Question: 1.For each statement, identify whether the statement is a violation of the efficient markets hypothesis? If the statement is a violation, briefly (one or two

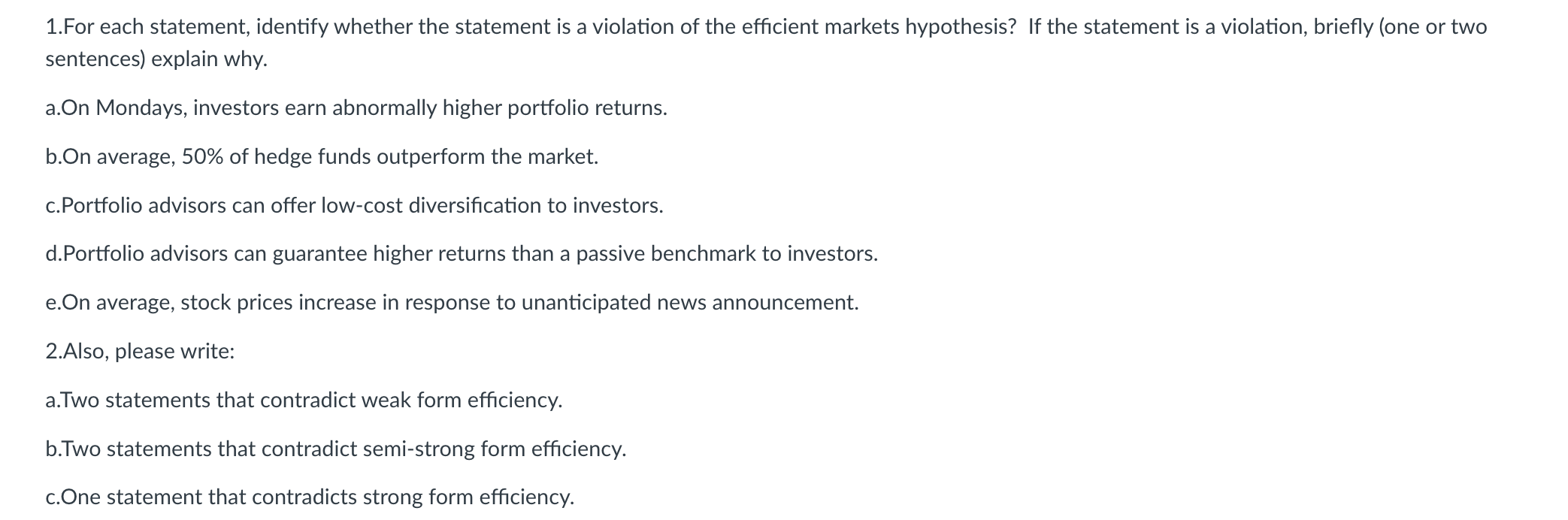

1.For each statement, identify whether the statement is a violation of the efficient markets hypothesis? If the statement is a violation, briefly (one or two sentences) explain why. a.On Mondays, investors earn abnormally higher portfolio returns. b.On average, 50% of hedge funds outperform the market. c.Portfolio advisors can offer low-cost diversification to investors. d.Portfolio advisors can guarantee higher returns than a passive benchmark to investors. e.On average, stock prices increase in response to unanticipated news announcement. 2.Also, please write: a.Two statements that contradict weak form efficiency. b.Two statements that contradict semi-strong form efficiency. c.One statement that contradicts strong form efficiency. 1.For each statement, identify whether the statement is a violation of the efficient markets hypothesis? If the statement is a violation, briefly (one or two sentences) explain why. a.On Mondays, investors earn abnormally higher portfolio returns. b.On average, 50% of hedge funds outperform the market. c.Portfolio advisors can offer low-cost diversification to investors. d.Portfolio advisors can guarantee higher returns than a passive benchmark to investors. e.On average, stock prices increase in response to unanticipated news announcement. 2.Also, please write: a.Two statements that contradict weak form efficiency. b.Two statements that contradict semi-strong form efficiency. c.One statement that contradicts strong form efficiency

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts