Question: 1.pdf 2 / 3 90% + | [G] ASSIgnment Units 1&2 1 1 1 1 On the 18th of August 2021, Farmer Steyn plants his

![1.pdf 2 / 3 90% + | [G] ASSIgnment Units 1&2](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fd8d4b128c8_81066fd8d4a7a0e0.jpg)

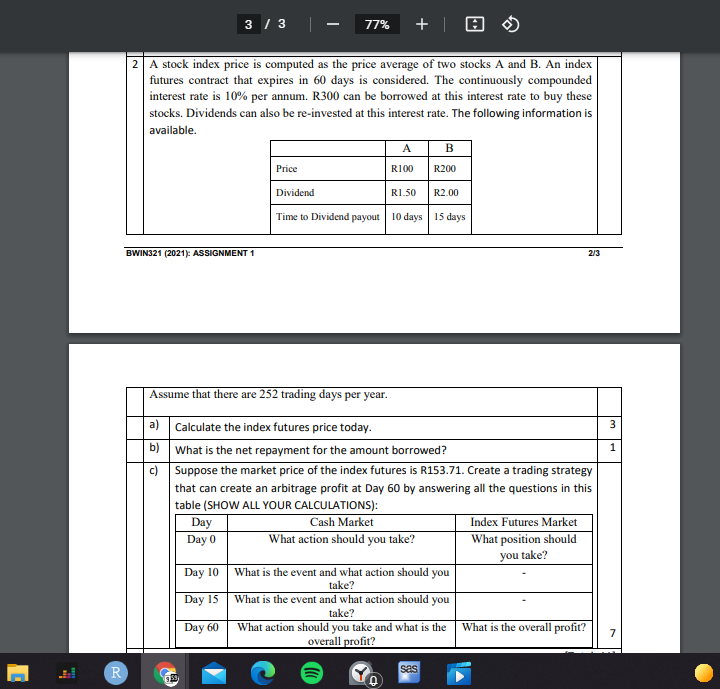

1.pdf 2 / 3 90% + | [G] ASSIgnment Units 1&2 1 1 1 1 On the 18th of August 2021, Farmer Steyn plants his crop of wheat and is concerned about the price he will receive when the crop is harvested on the 30th of September 2021. The premium for the option is R15 per contract; the strike price is R395 and the current futures price is R395. The continuously compounded interest rate is 5% per annum. Assume that there are 252 trading days per year. a) what is his main concern? b) How can he hedge with futures? c) How can he hedge with options? d) Compare the two hedging strategies by completing this table: Derivative used: Futures Contract European Option Initial Cost Calculate the profit/loss on the stated dates for each derivative strategy (SHOW ALL YOUR CALCULATIONS): Wheat spot price Futures Contract European Option 25 August spot price of wheat = R320 31 August spot price of wheat = R380 17 September spot price of wheat = R440 30 September spot price of wheat = R500 SHOW ALL YOUR CALCULATIONS. e) On the same set of axes draw the graphs showing the profits from these two derivative strategies. 9 2 0 R sas 93 24C Sur 3 / 3 77% + | 2 A stock index price is computed as the price average of two stocks A and B. An index futures contract that expires in 60 days is considered. The continuously compounded interest rate is 10% per annum. R300 can be borrowed at this interest rate to buy these stocks. Dividends can also be re-invested at this interest rate. The following information is available. B Price R100 A R200 Dividend RI 50 R2.00 Time to Dividend payout 10 days 15 days BWIN321 (2021): ASSIGNMENT 1 2/3 3 1 Assume that there are 252 trading days per year. a) Calculate the index futures price today. b) What is the net repayment for the amount borrowed? c) Suppose the market price of the index futures is R153.71. Create a trading strategy that can create an arbitrage profit at Day 60 by answering all the questions in this table (SHOW ALL YOUR CALCULATIONS): Day Cash Market Index Futures Market Day 0 What action should you take? What position should you take? Day 10 Day 15 What is the event and what action should you take? What is the event and what action should you take? What action should you take and what is the overall profit? Day 60 What is the overall profit? 7 R sas 933

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts