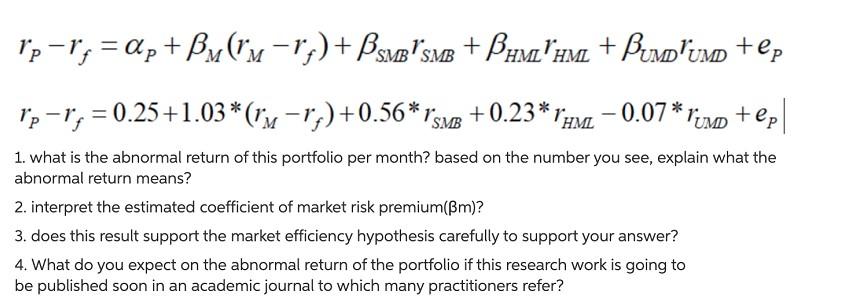

Question: 1p-r; = dp + Bulin-rs) + BombSMB + Pum'um. + Bump'umo +@p 1p-r; = 0.25+1.03 * (v-r) +0.56* IsmB+0.23* PHML -0.07* Fimo tep| 1. what

1p-r; = dp + Bulin-rs) + BombSMB + Pum'um. + Bump'umo +@p 1p-r; = 0.25+1.03 * (v-r) +0.56* IsmB+0.23* PHML -0.07* Fimo tep| 1. what is the abnormal return of this portfolio per month? based on the number you see, explain what the abnormal return means? 2. interpret the estimated coefficient of market risk premium(Bm)? 3. does this result support the market efficiency hypothesis carefully to support your answer? 4. What do you expect on the abnormal return of the portfolio if this research work is going to be published soon in an academic journal to which many practitioners refer? 1p-r; = dp + Bulin-rs) + BombSMB + Pum'um. + Bump'umo +@p 1p-r; = 0.25+1.03 * (v-r) +0.56* IsmB+0.23* PHML -0.07* Fimo tep| 1. what is the abnormal return of this portfolio per month? based on the number you see, explain what the abnormal return means? 2. interpret the estimated coefficient of market risk premium(Bm)? 3. does this result support the market efficiency hypothesis carefully to support your answer? 4. What do you expect on the abnormal return of the portfolio if this research work is going to be published soon in an academic journal to which many practitioners refer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts