Question: 1-Consider the following statements about the Adjusted Present Value (APV) and the Cost of Capital approach (CoC) to finding optimal leverage. (i) The APV approach

1-Consider the following statements about the Adjusted Present Value (APV) and the Cost of Capital approach (CoC) to finding optimal leverage.

(i) The APV approach is preferred when it is very difficult to compute bankruptcy-related distress costs

(ii) The CoC approach is better when the firm targets a monetary debt level to stay constant. The APV approach is superior is the firm targets a constant debt ratio.

(iii) The APV approach is superior when computing the present value of the tax shield is impossible

Below, TTT means that i, ii,iii are true, TTF means that i, ii. are true but iii is false, and so on. a.-TTT

b.- TTF c. - TFF. d. - FTT. e-FFF

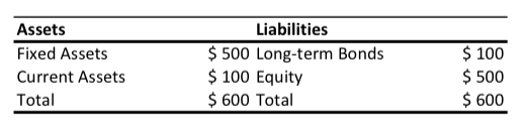

2-You have been called in as a consultant for ICL, a sporting goods retail firm, which is examining its debt policy. The firm currently has a balance sheet as follows:

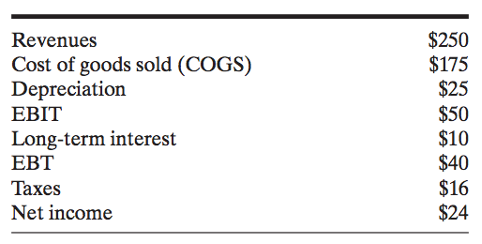

The firms income statement is as follows:

The firm currently has 100 shares outstanding, selling at a market price of $5 per share and the bonds are selling at par (so market and book value coincide). The firms current beta is 1.12, the equity risk premium is 5.5%, and the risk-free rate is 7%.

What is the firms implicit default spread and cost of capital?

a. 0% and 13.16%

b. 3% and 11.96%

c. 3% and 13.16%

d. 7% and 11.96%

e-6% and 13.16%

3-You are estimating the beta of Sonys stock. You have regressed the weekly return on Sonys stock on the weekly return of the S&P 500 your proxy of the market portfolio over a 2-year period. You obtained the following regression outputs:

The slope coefficient is 1.4.

The R-squared is 60%.

The intercept is exactly 0.

You are told that the risk-free rate was positive during the regression period.

Which of the following is TRUE?

a. Sonys stock did as well as expected during the regression period. 60% of the risk of Sonys stock can be attributed to market risk

b. Sonys stock did as well as expected during the regression period. 40% of the risk of Sonys stock can be attributed to market risk

c. Sonys stock did better than expected during the regression period. 60% of the risk of Sonys stock can be attributed to market risk

d. Sonys stock did worse than expected during the regression period. 60% of the risk of Sonys stock can be attributed to market risk

e-None of the above

\begin{tabular}{llc} \hline Assets & \multicolumn{1}{c}{ Liabilities } \\ \hline Fixed Assets & $500 Long-term Bonds & $100 \\ Current Assets & $100 Equity & $500 \\ Total & $600 Total & $600 \\ \hline \end{tabular} \begin{tabular}{lr} Revenues & $250 \\ Cost of goods sold (COGS) & $175 \\ Depreciation & $25 \\ EBIT & $50 \\ Long-term interest & $10 \\ EBT & $40 \\ Taxes & $16 \\ Net income & $24 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts