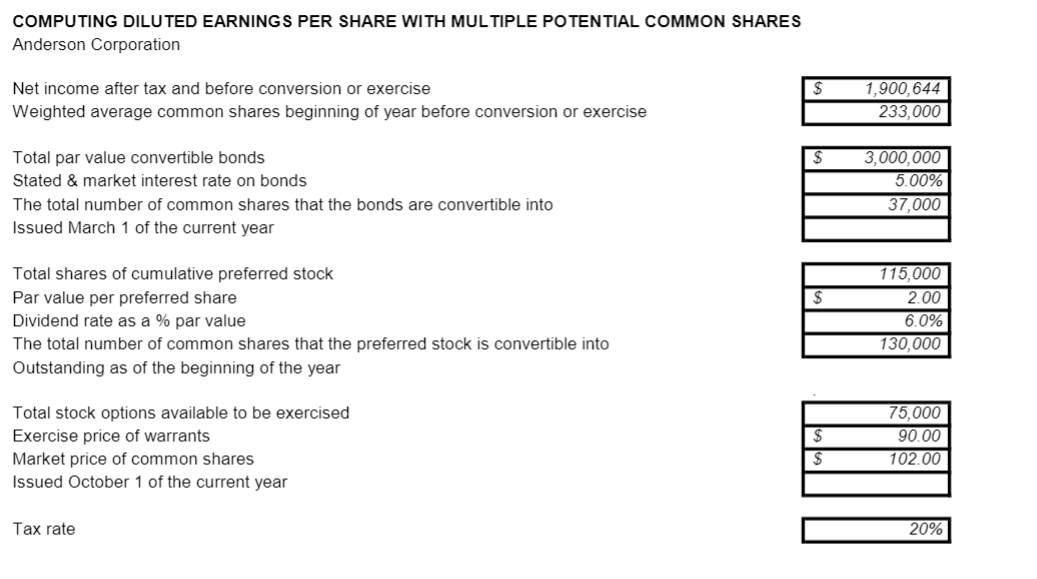

Question: 1.The convertible bonds should be ranked: A. first B. second C. third D. not ranked; anti=dilutive 2.Compute diluted earnings per share. COMPUTING DILUTED EARNINGS PER

1.The convertible bonds should be ranked:

A. first B. second C. third D. not ranked; anti=dilutive

2.Compute diluted earnings per share.

COMPUTING DILUTED EARNINGS PER SHARE WITH MULTIPLE POTENTIAL COMMON SHARES Anderson Corporation $ Net income after tax and before conversion or exercise Weighted average common shares beginning of year before conversion or exercise 1,900,644 233,000 Total par value convertible bonds Stated & market interest rate on bonds The total number of common shares that the bonds are convertible into Issued March 1 of the current year 3,000,000 5.00% 37,000 $ Total shares of cumulative preferred stock Par value per preferred share Dividend rate as a % par value The total number of common shares that the preferred stock is convertible into Outstanding as of the beginning of the year 115,000 2.00 6.0% 130,000 $ Total stock options available to be exercised Exercise price of warrants Market price of common shares Issued October 1 of the current year 75,000 90.00 102.00 $ Tax rate 20% COMPUTING DILUTED EARNINGS PER SHARE WITH MULTIPLE POTENTIAL COMMON SHARES Anderson Corporation $ Net income after tax and before conversion or exercise Weighted average common shares beginning of year before conversion or exercise 1,900,644 233,000 Total par value convertible bonds Stated & market interest rate on bonds The total number of common shares that the bonds are convertible into Issued March 1 of the current year 3,000,000 5.00% 37,000 $ Total shares of cumulative preferred stock Par value per preferred share Dividend rate as a % par value The total number of common shares that the preferred stock is convertible into Outstanding as of the beginning of the year 115,000 2.00 6.0% 130,000 $ Total stock options available to be exercised Exercise price of warrants Market price of common shares Issued October 1 of the current year 75,000 90.00 102.00 $ Tax rate 20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts