Question: 1.Please for question (a) draw the loan amortization table and show how you got the figures. Please show calculations 2.For question (b) draw the loan

1.Please for question (a) draw the loan amortization table

and show how you got the figures. Please show calculations

2.For question (b) draw the loan arrangement cash flow template and put figures in table. Also show how you got these figures.

3.For question (b) draw the leasing arrangement cash flow template and put figures in it. Also show how you got these figures.

4.Please show calculations and explain clearly the question-using a discount rate of 8% as the cost of capital, evaluate which financing option the company should go for?

5.Prepare the loan amortization table

6.Using the template above, establish the cash flow pattern under each financing option

7.Using a discount rate of 8% as the cost of capital, evaluate which financing option the company should go for

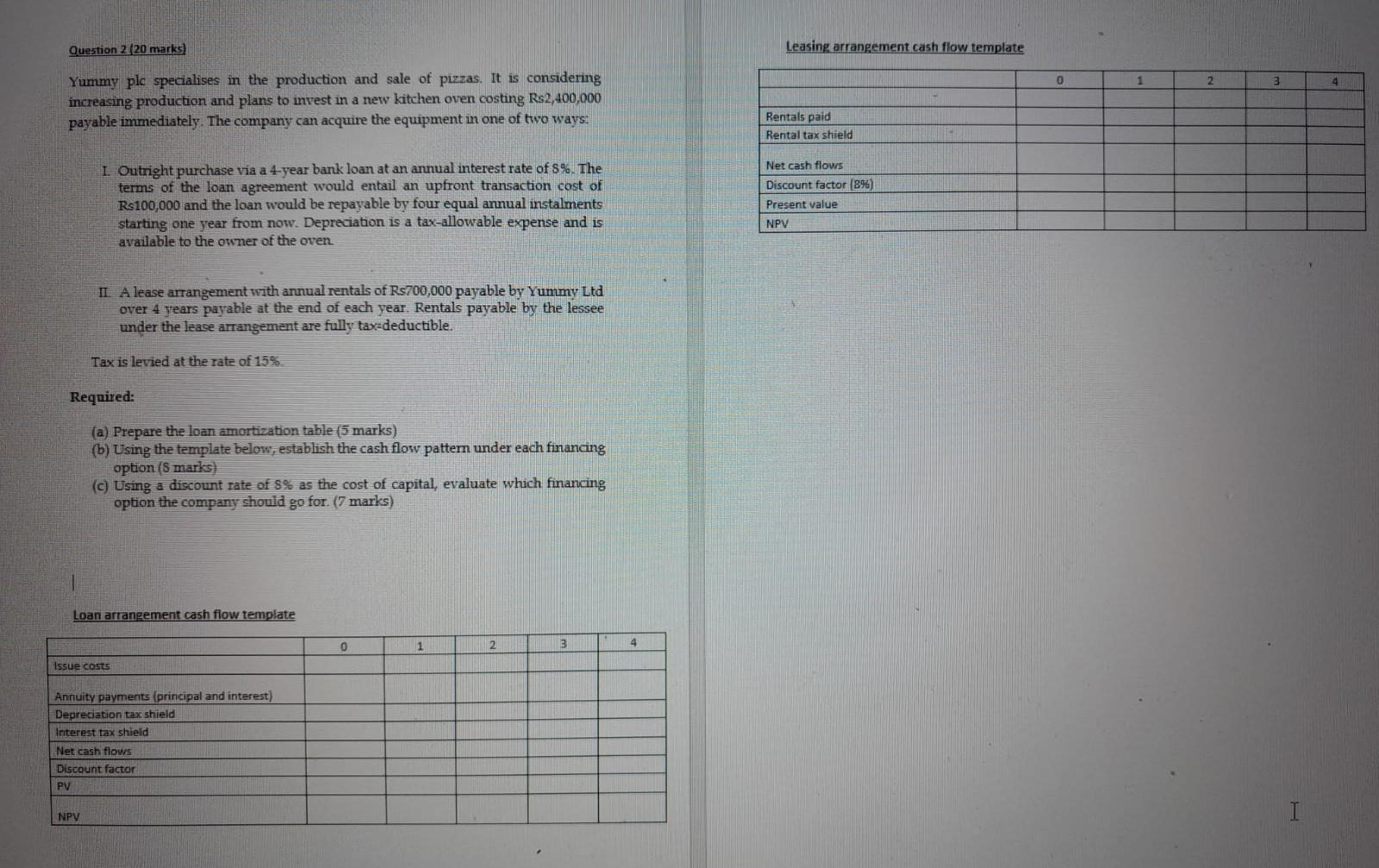

Question 2 (20 marks) Yummy plc specialises in the production and sale of pizzas. It is considering increasing production and plans to invest in a new kitchen oven costing Rs2,400,000 payable immediately. The company can acquire the equipment in one of two ways: 1 Outright purchase via a 4-year bank loan at an annual interest rate of 5%. The terms of the loan agreement would entail an upfront transaction cost of Rs100,000 and the loan would be repayable by four equal annual instalments starting one year from now. Depreciation is a tax-allowable expense and is available to the owner of the oven. II A lease arrangement with annual rentals of Rs700,000 payable by Yummy Ltd over 4 years payable at the end of each year. Rentals payable by the lessee under the lease arrangement are fully tax-deductible. Tax is levied at the rate of 15%. Required: (a) Prepare the loan amortization table (5 marks) (b) Using the template below, establish the cash flow pattern under each financing option (S marks) (c) Using a discount rate of 8% as the cost of capital, evaluate which financing option the company should go for. (7 marks) Loan arrangement cash flow template Issue costs Annuity payments (principal and interest) Depreciation tax shield Interest tax shield NPV Net cash flows Discount factor PV 0 1 2 3 4 Leasing arrangement cash flow template Rentals paid Rental tax shield Net cash flows Discount factor (8%) Present value NPV 0 1 2 3 4

Step by Step Solution

There are 3 Steps involved in it

Ill break down the task into clear steps for each part of the question Heres how to approach it 1 Loan Amortization Table Question 1a To prepare the loan amortization table we need the following data ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

20250603_173931.xlsx

300 KBs Excel File