Question: 1.do, do 2. secured with an additional mortage on your house, unsecured 3. the self disipline to use it only in emergencies, simply staying below

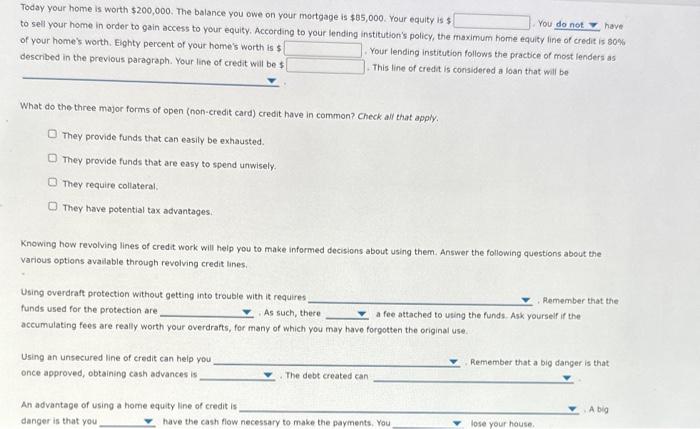

to sell your home in order to gain access to your equity. According to your lending institution's policy, the fmaximum home equity line of credit is sos. of your home's worth. Eighty percent of your home's worth is 5 described in the previous paragraph. Your line of credit will be s Your lending institution follows the practice of most lenders as . This line of credit is considered a loan that will be What do the three major forms of open (non-credit card) credit have in common? Check an chat apply. They provide funds that can easily be exhausted. They provide funds that are easy to spend unwisely. They require collateral. They have potential tax advantages: Knowing how revolving lines of credit work will help you to make informed decisions about using them. Answer the following questions about the various options available through revolving credit lines. Using overdraft protection without getting into trouble with it requires . Pemember that the funds used for the protection are, As such, there accumulating fees are really worth your overdrafts, for many of which you may have forgotten the original use. Using an unsecured line of credit can help you Remember that a big danger is that once approved, obtaining cash advances is . The debt created can. An advantage of using a home equity line of credit is danger is that you have the cash flow necessary to make the payments. You

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts