Question: 1.Create a table for NWC and Change in NWC for each year for Galveston 2. Create a table for gross CAPEX and change in CAPEX

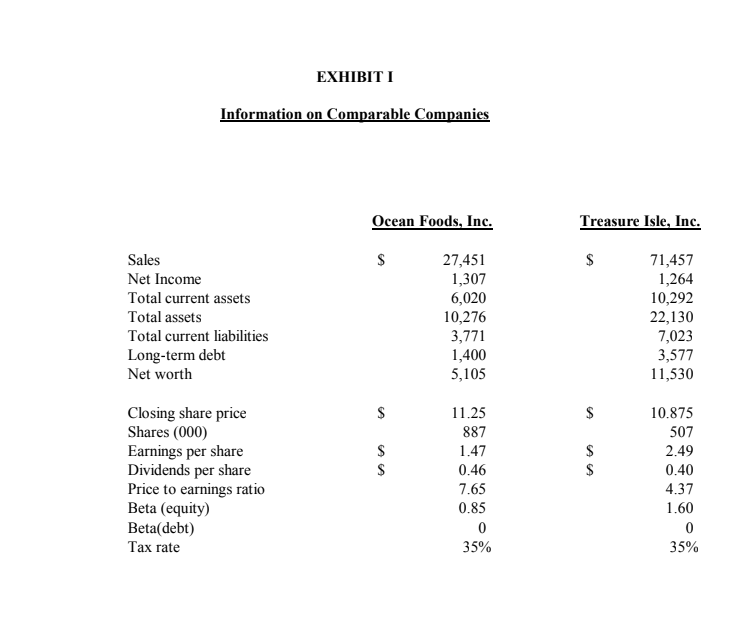

1.Create a table for NWC and Change in NWC for each year for Galveston

2. Create a table for gross CAPEX and change in CAPEX for each year for Galveston

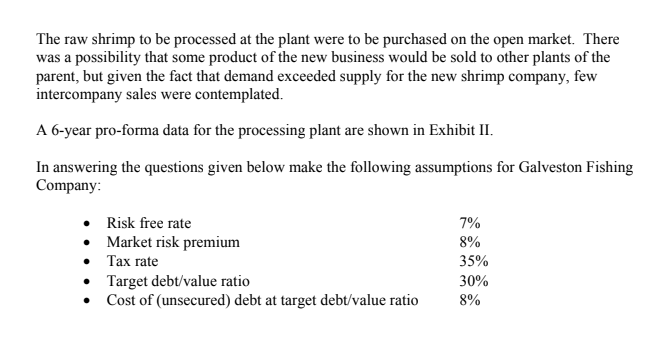

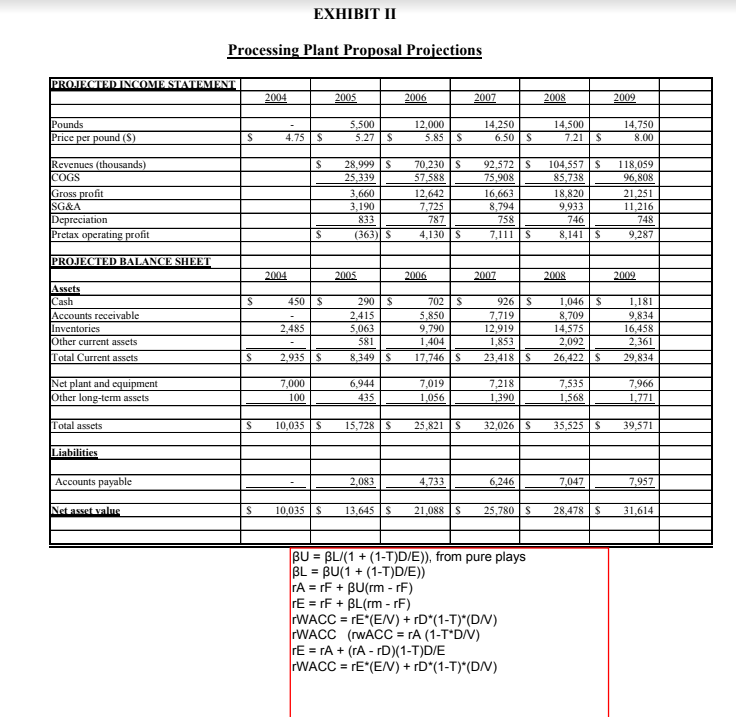

3. Calsulcate ROE, Bu, Ru, and WACC for Ocean Foods and Treasure Isle.

4. Given a beta of 1.5, calculate the Ra, Bl, WACC, and Re of Galveston

5. Calculate UFCF for each year for Galveston. Include Terminal Value.

6. What is the NPV of the Galveston?

7. What is the value of the interest tax shield?

8. Based on the NPV from #7, would you go ahead with the project? Why or why not?

9. Similar to question #8 but in a debtholder's and equity holder's perspective. Why or why not?

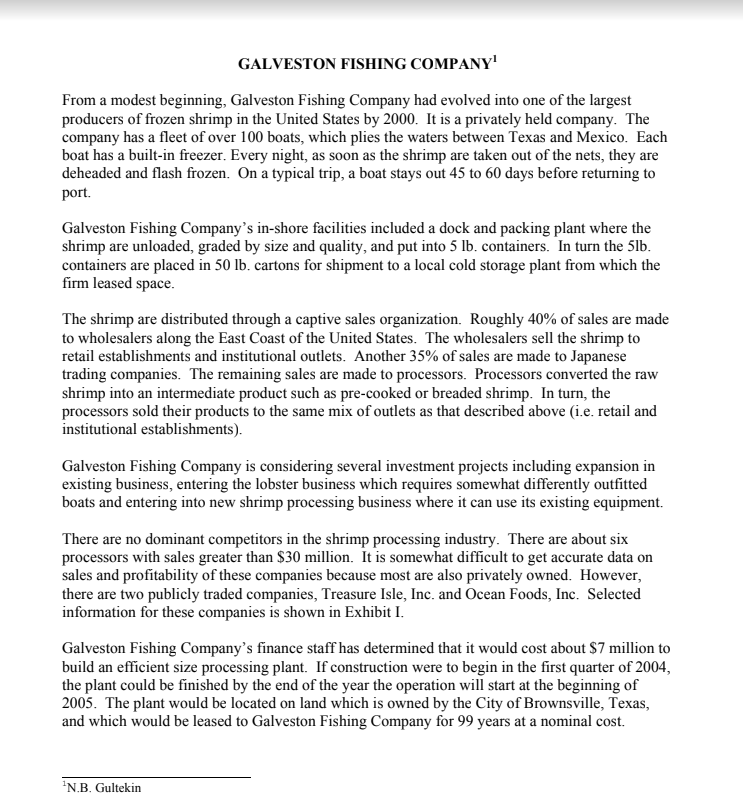

GALVESTON FISHING COMPANY From a modest beginning, Galveston Fishing Company had evolved into one of the largest producers of frozen shrimp in the United States by 2000. It is a privately held company. The company has a fleet of over 100 boats, which plies the waters between Texas and Mexico. Each boat has a built-in freezer. Every night, as soon as the shrimp are taken out of the nets, they are deheaded and flash frozen. On a typical trip, a boat stays out 45 to 60 days before returning to port. Galveston Fishing Company's in-shore facilities included a dock and packing plant where the shrimp are unloaded, graded by size and quality, and put into 5 lb. containers. In turn the 5lb containers are placed in 50 lb. cartons for shipment to a local cold storage plant from which the firm leased space The shrimp are distributed through a captive sales organization. Roughly 40% of sales are made to wholesalers along the East Coast of the United States. The wholesalers sell the shrimp to retail establishments and institutional outlets. Another 35% of sales are made to Japanese trading companies. The remaining sales are made to processors. Processors converted the raw shrimp into an intermediate product such as pre-cooked or breaded shrimp. In turn, the processors sold their products to the same mix of outlets as that described above (i.e. retail and institutional establishments) Galveston Fishing Company is considering several investment projects including expansion in existing business, entering the lobster business which requires somewhat differently outfitted boats and entering into new shrimp processing business where it can use its existing equipment. There are no dominant competitors in the shrimp processing industry. There are about six processors with sales greater than $30 million. It is somewhat difficult to get accurate data on sales and profitability of these companies because most are also privately owned. However, there are two publicly traded companies, Treasure Isle, Inc. and Ocean Foods, Inc. Selected information for these companies is shown in Exhibit I Galveston Fishing Company's finance staff has determined that it would cost about $7 million to build an efficient size processing plant. If construction were to begin in the first quarter of 2004 the plant could be finished by the end of the year the operation will start at the beginning of 2005. The plant would be located on land which is owned by the City of Brownsville, Texas and which would be leased to Galveston Fishing Company for 99 years at a nominal cost. N.B. Gultekin

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts