Question: 1st drop down options: always do not necessarily 2nd drop down options: front-end load low-load no-load back-end load Understanding the Costs Involved in Mutual Fund

1st drop down options:

1st drop down options:

always

do not necessarily

2nd drop down options:

front-end load

low-load

no-load

back-end load

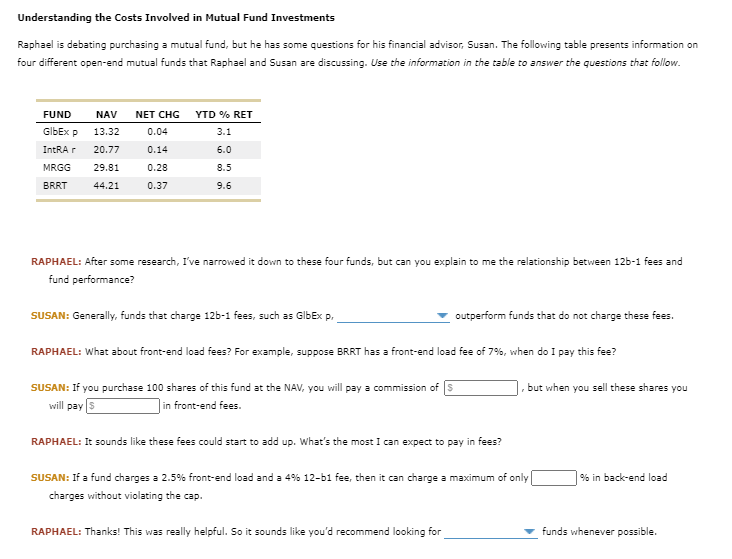

Understanding the Costs Involved in Mutual Fund Investments Raphael is debating purchasing a mutual fund, but he has some questions for his financial advisor Susan. The following table presents information on four different open-end mutual funds that Raphael and Susan are discussing. Use the information in the table to answer the questions that follow. NAV NET CHG 0.04 FUND GbExp IntRA MRGG BRRT 13.32 20.77 YTD % RET 3.1 6.0 0.14 29.81 0.28 8.5 44.21 0.37 9.6 RAPHAEL: After some research, I've narrowed it down to these four funds, but can you explain to me the relationship between 125-1 fees and fund performance? SUSAN: Generally, funds that charge 125-1 fees, such as GlbEx P. outperform funds that do not charge these fees. RAPHAEL: What about front-end load fees? For example, suppose BRRT has a front-end load fee of 7%, when do I pay this fee? SUSAN: If you purchase 100 shares of this fund at the NAV, you will pay a commission of S will pays in front-end fees. but when you sell these shares you RAPHAEL: It sounds like these fees could start to add up. What's the most I can expect to pay in fees? % in back-end load SUSAN: If a fund charges a 2.5% front-end load and a 4% 12-b1 fee, then it can charge a maximum of only charges without violating the cap. RAPHAEL: Thanks! This was really helpful. So it sounds like you'd recommend looking for funds whenever possible

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts