Question: 1.Calculate return on investment (ROI) for each division using operating income as a measure of income and total assets as a measure of investment. 2.

1.Calculate return on investment (ROI) for each division using operating income as a measure of income and total assets as a measure of investment.

2. Calculate residual income (RI) for each division using operating income as a measure of income and total assets minus current liabilities as a measure of investment.

3.William Abraham, the new car division manager, argues that the performance parts division has load- ed up on a lot of short-term debt to boost its RI. Calculate an alternative RI for each division that is not sensitive to the amount of short-term debt taken on by the performance parts division. Comment on the result.

4.Performance Auto Company, whose tax rate is 40%, has two sources of funds: long-term debt with a market value of $18,000,000 at an interest rate of 10% and equity capital with a market value of $12,000,000 and a cost of equity of 15%. Applying the same weighted-average cost of capital (WACC) to each division, calculate EVA for each division.

5.Use your preceding calculations to comment on the relative performance of each division.

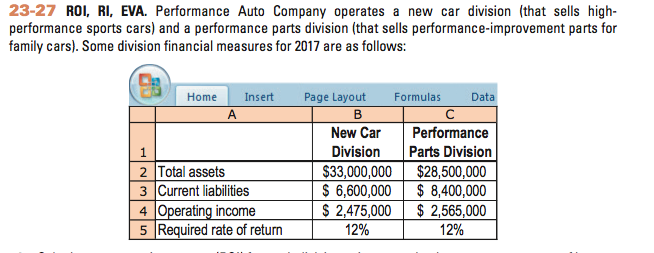

23-27 RO, RI, EVA. Performance Auto Company operates a new car division (that sells high- performance sports cars) and a performance parts division (that sells performance-improvement parts for family cars). Some division financial measures for 2017 are as follows: GB HomeInsert Page Layout Formulas Data 2 Total assets 3 Current liabilities 4. 5 Required rate of return New CarPerformance Division Parts Division $33,000,000 $28,500,000 S 6,600,000 8,400,000 $ 2,475,000$ 2,565,000 12% 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts