Question: 1.How do I prepare a straight-line amortization table for the bond listed belows life? 2. How do I prepare the necessary journal entries for the

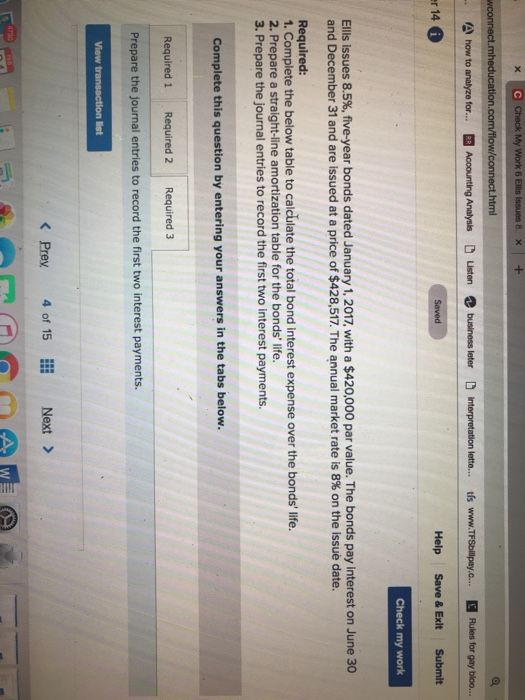

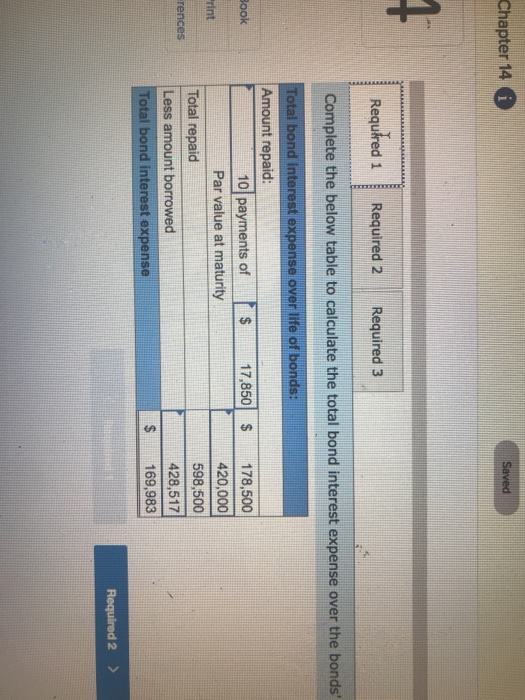

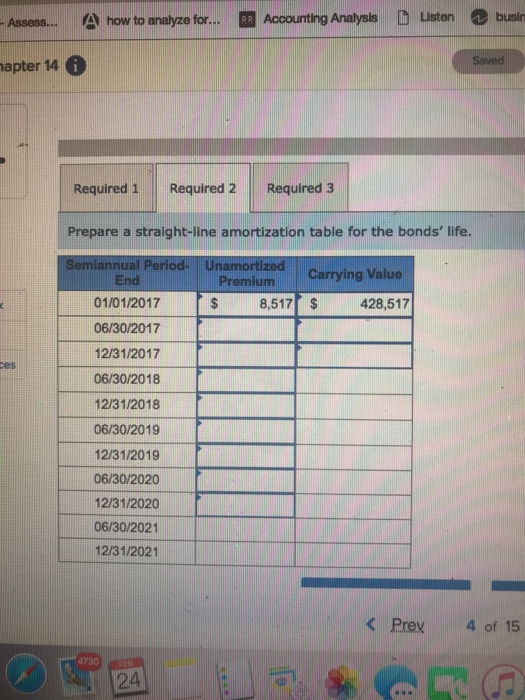

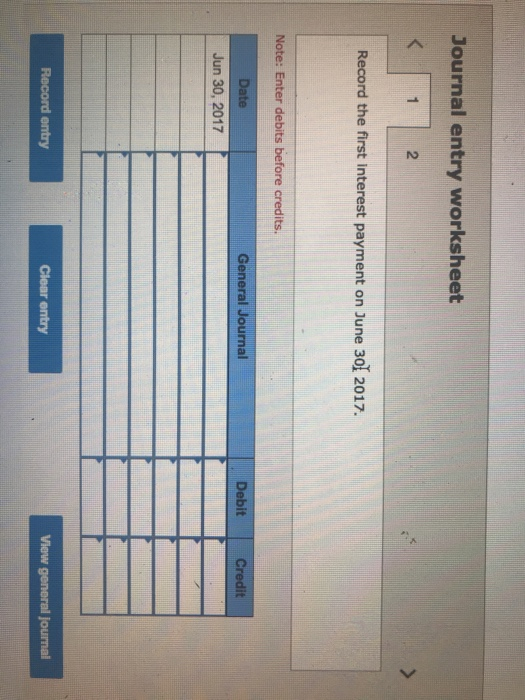

on lette... tfs www Rules for gay r 14 Help Save & Exit Submit Ellis Issues 8.5%, five-year bonds dated January 1, 2017, with a $420,000 par value. The bonds pay interest on June 30 and December 31 and are issued at a price of $428,517. The annual market rate is 8% on the issue date. Required: 1. Complete the below table to calculate the total bond interest expense over the bonds' life. 2. Prepare a straight-line amortization table for the bonds' life. 3. Prepare the journal entries to record the first two interest payments Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare the journal entries to record the first two interest payments. K Prey 4 of 15 Next> Chapter 14 Required 1 Required 2 Required 3 Complete the below table to calculate the total bond interest expense over the bonds Total bond interest expense over life of bonds 10 payments of Par value at maturity 17,850 178,500 420,000 598,500 428,517 $ 169,983 ook rint Total repaid Less amount Total bond interest expense rences Assess.. A how to analyze for... RR Accounting Analysls Liston busin apter 14 Required 1 Required 2 Required 3 Prepare a straight-line amortization table for the bonds' life. Semiannual Period- Unamortized End 01/01/2017 06/30/2017 12/31/2017 06/30/2018 12/31/2018 06/30/2019 12/31/2019 06/30/2020 12/31/2020 06/30/2021 12/31/2021 PremiumCarrying Value 8,517 $ 428,517 ces K Prex4 of 15 4730 24 Journal entry worksheet 2 Record the first interest payment on June 30] 2017. Note: Enter debits before credits. Date General Journal Debit Credit Jun 30, 2017 Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts