Question: 1.Based only on quantitative factors that are provided above, should RL choose to provide services to the individual client segment or small business client segment

1.Based only on quantitative factors that are provided above, should RL choose to provide services to the individual client segment or small business client segment or neither for the next 3 months? Explain. Show all workings.

2.

While estimates of the number of potential new clients who are expected to approach RL for tax services (provided in the previous table) are reliable, RL now realises that there is some uncertainty with regard to the number of staff who will be on leave over the next 3 months. Hence, there is also some uncertainty with regard to the number of available professional labour hours to serve clients in either the individual or small business segment.

Based only on quantitative factors that are provided previously (with the exception of available professional labour hours), should RL choose to provide services to the individual client segment or small business client segment or neither for the next 3 months IF

(i) the number of available professional labour hours is 270? Show all workings [2.5 marks]

(ii) the number of available professional labour hours is 420? Show all workings [2.5 marks]

3.Would calculating the break-even number of clients for the individual client segment and small business client segment help RL make its decision (i.e., whether to provide services to the individual client segment or small business client segment or neither for the next 3 months)? Explain.

4.

RL has just been informed by their IT system vendor that they will have to pay them an additional fixed fee if it decides to start serving a new segment for the next 3 months. This fee would be the same irrespective of whether RL chooses the individual client segment OR the small business segment.

Explain whether this new development would or would not change your answer to Question 21? Similar to Question 21, assume that the available professional labour hours over the next three months is 480.

5.

As mentioned in the previous question, one of the fixed costs allocated to RL's clients is the IT system's license fee paid to the provider of the system. This IT system is a specialised tax system used by employees to help them complete the tax returns for all clients.

Apart from professional labour hours, what are 2 other feasible allocation bases that can be used to allocate the IT system license fee to each client at RL? Explanations are not necessary.

6.

Do you agree with the following statement? Explain

"Based on the quantitative information provided in the tables above, it is likely that all of RL's fixed costs are allocated to each client using professional (i.e., tax accountant) labour hours as the single allocation base". Note that all of RL's fixed costs are categorised as indirect cost with respect to each client.

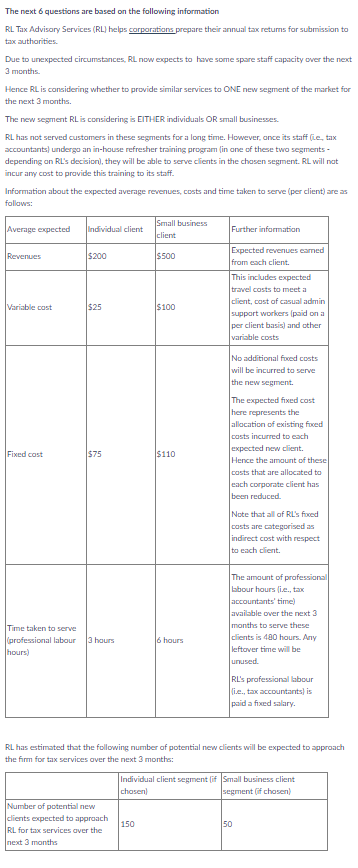

The next 6 questions are based on the following information RL Tax Advisory Services (RL) helps corporations prepare their annual tax returns for submission to tax authorities Due to unexpected circumstances, RL now expects to have some spare staff capacity over the next 3 months. Hence RL is considering whether to provide similar services to ONE new segment of the market for the next 3 months. The new segment RLis considering is EITHER individuals OR small businesses RL has not served customers in these segments for a long time. However, once its staff (ie, tax accountants) undergo an in-house refresher training program in one of these two segments - depending on RL's decision, they will be able to serve clients in the chosen segment. RL will not incur any cost to provide this training to its staff. Information about the expected average revenues, costs and time taken to serve (per client) are as follows: Average expected Individual client Small business client Further information Revenues $200 $500 Expected revenues eamed from each client This includes expected travel costs to meet a client, cost of casual admin support workers (paid on a per client basis) and other variable costs Variable cost $25 $100 No additional forced costs will be incurred to serve the new segment. Fixed cost $75 $110 The expected fixed cost here represents the allocation of existing forced costs incurred to each expected new client. Hence the amount of these casts that are allocated to each corporate client has been reduced Note that all of RL's foced costs are categorised as indirect cost with respect to each client. Time taken to serve professional labour hours) 3 hours 6 hours The amount of professional Labour hours lie., tax accountants' time) available over the next 3 months to serve these clients is 480 hours. Any leftover time will be unused RL's professional labour lie., tax accountants) is paid a fixed salary RL has estimated that the following number of potential new clients will be expected to approach the form for tax services over the next 3 months: Individual client segment lif Small business client chosen segment of chosen Number of potential new clients expected to approach 150 RL for tax services over the next 3 months 50Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts