Question: 1)Net value present for each machine? 2) Internal rate of return for each machine? 3) Which machine should be recommended and why? Please answer in

1)Net value present for each machine?

2) Internal rate of return for each machine?

3) Which machine should be recommended and why?

Please answer in detail.

Thank you

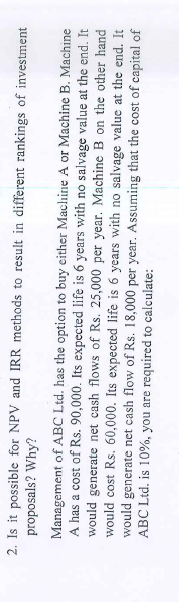

2. Is it possible for NPV and IRR methods to result in different rankings of investment proposals? Why? Management of ABC Ltd. has the option to buy either Machine A or Machine B. Machine A has a cost of Rs. 90,000. Its expected life is 6 years with no salvage value at the end. It would generate net cash flows of Rs. 25,000 per year. Machine B on the other hand would cost Rs. 60,000. Its expected life is 6 years with no salvage value at the end. It would generate net cash flow of Rs. 18,000 per year. Assuming that the cost of capital of ABC Ltd. is 10%, you are required to calculate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts