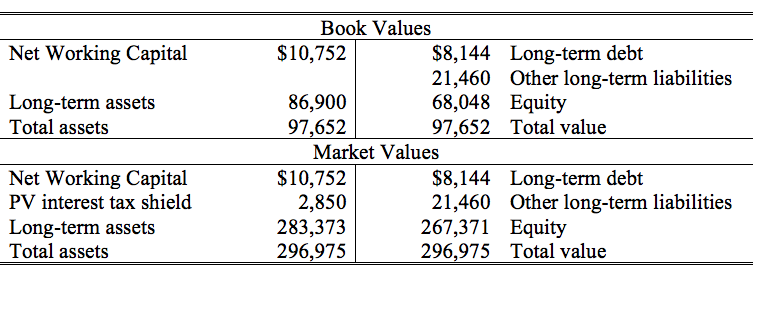

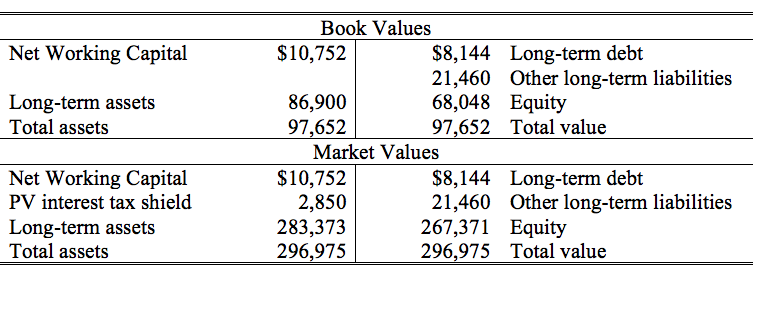

Question: 1.Suppose that Pfizer moves to a 40 percent book leverage ratio ((long-term debt + other long-term liabilities)/total assets) by issuing debt and using the proceeds

1.Suppose that Pfizer moves to a 40 percent book leverage ratio ((long-term debt + other long-term liabilities)/total assets) by issuing debt and using the proceeds to repurchase shares. Consider only corporate taxes and assume that debt will be held constant to perpetuity. Reconstruct its book and market balance sheets to reflect the new capital structure. How much additional value is added if the assumptions in the table are correct?

Book Values Net Working Capital $10,752 $8,144 Long-term debt 21,460 Other long-term liabilities Long-term assets 86,900 68,048 Equity Total assets 97,652 97,652 Total value Market Values Net Working Capital $10,752 $8,144 Long-term debt PV interest tax shield 2,850 21,460 Other long-term liabilities Long-term assets 283,373 267,371 Equity Total assets 296,975 296,975 Total value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts