Question: 1st pic is the previous question. answer 2nd pic A borrower takes out a 30-year adjustable rate mortgage loan for $410.000 with monthly payments. The

1st pic is the previous question.

answer 2nd pic

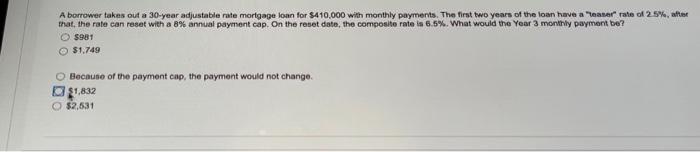

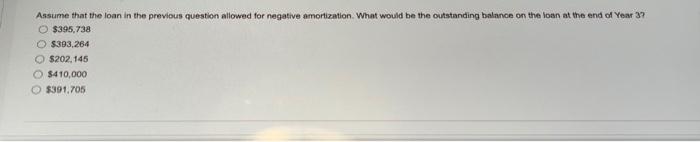

A borrower takes out a 30-year adjustable rate mortgage loan for $410.000 with monthly payments. The first two years of the loan have a Teasar" rate of 2.5%, after that, the rate can reset with a 8% annual payment cap. On the reset date, the composite rate is 6.5%. What would the Year 3 monthily payment be? $981 $1,749 Because of the payment cap, the payment would not change. 51,832 52,531 Assume that the loan in the previous question allowed for negative amortization. What would be the outstanding balance on the losn at the end of Year 3 ? $345,738 $393,264 $202,145 3410,000 5391,705

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock