Question: 1.Based on the zero-growth model, what is the intrinsic value of PALTEL stock? 2. Using CAPM, and assuming a monthly risk-free rate of 0.2% and

1.Based on the zero-growth model, what is the intrinsic value of PALTEL stock?

2.

Using CAPM, and assuming a monthly risk-free rate of 0.2% and a monthly market return of 0.9%, what is the monthly required return for PALTEL

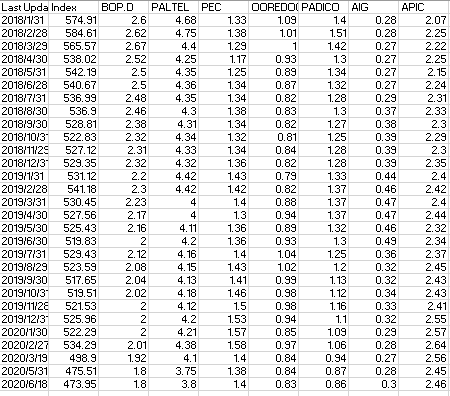

Last Upda Index 2018/1/31 574.91 2018/2/28 584.61 2018/3/29 565.57 2018/4/30 538.02 2018/5/31 542.19 2018/6/28 540.67 2018/7/31 536.99 2018/8/30 536.9 2018/9/30 528.81 2018/10/3 522.83 2018/11/25 527.12 2018/12/3 529.35 2019/1/31 531.12 2019/2/28 541.18 2019/3/31 530.45 2019/4/30 527.56 2019/5/30 525.43 2019/6/30 519.83 2019/7/31 529.43 2019/8/29 523.59 2019/9/30 517.65 2019/10/31 519.51 2019/11/28 521.53 2019/12/3 525.96 2020/1/30 522.29 2020/2/27 534.29 2020/3/19 498.9 2020/5/31 475.51 2020/6/18 473.95 BOP.D PALTEL PEC 2.6 4.68 2.62 4.75 2.67 4.4 2.52 4.25 2.5 4.35 2.5 4.36 2.48 4.35 2.46 4.3 2.38 4.31 2.32 4.34 2.31 4.33 2.32 4.32 2.2 4.42 2.3 4.42 2.23 4 2.17 4 2.16 4.11 2 4.2 2.12 4.16 2.08 4.15 2.04 4.13 2.02 4.18 4.12 4.2 4.21 2.01 4.38 1.92 4.1 1.8 3.75 1.8 3.8 OOREDOI PADICO AIG 1.33 1.09 1.4 1.38 1.01 1.51 1.29 1 1.42 1.17 0.93 1.3 1.25 0.89 1.34 1.34 0.87 1.32 1.34 0.82 1.28 1.38 0.83 1.3 1.34 0.82 1.27 1.32 0.81 1.25 1.34 0.84 1.28 1.36 0.82 1.28 1.43 0.79 1.33 1.42 0.82 1.37 1.4 0.88 1.37 1.3 0.94 1.37 1.36 0.89 1.32 1.36 0.93 1.3 1.4 1.04 1.25 1.43 1.02 1.2 1.41 0.99 1.13 1.46 0.98 1.12 1.5 0.98 1.16 1.53 0.94 1.1 1.57 0.85 1.09 1.58 0.97 1.06 1.4 0.84 0.94 1.38 0.84 0.87 1.4 0.83 0.86 APIC 0.28 2.07 0.28 2.25 0.27 2.22 0.27 2.25 0.27 2.15 0.27 2.24 0.29 2.31 0.37 2.33 0.38 2.3 0.39 2.29 0.39 2.3 0.39 2.35 0.44 2.4 0.46 2.42 0.47 2.4 0.47 2.44 0.46 2.32 0.49 2.34 0.36 2.37 0.32 2.45 0.32 2.43 0.34 2.43 0.33 2.41 0.32 2.55 0.29 2.57 0.28 2.64 0.27 2.56 0.28 2.45 0.3 2.46 NNN

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts