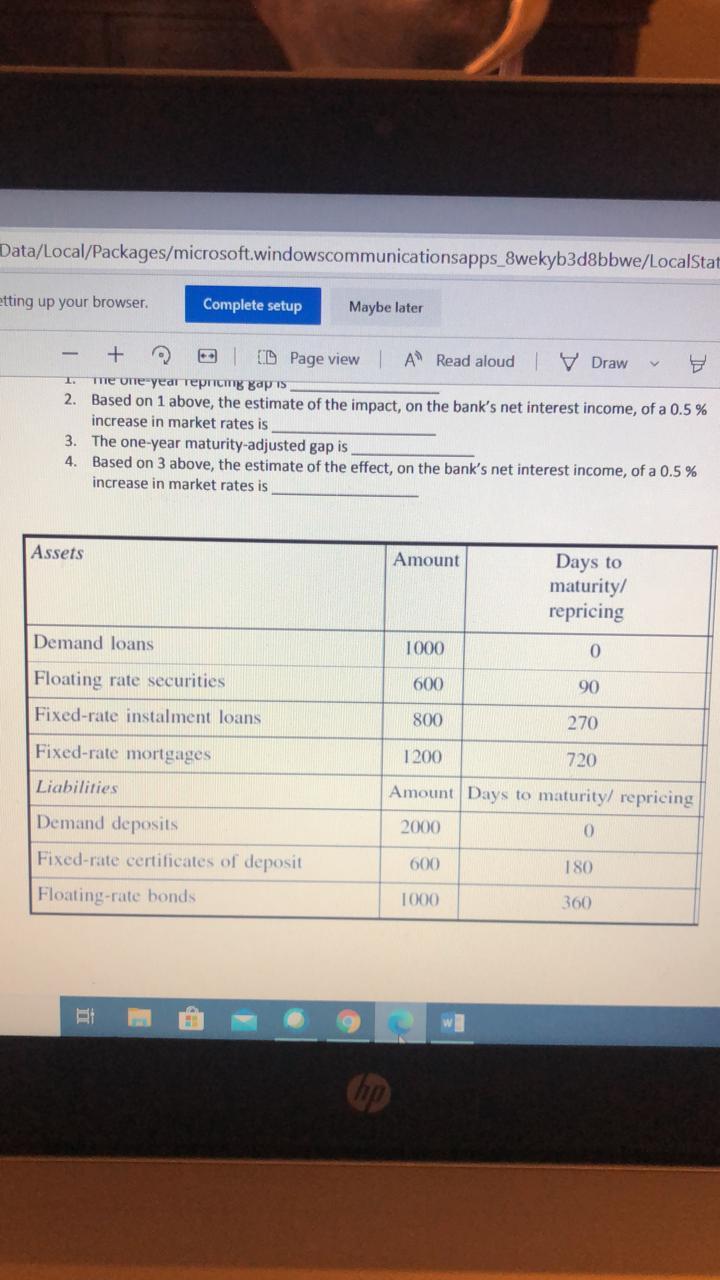

Question: 1,The oneyear repricing gap is; __________________ 2. Based on 1 above, the estimate of the impact, on the banks net interest income, of a 0.5

1,The oneyear repricing gap is; __________________ 2. Based on 1 above, the estimate of the impact, on the banks net interest income, of a 0.5 % increase in market rates is ____________________ 3. The oneyear maturityadjusted gap is _______________ 4. Based on 3 above, the estimate of the effect, on the banks net interest income, of a 0.5 % increase in market rates is __________________

Data/Local/Packages/microsoft.windowscommunicationsapps_8wekyb3d8bbwe/LocalStat etting up your browser. Complete setup Maybe later v + EL Page view A Read aloud V Draw The one year reprem kapis 2. Based on 1 above, the estimate of the impact on the bank's net interest income, of a 0.5% increase in market rates is 3. The one-year maturity-adjusted gap is 4. Based on 3 above, the estimate of the effect, on the bank's net interest income, of a 0.5% increase in market rates is Assets Amount Days to maturity/ repricing Demand loans 1000 0 Floating rate securities 600 90 Fixed-rate instalment loans 800 270 Fixed-rate mortgages 1200 720 Liabilities Amount Days to maturity/ repricing 2000 0 Demand deposits Fixed-rate certificates of deposit 600 180 Floating-rate bonds 1000 360 Data/Local/Packages/microsoft.windowscommunicationsapps_8wekyb3d8bbwe/LocalStat etting up your browser. Complete setup Maybe later v + EL Page view A Read aloud V Draw The one year reprem kapis 2. Based on 1 above, the estimate of the impact on the bank's net interest income, of a 0.5% increase in market rates is 3. The one-year maturity-adjusted gap is 4. Based on 3 above, the estimate of the effect, on the bank's net interest income, of a 0.5% increase in market rates is Assets Amount Days to maturity/ repricing Demand loans 1000 0 Floating rate securities 600 90 Fixed-rate instalment loans 800 270 Fixed-rate mortgages 1200 720 Liabilities Amount Days to maturity/ repricing 2000 0 Demand deposits Fixed-rate certificates of deposit 600 180 Floating-rate bonds 1000 360

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts