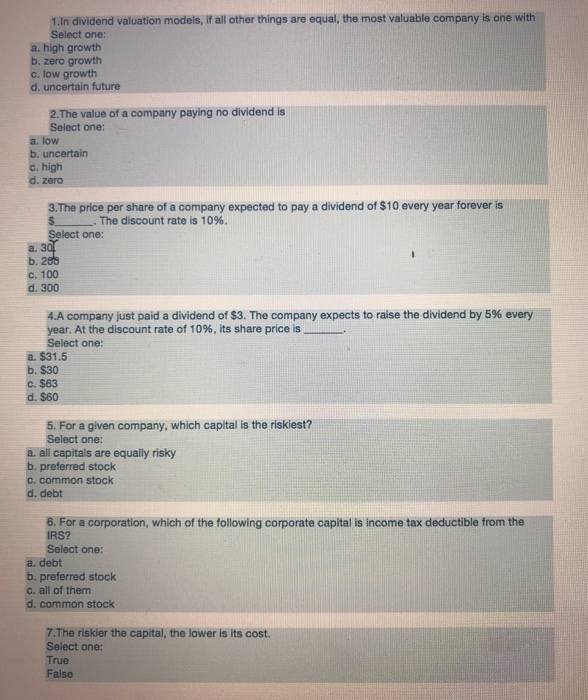

Question: 1.In dividend valuation models, if all other things are equal, the most valuable company is one with elect one: a. high growth b. zero growth

1.In dividend valuation models, if all other things are equal, the most valuable company is one with elect one: a. high growth b. zero growth c. low growth d. uncertain future 2.The value of a company paying no dividend is Select one: a. low b. uncertain c. high d. zero 3.The price per share of a company expected to pay a dividend of $10 every year forever is The discount rate is 10%. Select one: a. b. 2 c. 100 d. 300 4.A company just paid a dividend of $3. The company expects to raise the dividend by 5% every- year. At the discount rate of 10%, its share price is- Select one: a. $31.5 b. $30 c. $63 d. $60 5. For a given company, which capital is the riskiest? a. all capitals are equally risky c. common stock Select one: preferred stock d. debt 6. For a corporation, which of the following corporate capital is income tax deductible from the IRS? Select one: a. debt b. preferred stock c. all of them d. common stock 7.The riskier the capital, the lower is its cost. Select one: True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts