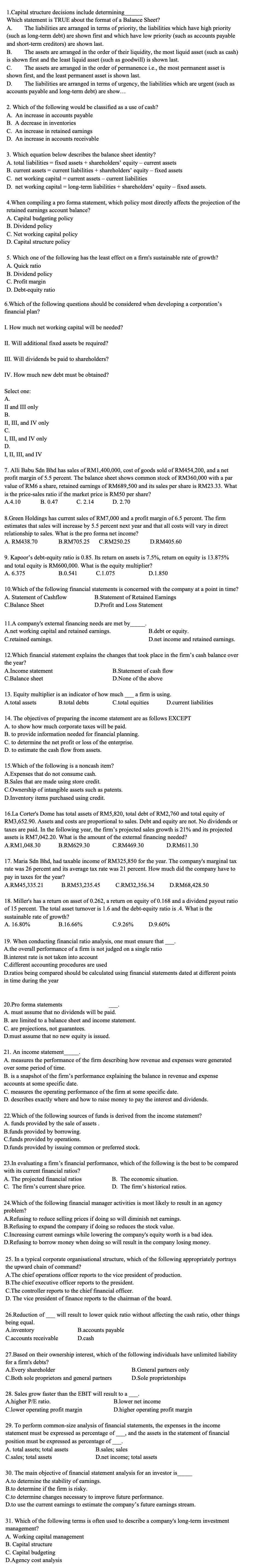

Question: 1.Capital structure decisions include determining_ Which statement is TRUE about the format of a Balance Sheet? A. The liabilities are arranged in terms of priority,

1.Capital structure decisions include determining_ Which statement is TRUE about the format of a Balance Sheet? A. The liabilities are arranged in terms of priority, the liabilities which have high priority (such as long-term debt) are shown first and which have low priority (such as accounts payable and short-term creditors) are shown last. B. The assets are arranged in the order of their liquidity, the most liquid asset (such as cash) is shown first and the least liquid asset (such as goodwill) is shown last. C. The assets are arranged in the order of permanence i.e., the most permanent asset is shown first, and the least permanent asset is shown last. D. The liabilities are arranged in terms of urgency, the liabilities which are urgent (such as accounts payable and long-term debt) are show... 2. Which of the following would be classified as a use of cash? A. An increase in accounts payable B. A decrease in inventories C. An increase in retained earnings D. An increase in accounts receivable 3. Which equation below describes the balance sheet identity? A. total liabilities = fixed assets + shareholders' equity - current assets B. current assets = current liabilities + shareholders' equity - fixed assets C. net working capital = current assets - current liabilities D. net working capital = long-term liabilities + shareholders' equity - fixed assets. 4.When compiling a pro forma statement, which policy most directly affects the projection of the retained earnings account balance? A. Capital budgeting policy B. Dividend policy C. Net working capital policy D. Capital structure policy 5. Which one of the following has the least effect on a firm's sustainable rate of growth? A. Quick ratio B. Dividend policy C. Profit margin D. Debt-equity ratio 6. Which of the following questions should be considered when developing a corporation's financial plan? I. How much net working capital will be needed? II. Will additional fixed assets be required? III. Will dividends be paid to shareholders? IV. How much new debt must be obtained? Select one: A. II and III only B. II, III, and IV only C. I, III, and IV only D. I, II, III, and IV 7. Alli Babu Sdn Bhd has sales of RM1,400,000, cost of goods sold of RM454,200, and a net profit margin of 5.5 percent. The balance sheet shows common stock of RM360,000 with a par value of RM6 a share, retained earnings of RM689,500 and its sales per share is RM23.33. What is the price-sales ratio if the market price is RM50 per share? A.4.10 C. 2.14 D. 2.70 B. 0.47 8. Green Holdings has current sales of RM7,000 and a profit margin of 6.5 percent. The firm estimates that sales will increase by 5.5 percent next year and that all costs will vary in direct relationship to sales. What is the pro forma net income? A. RM438.70 B.RM705.25 C.RM250.25 D.RM405.60 9. Kapoor's debt-equity ratio is 0.85. Its return on assets is 7.5%, return on equity is 13.875% and total equity is RM600,000. What is the equity multiplier? A. 6.375 B.0.541 C.1.075 D.1.850 10. Which of the following financial statements is concerned with the company at a point in time? B.Statement of Retained Earnings A. Statement of Cashflow C.Balance Sheet D.Profit and Loss Statement 11.A company's external financing needs are met by_ A.net working capital and retained earnings. B.debt or equity. C.retained earnings. D.net income and retained earnings. 12. Which financial statement explains the changes that took place in the firm's cash balance over the year? B.Statement of cash flow A.Income statement C.Balance sheet D.None of the above a firm is using. 13. Equity multiplier is an indicator of how much B.total debts A.total assets C.total equities D.current liabilities. 14. The objectives of preparing the income statement are as follows EXCEPT A. to show how much corporate taxes will be paid. B. to provide information needed for financial planning. C. to determine the net profit or loss of the enterprise. D. to estimate the cash flow from assets. 15. Which of the following is a noncash item? A.Expenses that do not consume cash. B.Sales that are made using store credit. C.Ownership of intangible assets such as patents. D.Inventory items purchased using credit. 16.La Corter's Dome has total assets of RM5,820, total debt of RM2,760 and total equity of RM3,652.90. Assets and costs are proportional to sales. Debt and equity are not. No dividends or taxes are paid. In the following year, the firm's projected sales growth is 21% and its projected assets is RM7,042.20. What is the amount of the external financing needed? A.RM1,048.30 D.RM611.30 B.RM629.30 C.RM469.30 17. Maria Sdn Bhd, had taxable income of RM325,850 for the year. The company's marginal tax rate was 26 percent and its average tax rate was 21 percent. How much did the company have to pay in taxes for the year? A.RM45,335.21 B.RM53,235.45 C.RM32,356.34 D.RM68,428.50 18. Miller's has a return on asset of 0.262, a return on equity of 0.168 and a dividend payout ratio of 15 percent. The total asset turnover is 1.6 and the debt-equity ratio is .4. What is the sustainable rate of growth? A. 16.80% B.16.66% C.9.26% D.9.60% 19. When conducting financial ratio analysis, one must ensure that A.the overall performance of a firm is not judged on a single ratio B.interest rate is not taken into account C.different accounting procedures are used D.ratios being compared should be calculated using financial statements dated at different points in time during the year 20.Pro forma statements A. must assume that no dividends will be paid. B. are limited to a balance sheet and income statement. C. are projections, not guarantees. D.must assume that no new equity is issued. 21. An income statement A. measures the performance of the firm describing how revenue and expenses were generated over some period of time. B. is a snapshot of the firm's performance explaining the balance in revenue and expense accounts at some specific date. C. measures the operating performance of the firm at some specific date. D. describes exactly where and how to raise money to pay the interest and dividends. 22. Which of the following sources of funds is derived from the income statement? A. funds provided by the sale of assets. B.funds provided by borrowing. C.funds provided by operations. D.funds provided by issuing common or preferred stock. 23.In evaluating a firm's financial performance, which of the following is the best to be compared with its current financial ratios? A. The projected financial ratios B. The economic situation. C. The firm's current share price. D. The firm's historical ratios. 24. Which of the following financial manager activities is most likely to result in an agency problem? A.Refusing to reduce selling prices if doing so will diminish net earnings. B.Refusing to expand the company if doing so reduces the stock value. C. Increasing current earnings while lowering the company's equity worth is a bad idea. D.Refusing to borrow money when doing so will result in the company losing money. 25. In a typical corporate organisational structure, which of the following appropriately portrays the upward chain of command? A.The chief operations officer reports to the vice president of production. B.The chief executive officer reports to the president. C.The controller reports to the chief financial officer. D. The vice president of finance reports to the chairman of the board. 26.Reduction of will result to lower quick ratio without affecting the cash ratio, other things being equal. A.inventory B.accounts payable C.accounts receivable D.cash 27.Based on their ownership interest, which of the following individuals have unlimited liability for a firm's debts? A.Every shareholder B.General partners only C.Both sole proprietors and general partners D.Sole proprietorships 28. Sales grow faster than the EBIT will result to a A.higher P/E ratio. C.lower operating profit margin B.lower net income D.higher operating profit margin 29. To perform common-size analysis of financial statements, the expenses in the income statement must be expressed as percentage of and the assets in the statement of financial position must be expressed as percentage of B.sales; sales A. total assets; total assets C.sales; total assets D.net income; total assets 30. The main objective of financial statement analysis for an investor is A.to determine the stability of earnings. B.to determine if the firm is risky. necessary to improve future performance. C.to determine changes D.to use the current earnings to estimate the company's future earnings stream. 31. Which of the following terms is often used to describe a company's long-term investment management? A. Working capital management B. Capital structure C. Capital budgeting D.Agency cost analysis 1.Capital structure decisions include determining_ Which statement is TRUE about the format of a Balance Sheet? A. The liabilities are arranged in terms of priority, the liabilities which have high priority (such as long-term debt) are shown first and which have low priority (such as accounts payable and short-term creditors) are shown last. B. The assets are arranged in the order of their liquidity, the most liquid asset (such as cash) is shown first and the least liquid asset (such as goodwill) is shown last. C. The assets are arranged in the order of permanence i.e., the most permanent asset is shown first, and the least permanent asset is shown last. D. The liabilities are arranged in terms of urgency, the liabilities which are urgent (such as accounts payable and long-term debt) are show... 2. Which of the following would be classified as a use of cash? A. An increase in accounts payable B. A decrease in inventories C. An increase in retained earnings D. An increase in accounts receivable 3. Which equation below describes the balance sheet identity? A. total liabilities = fixed assets + shareholders' equity - current assets B. current assets = current liabilities + shareholders' equity - fixed assets C. net working capital = current assets - current liabilities D. net working capital = long-term liabilities + shareholders' equity - fixed assets. 4.When compiling a pro forma statement, which policy most directly affects the projection of the retained earnings account balance? A. Capital budgeting policy B. Dividend policy C. Net working capital policy D. Capital structure policy 5. Which one of the following has the least effect on a firm's sustainable rate of growth? A. Quick ratio B. Dividend policy C. Profit margin D. Debt-equity ratio 6. Which of the following questions should be considered when developing a corporation's financial plan? I. How much net working capital will be needed? II. Will additional fixed assets be required? III. Will dividends be paid to shareholders? IV. How much new debt must be obtained? Select one: A. II and III only B. II, III, and IV only C. I, III, and IV only D. I, II, III, and IV 7. Alli Babu Sdn Bhd has sales of RM1,400,000, cost of goods sold of RM454,200, and a net profit margin of 5.5 percent. The balance sheet shows common stock of RM360,000 with a par value of RM6 a share, retained earnings of RM689,500 and its sales per share is RM23.33. What is the price-sales ratio if the market price is RM50 per share? A.4.10 C. 2.14 D. 2.70 B. 0.47 8. Green Holdings has current sales of RM7,000 and a profit margin of 6.5 percent. The firm estimates that sales will increase by 5.5 percent next year and that all costs will vary in direct relationship to sales. What is the pro forma net income? A. RM438.70 B.RM705.25 C.RM250.25 D.RM405.60 9. Kapoor's debt-equity ratio is 0.85. Its return on assets is 7.5%, return on equity is 13.875% and total equity is RM600,000. What is the equity multiplier? A. 6.375 B.0.541 C.1.075 D.1.850 10. Which of the following financial statements is concerned with the company at a point in time? B.Statement of Retained Earnings A. Statement of Cashflow C.Balance Sheet D.Profit and Loss Statement 11.A company's external financing needs are met by_ A.net working capital and retained earnings. B.debt or equity. C.retained earnings. D.net income and retained earnings. 12. Which financial statement explains the changes that took place in the firm's cash balance over the year? B.Statement of cash flow A.Income statement C.Balance sheet D.None of the above a firm is using. 13. Equity multiplier is an indicator of how much B.total debts A.total assets C.total equities D.current liabilities. 14. The objectives of preparing the income statement are as follows EXCEPT A. to show how much corporate taxes will be paid. B. to provide information needed for financial planning. C. to determine the net profit or loss of the enterprise. D. to estimate the cash flow from assets. 15. Which of the following is a noncash item? A.Expenses that do not consume cash. B.Sales that are made using store credit. C.Ownership of intangible assets such as patents. D.Inventory items purchased using credit. 16.La Corter's Dome has total assets of RM5,820, total debt of RM2,760 and total equity of RM3,652.90. Assets and costs are proportional to sales. Debt and equity are not. No dividends or taxes are paid. In the following year, the firm's projected sales growth is 21% and its projected assets is RM7,042.20. What is the amount of the external financing needed? A.RM1,048.30 D.RM611.30 B.RM629.30 C.RM469.30 17. Maria Sdn Bhd, had taxable income of RM325,850 for the year. The company's marginal tax rate was 26 percent and its average tax rate was 21 percent. How much did the company have to pay in taxes for the year? A.RM45,335.21 B.RM53,235.45 C.RM32,356.34 D.RM68,428.50 18. Miller's has a return on asset of 0.262, a return on equity of 0.168 and a dividend payout ratio of 15 percent. The total asset turnover is 1.6 and the debt-equity ratio is .4. What is the sustainable rate of growth? A. 16.80% B.16.66% C.9.26% D.9.60% 19. When conducting financial ratio analysis, one must ensure that A.the overall performance of a firm is not judged on a single ratio B.interest rate is not taken into account C.different accounting procedures are used D.ratios being compared should be calculated using financial statements dated at different points in time during the year 20.Pro forma statements A. must assume that no dividends will be paid. B. are limited to a balance sheet and income statement. C. are projections, not guarantees. D.must assume that no new equity is issued. 21. An income statement A. measures the performance of the firm describing how revenue and expenses were generated over some period of time. B. is a snapshot of the firm's performance explaining the balance in revenue and expense accounts at some specific date. C. measures the operating performance of the firm at some specific date. D. describes exactly where and how to raise money to pay the interest and dividends. 22. Which of the following sources of funds is derived from the income statement? A. funds provided by the sale of assets. B.funds provided by borrowing. C.funds provided by operations. D.funds provided by issuing common or preferred stock. 23.In evaluating a firm's financial performance, which of the following is the best to be compared with its current financial ratios? A. The projected financial ratios B. The economic situation. C. The firm's current share price. D. The firm's historical ratios. 24. Which of the following financial manager activities is most likely to result in an agency problem? A.Refusing to reduce selling prices if doing so will diminish net earnings. B.Refusing to expand the company if doing so reduces the stock value. C. Increasing current earnings while lowering the company's equity worth is a bad idea. D.Refusing to borrow money when doing so will result in the company losing money. 25. In a typical corporate organisational structure, which of the following appropriately portrays the upward chain of command? A.The chief operations officer reports to the vice president of production. B.The chief executive officer reports to the president. C.The controller reports to the chief financial officer. D. The vice president of finance reports to the chairman of the board. 26.Reduction of will result to lower quick ratio without affecting the cash ratio, other things being equal. A.inventory B.accounts payable C.accounts receivable D.cash 27.Based on their ownership interest, which of the following individuals have unlimited liability for a firm's debts? A.Every shareholder B.General partners only C.Both sole proprietors and general partners D.Sole proprietorships 28. Sales grow faster than the EBIT will result to a A.higher P/E ratio. C.lower operating profit margin B.lower net income D.higher operating profit margin 29. To perform common-size analysis of financial statements, the expenses in the income statement must be expressed as percentage of and the assets in the statement of financial position must be expressed as percentage of B.sales; sales A. total assets; total assets C.sales; total assets D.net income; total assets 30. The main objective of financial statement analysis for an investor is A.to determine the stability of earnings. B.to determine if the firm is risky. necessary to improve future performance. C.to determine changes D.to use the current earnings to estimate the company's future earnings stream. 31. Which of the following terms is often used to describe a company's long-term investment management? A. Working capital management B. Capital structure C. Capital budgeting D.Agency cost analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts