Question: 1D. 5 points. One year ago, you signed a forward contract in which you agreed to buy 17,255 British pounds today at a price of

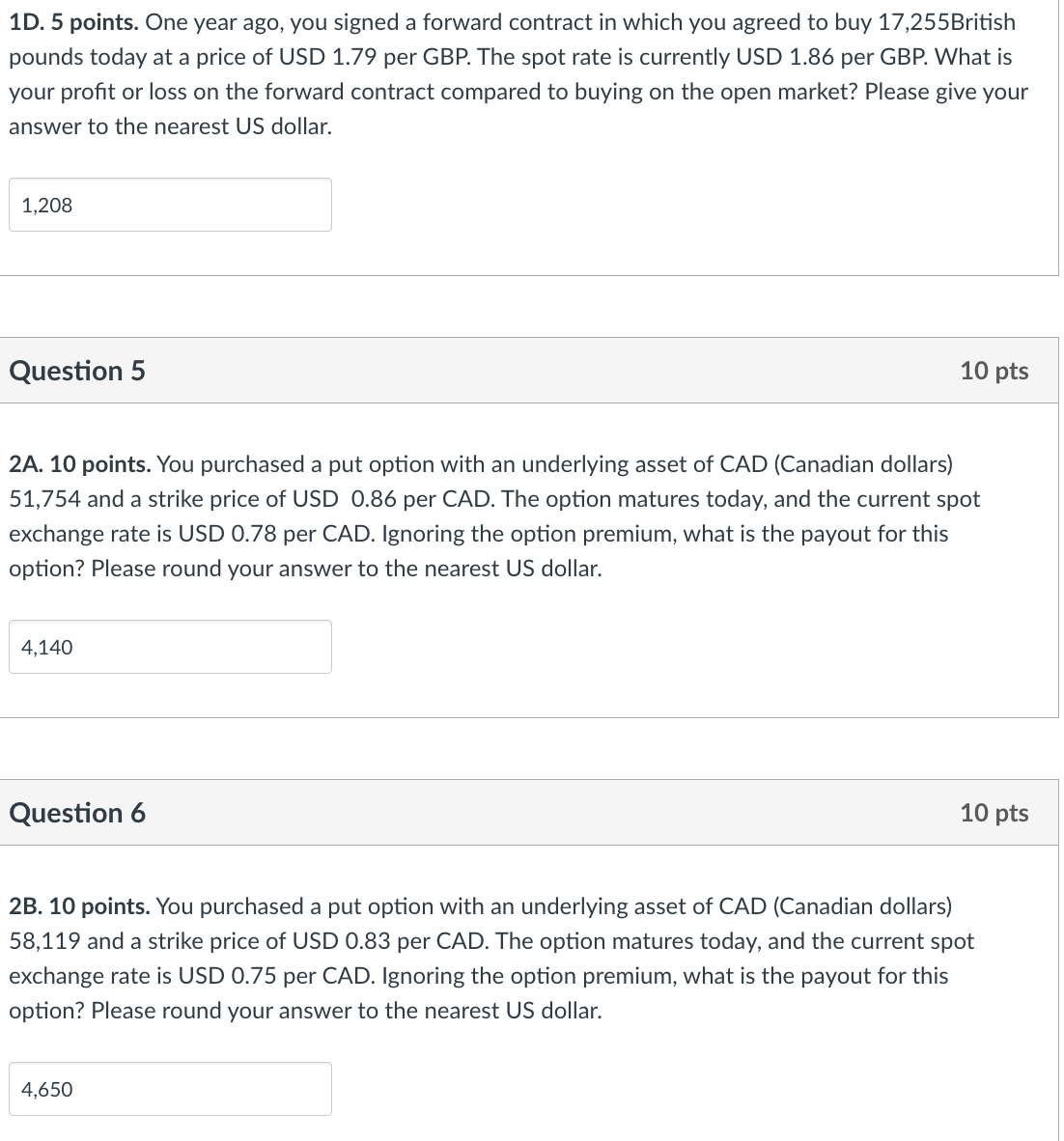

1D. 5 points. One year ago, you signed a forward contract in which you agreed to buy 17,255 British pounds today at a price of USD 1.79 per GBP. The spot rate is currently USD 1.86 per GBP. What is your profit or loss on the forward contract compared to buying on the open market? Please give your answer to the nearest US dollar. Question 5 10 pts 2A. 10 points. You purchased a put option with an underlying asset of CAD (Canadian dollars) 51,754 and a strike price of USD 0.86 per CAD. The option matures today, and the current spot exchange rate is USD 0.78 per CAD. Ignoring the option premium, what is the payout for this option? Please round your answer to the nearest US dollar. Question 6 10 pts 2B. 10 points. You purchased a put option with an underlying asset of CAD (Canadian dollars) 58,119 and a strike price of USD 0.83 per CAD. The option matures today, and the current spot exchange rate is USD 0.75 per CAD. Ignoring the option premium, what is the payout for this option? Please round your answer to the nearest US dollar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts