Question: 1.Discuss whether differences in the hedge ratio between the two commodities will have any effect on the effectiveness of the hedge. 2.Recommend a convenient hedging

1.Discuss whether differences in the hedge ratio between the two commodities will have any effect on the effectiveness of the hedge. 2.Recommend a convenient hedging strategy to the CFO using the data provided and explain the corresponding hedging position 3.Discuss the potential factors may weaken your suggested strategy.

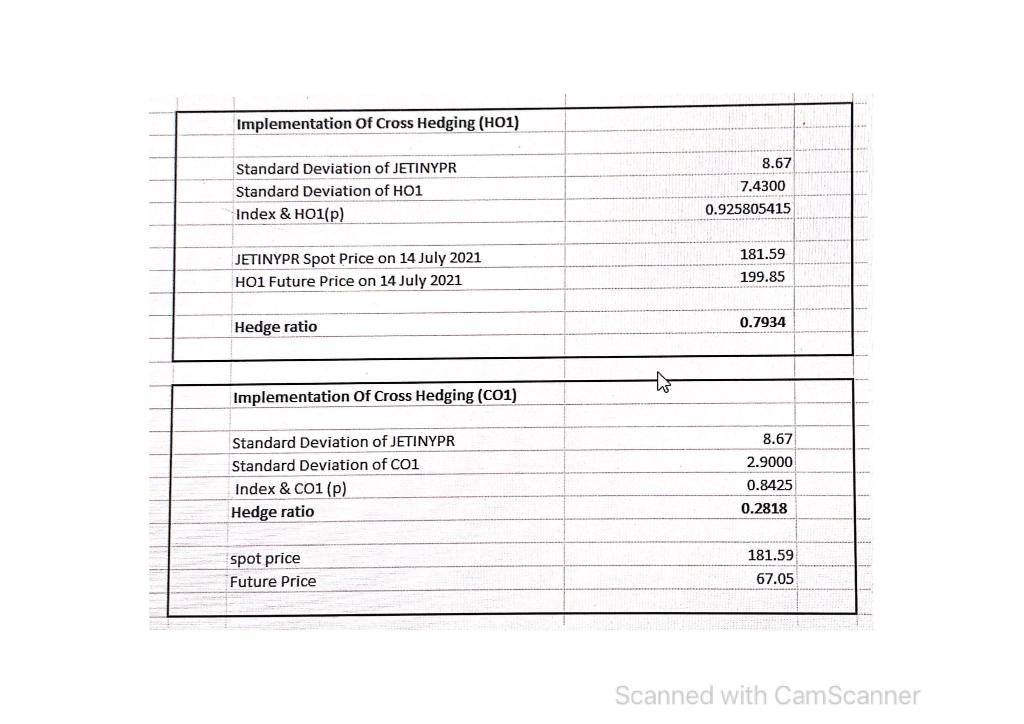

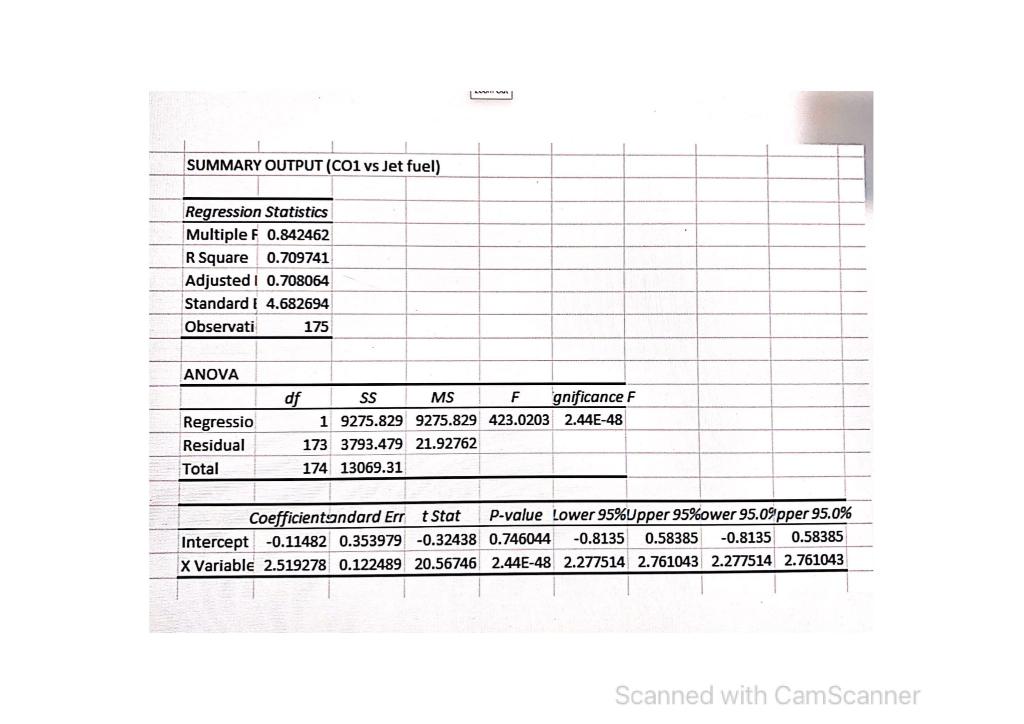

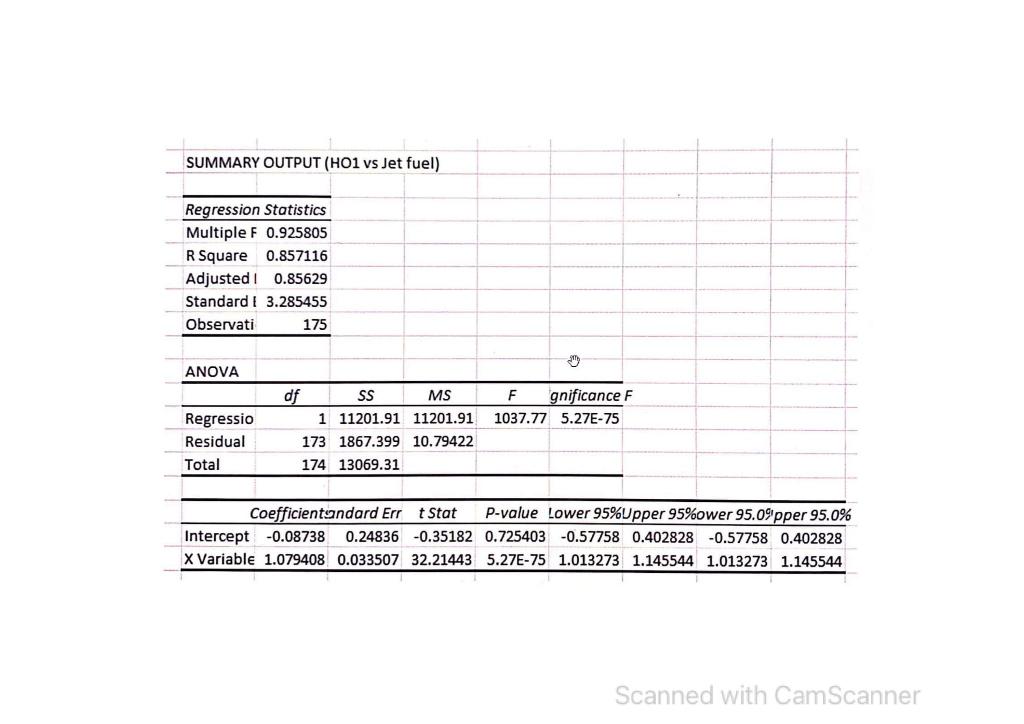

Implementation of Cross Hedging (H01) Standard Deviation of JETINYPR Standard Deviation of H01 Index & H01(p) 8.67 7.4300 0.925805415 JETINYPR Spot Price on 14 July 2021 HO1 Future Price on 14 July 2021 181.59 199.85 Hedge ratio 0.7934 Implementation Of Cross Hedging (C01) Standard Deviation of JETINYPR Standard Deviation of C01 Index & C01 (p) Hedge ratio 8.67 2.9000 0.8425 0.2818 spot price Future Price 181.59 67.05 Scanned with CamScanner SUMMARY OUTPUT (CO1 vs Jet fuel) Regression Statistics Multiple F 0.842462 R Square 0.709741 Adjusted I 0.708064 Standard I 4.682694 Observati 175 ANOVA Regressio Residual Total df SS MS F gnificance F 1 9275.829 9275.829 423.0203 2.44E-48 173 3793.479 21.92762 174 13069.31 Coefficientandard Errt Stat P-value Lower 95%Upper 95%ower 95.09pper 95.0% Intercept -0.11482 0.353979 -0.32438 0.746044 -0.8135 0.58385 -0.8135 0.58385 X Variable 2.519278 0.122489 20.56746 2.44E-48 2.277514 2.761043 2.277514 2.761043 Scanned with CamScanner SUMMARY OUTPUT (HO1 vs Jet fuel) Regression Statistics Multiple F 0.925805 R Square 0.857116 Adjusted! 0.85629 Standard I 3.285455 Observati 175 ANOVA F gnificance F 1037.77 5.27E-75 Regressio Residual Total df SS MS 1 11201.91 11201.91 173 1867.399 10.79422 174 13069.31 Coefficientandard Errt Stat P-value Lower 95%Upper 95%ower 95.09 pper 95.0% Intercept -0.08738 0.24836 -0.35182 0.725403 -0.57758 0.402828 -0.57758 0.402828 X Variable 1.079408 0.033507 32.21443 5.27E-75 1.013273 1.145544 1.013273 1.145544 Scanned with CamScanner Implementation of Cross Hedging (H01) Standard Deviation of JETINYPR Standard Deviation of H01 Index & H01(p) 8.67 7.4300 0.925805415 JETINYPR Spot Price on 14 July 2021 HO1 Future Price on 14 July 2021 181.59 199.85 Hedge ratio 0.7934 Implementation Of Cross Hedging (C01) Standard Deviation of JETINYPR Standard Deviation of C01 Index & C01 (p) Hedge ratio 8.67 2.9000 0.8425 0.2818 spot price Future Price 181.59 67.05 Scanned with CamScanner SUMMARY OUTPUT (CO1 vs Jet fuel) Regression Statistics Multiple F 0.842462 R Square 0.709741 Adjusted I 0.708064 Standard I 4.682694 Observati 175 ANOVA Regressio Residual Total df SS MS F gnificance F 1 9275.829 9275.829 423.0203 2.44E-48 173 3793.479 21.92762 174 13069.31 Coefficientandard Errt Stat P-value Lower 95%Upper 95%ower 95.09pper 95.0% Intercept -0.11482 0.353979 -0.32438 0.746044 -0.8135 0.58385 -0.8135 0.58385 X Variable 2.519278 0.122489 20.56746 2.44E-48 2.277514 2.761043 2.277514 2.761043 Scanned with CamScanner SUMMARY OUTPUT (HO1 vs Jet fuel) Regression Statistics Multiple F 0.925805 R Square 0.857116 Adjusted! 0.85629 Standard I 3.285455 Observati 175 ANOVA F gnificance F 1037.77 5.27E-75 Regressio Residual Total df SS MS 1 11201.91 11201.91 173 1867.399 10.79422 174 13069.31 Coefficientandard Errt Stat P-value Lower 95%Upper 95%ower 95.09 pper 95.0% Intercept -0.08738 0.24836 -0.35182 0.725403 -0.57758 0.402828 -0.57758 0.402828 X Variable 1.079408 0.033507 32.21443 5.27E-75 1.013273 1.145544 1.013273 1.145544 Scanned with CamScanner

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts