Question: 1)if you use both models for evaluation tje expected rate of return you obtained will be ? choose one : the same / not enough

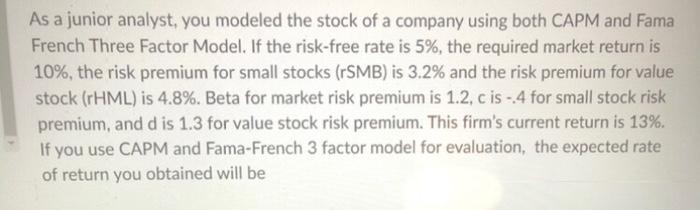

As a junior analyst, you modeled the stock of a company using both CAPM and Fama French Three Factor Model. If the risk-free rate is 5%, the required market return is 10%, the risk premium for small stocks (rSMB) is 3.2% and the risk premium for value stock (rHML) is 4.8%. Beta for market risk premium is 1.2,c is .4 for small stock risk premium, and d is 1.3 for value stock risk premium. This firm's current return is 13%. If you use CAPM and Fama-French 3 factor model for evaluation, the expected rate of return you obtained will be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts