 Initial price 50835 Maturity 5 years Semiannual periods To Verify If the bond yields about 14 to matu... View full answer

Get step-by-step solutions from verified subject matter experts