Question: 1)NPV 2)budgeting decisions ? Chapter 11 Assignment c Back to Assignment Attempts: Keep the Highest:/20 Attention: Due to a bug in Google Chrome, this page

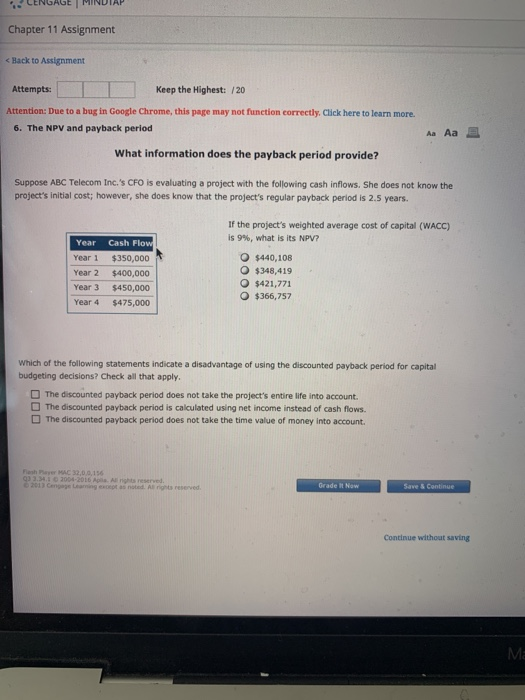

Chapter 11 Assignment c Back to Assignment Attempts: Keep the Highest:/20 Attention: Due to a bug in Google Chrome, this page may not function correctly. Click here to learn more. 6. The NPV and payback period Aa Aa What information does the payback period provide? Suppose ABC Telecom Inc.'s CFO is evaluating a project with the following cash inflows. She does not know the project's initial cost; however, she does know that the project's regular payback period is 2.5 years. If the project's weighted average cost of capital (WACC) is 9%, what is its NPV? Year Cash Flow Year 1 $350,000 Year 2 $400,000 Year 3 $450,000 Year 4 $475,000 O $440,108 O $348,419 O $421,771 O $366,757 which of the following statements indicate a disadvantage of using the discounted payback period for capital budgeting decisions? Check all that apply. The discounted payback period does not take the project's entire life into account The discounted payback period is calculated using net income instead of cash flows. The discounted payback period does not take the time value of money into account. Flash Payer MAC 32,0.0,16 3.343 0 2004-2016 Apa All rights reserved Continue without saving

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts