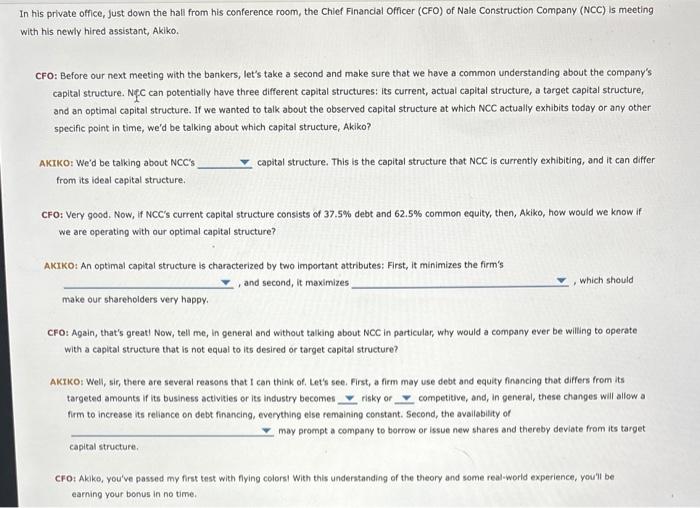

Question: 1st drop down options: target, actual, optimal 2nd: shareholder wealth, WACC 3rd: the firm's WACC, the value of the firm 4th: less, more 5th: less,

n his private office, just down the hall from his conference room, the Chief Financial Officer (CFO) of Nale Construction Company (NCC) is meeting vith his newly hired assistant, Akiko. CFO: Before our next meeting with the bankers, let's take a second and make sure that we have a common understanding about the company's capital structure. NfeC can potentially have three different capital structures: its current, actual capital structure, a target capital structure, and an optimal copital structure. If we wanted to talk about the observed capital structure at which NCC actually exhibits today or any other specific point in time, we'd be talking about which capital structure, Akiko? AKIKC: We'd be talking about NCC's capital structure. This is the capital structure that NCC is currently exhibiting, and it can differ from its ideal capital structure. CFO: Very good, Now, if NCC's current capital structure consists of 37.5% debt and 62.5% common equity, then, Akiko, how would we know if we are operating with our optimal capital structure? AKIKO: An optimal capital structure is characterized by two important attributes: First, it minimizes the firm's , and second, it maximizes _ , which should make our shareholders very happy. CFO: Again, that's greatl Now, tell me, in general and without talking about NCC in particular, why would a company ever be willing to operate with a capital structure that is not equal to its desired or target capital structure? AKIKO: Well, sir, there are several reasons that 1 can think of, Let's see. First, a firm may use debt and equity financing that differs from its targeted amounts if its business activities or its industry becomes risky of competitive, and, in general, these changes will allow a firm to increase its reliance on debt financing, everything else remaining constant. Second, the availability of may prompt a company to borrow or issue new shares and thereby deviate from its target capital structure. CFO: Akke, you've passed my first test with flying colorsi with this understanding of the theory and some real-world experience, you'll be earning your bonus in no time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts