Question: 1st pic is question ,need answer to second pic Actual $ 605,000 $ 78,000 $ 210.000 1. As sales manager, Joe Batista was given the

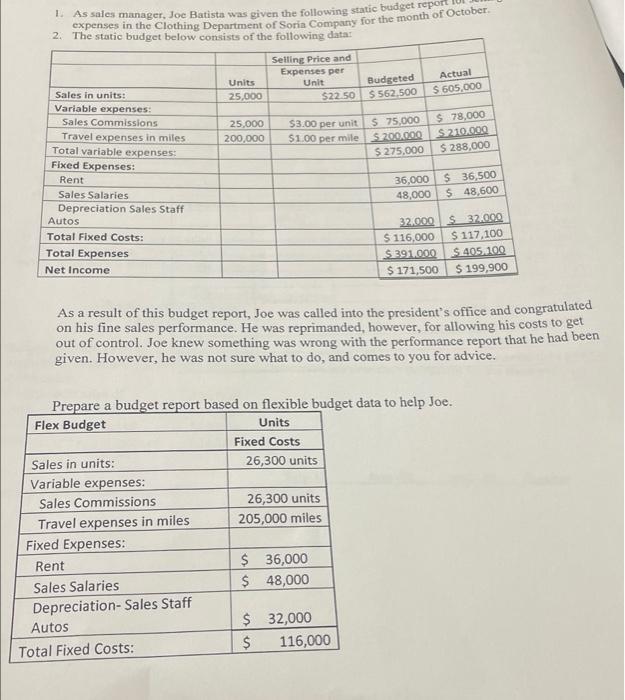

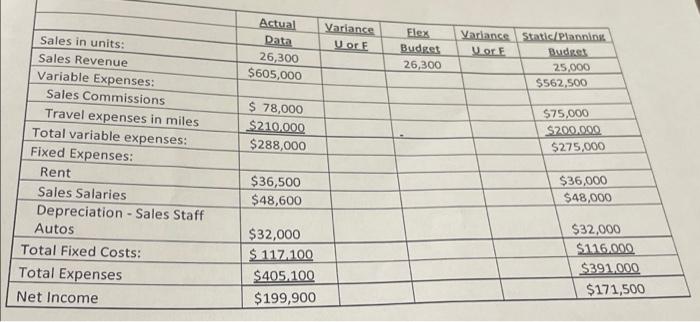

Actual $ 605,000 $ 78,000 $ 210.000 1. As sales manager, Joe Batista was given the following static budget report expenses in the Clothing Department of Soria Company for the month of October 2. The static budget below consists of the following datar Selling Price and Expenses per Units Unit Budgeted Sales in units: 25,000 $22.50 $ 562.500 Variable expenses: Sales Commissions 25,000 $3.00 per unit $ 75,000 Travel expenses in miles 200,000 $1.00 per mile $200.000 Total variable expenses: $ 275,000 $ 288,000 Fixed Expenses: Rent 36,000 Sales Salaries 48,000 $ 48,600 Depreciation Sales Staff Autos 32.000 32.000 Total Fixed Costs: $ 116,000 $ 117,100 Total Expenses $ 391.000 S 405 100 Net Income $ 171,500 $ 199,900 $36,500 As a result of this budget report, Joe was called into the president's office and congratulated on his fine sales performance. He was reprimanded, however, for allowing his costs to get out of control. Joe knew something was wrong with the performance report that he had been given. However, he was not sure what to do, and comes to you for advice. Prepare a budget report based on flexible budget data to help Joe. Flex Budget Units Fixed Costs Sales in units: 26,300 units Variable expenses: Sales Commissions 26,300 units Travel expenses in miles 205,000 miles Fixed Expenses: Rent $ 36,000 Sales Salaries $ 48,000 Depreciation-Sales Staff Autos $ 32,000 Total Fixed Costs: $ 116,000 Actual Data 26,300 $605,000 Variance UorE Flex Budget 26,300 Variance Static Plannin UorE Budget 25,000 $562,500 $ 78,000 $210.000 $288,000 $75,000 $200.000 $275,000 Sales in units: Sales Revenue Variable Expenses: Sales Commissions Travel expenses in miles Total variable expenses: Fixed Expenses: Rent Sales Salaries Depreciation - Sales Staff Autos Total Fixed Costs: Total Expenses Net Income $36,500 $48,600 $36,000 $48,000 $32,000 $ 117.100 $405,100 $199,900 $32,000 $116.000 $391.000 $171,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts