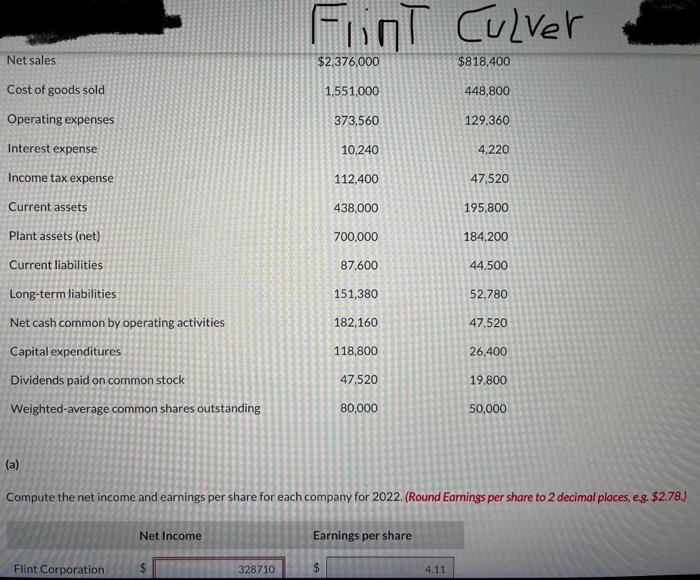

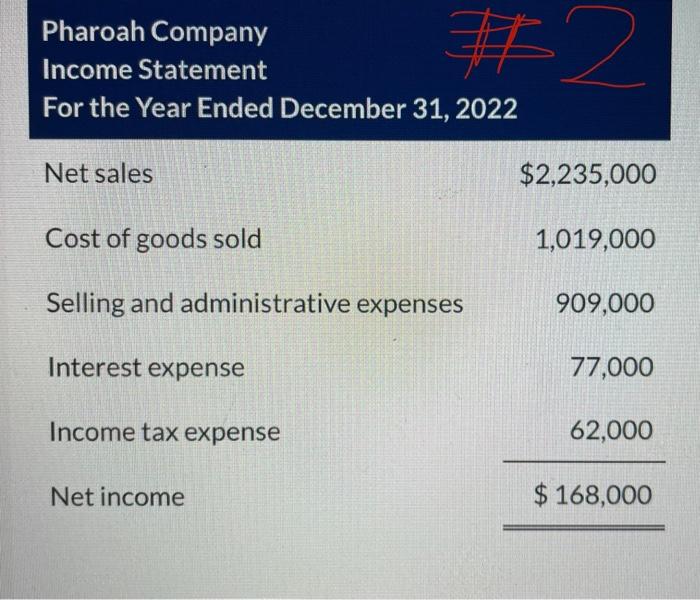

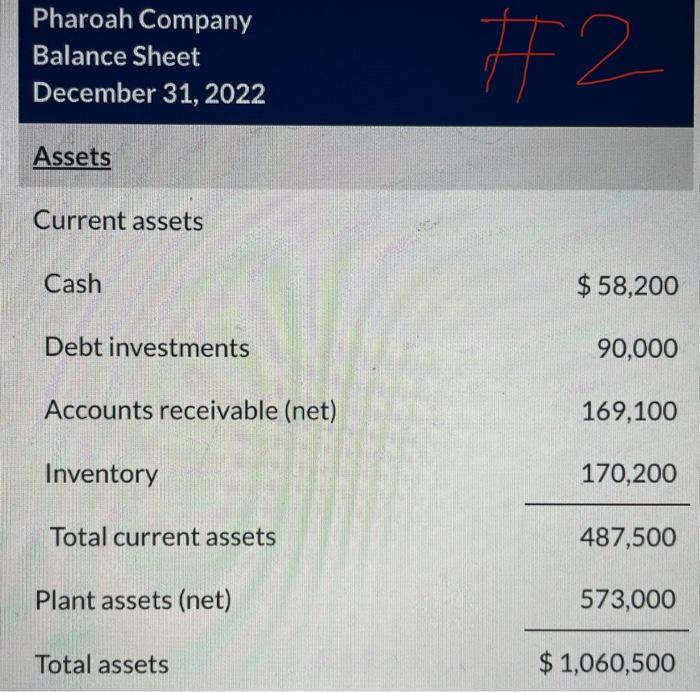

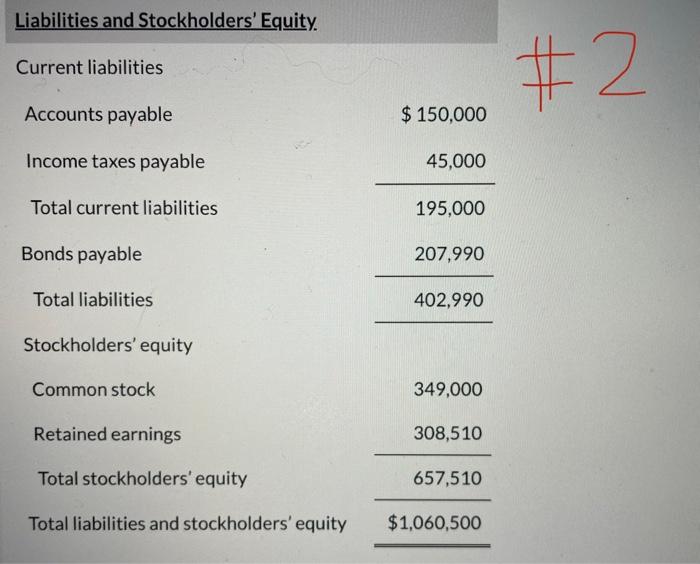

Question: 1ST PIC (Flint & Culver) is problem #1 2nd, 3rd, 4th, and 5th PIC are problems #2 with numbers needed, THEY R LABELED #2 (Pharoah

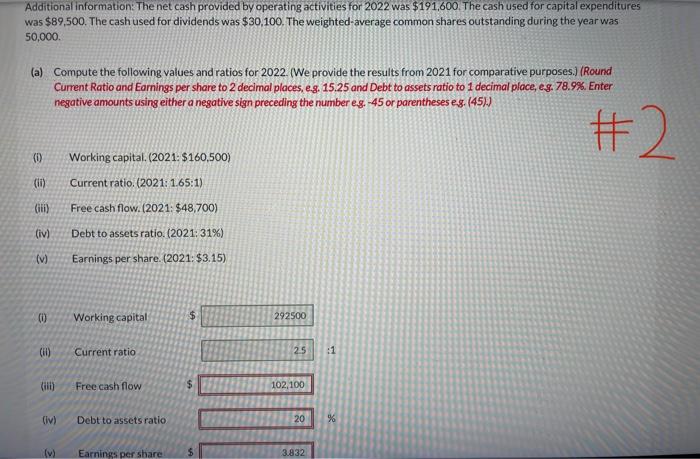

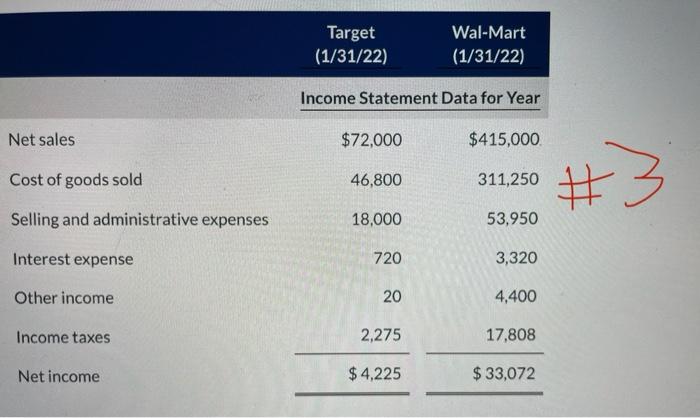

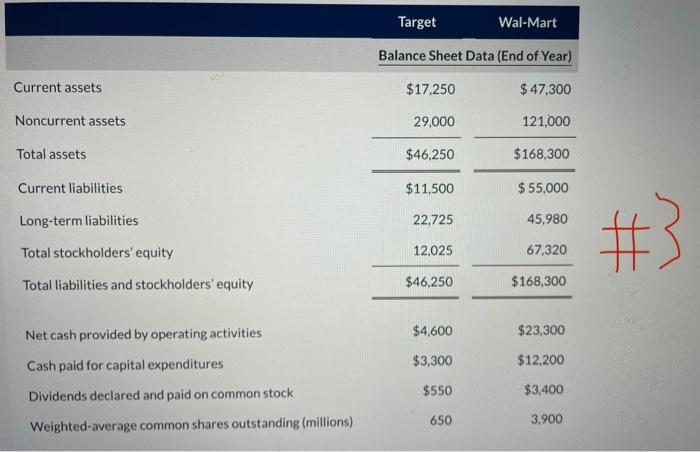

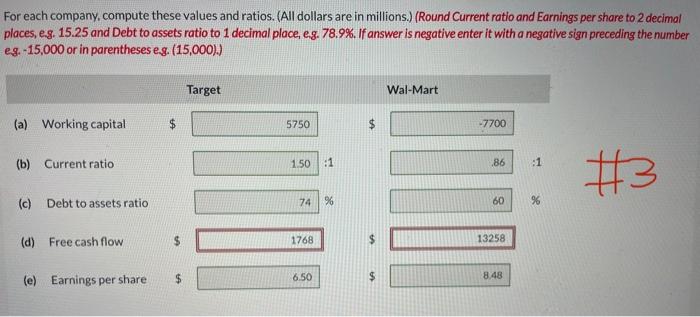

Font Culver Net sales $2,376,000 $818,400 Cost of goods sold 1,551,000 448,800 Operating expenses 373,560 129,360 Interest expense 10,240 4.220 Income tax expense 112,400 47.520 Current assets 438,000 195,800 Plant assets (net) 700,000 184,200 Current liabilities 87,600 44,500 Long-term liabilities 151,380 52.780 Net cash common by operating activities 182,160 47.520 Capital expenditures 118.800 26,400 Dividends paid on common stock 47.520 19.800 Weighted-average common shares outstanding 80,000 50,000 (a) Compute the net income and earnings per share for each company for 2022. (Round Earnings per share to 2 decimal places, eg. $2.78.) Net Income Earnings per share Flint Corporation 328710 $ 4.11 Pharoah Company Income Statement For the Year Ended December 31, 2022 #2 = Net sales $2,235,000 Cost of goods sold 1,019,000 Selling and administrative expenses 909,000 Interest expense 77,000 Income tax expense 62,000 Net income $ 168,000 Pharoah Company Balance Sheet December 31, 2022 #2 Assets Current assets Cash $ 58,200 Debt investments 90,000 Accounts receivable (net) 169,100 Inventory 170,200 Total current assets 487,500 Plant assets (net) 573,000 Total assets $ 1,060,500 Liabilities and Stockholders' Equity. Current liabilities # #2 Accounts payable $ 150,000 Income taxes payable 45,000 Total current liabilities 195,000 Bonds payable 207,990 Total liabilities 402,990 Stockholders' equity Common stock 349,000 Retained earnings 308,510 Total stockholders' equity 657,510 Total liabilities and stockholders' equity $1,060,500 Additional information: The net cash provided by operating activities for 2022 was $191,600. The cash used for capital expenditures was $89,500. The cash used for dividends was $30,100. The weighted average common shares outstanding during the year was 50,000. (a) Compute the following values and ratios for 2022. (We provide the results from 2021 for comparative purposes.) (Round Current Ratio and Earnings per share to 2 decimal places, eg. 15.25 and Debt to assets ratio to 1 decimal place, eg. 78.9%. Enter negative amounts using either a negative sign preceding the number eg.-45 or parentheses eg. (451) #2 (0) Working capital. (2021: $160,500) Current ratio. (2021: 1.65:1) (11) Gili) Free cash flow. (2021: $48,700) (iv) Debt to assets ratio. (2021: 31%) (v) Earnings per share. (2021: $3.15) 00 Working capital $ 292500 (ii) Current ratio 25 :1 (IND) Free cash flow 102,100 (iv) Debt to assets ratio 20 % (v) Earnings per share 3.832 Target (1/31/22) Wal-Mart (1/31/22) Income Statement Data for Year Net sales $72,000 $415,000 Cost of goods sold 46,800 311,250 #3 # Selling and administrative expenses 18,000 53,950 Interest expense 720 3,320 Other income 20 4,400 Income taxes 2,275 17,808 Net income $ 4,225 $33,072 Target Wal-Mart Balance Sheet Data (End of Year) Current assets $17.250 $ 47,300 Noncurrent assets 29,000 121,000 Total assets $46,250 $168,300 Current liabilities $11,500 $ 55,000 Long-term liabilities 22,725 45,980 #3 Total stockholders' equity 12.025 67,320 Total liabilities and stockholders' equity $46,250 $168,300 $4,600 $23,300 Net cash provided by operating activities Cash paid for capital expenditures Dividends declared and paid on common stock $3,300 $12,200 $550 $3,400 650 3.900 Weighted-average common shares outstanding (millions) For each company, compute these values and ratios. (All dollars are in millions.) (Round Current ratio and Earnings per share to 2 decimal places, e.g. 15.25 and Debt to assets ratio to 1 decimal place, eg. 78.9%. If answer is negative enter it with a negative sign preceding the number eg. 15,000 or in parentheses eg. (15,000).) Target Wal-Mart (a) Working capital 5750 -7700 (b) Current ratio 1.50 :1 .86 .1 #3 (c) Debt to assets ratio 74 96 60 (d) Free cash flow 1768 13258 $ 6.50 $ (e) Earnings per share 8.48

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts