Question: 1.The present value of a single future sum: increases as the number of discount periods increases. is generally larger than the future sum. depends upon

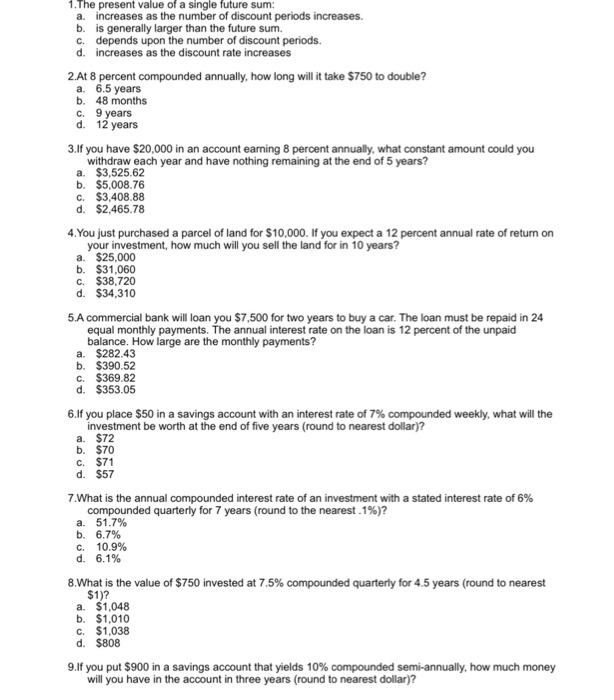

1.The present value of a single future sum: increases as the number of discount periods increases. is generally larger than the future sum. depends upon the number of discount periods. increases as the discount rate increases a. b. c. d. 2.At 8 percent compounded annually, how long will it take $750 to double? a. 6.5 years b. 48 months c. 9 years d. 12 years 3.If you have $20,000 in an account earning 8 percent annually, what constant amount could you withdraw each year and have nothing remaining at the end of 5 years? a. $3,525.62 b. $5,008.76 c. $3,408.88 d. $2,465.78 4.You just purchased a parcel of land for $10,000. If you expect a 12 percent annual rate of return on your investment, how much will you sell the land for in 10 years? a. $25,000 b. $31.060 c. $38,720 d. $34,310 5.A commercial bank will loan you $7,500 for two years to buy a car. The loan must be repaid in 24 equal monthly payments. The annual interest rate on the loan is 12 percent of the unpaid balance. How large are the monthly payments? a. $282.43 b. $390.52 c. $369.82 d. $353.05 6.If you place $50 in a savings account with an interest rate of 7% compounded weekly, what will the investment be worth at the end of five years (round to nearest dollar)? a. $72 b. $70 C. $71 d. $57 7 What is the annual compounded interest rate of an investment with a stated interest rate of 6% compounded quarterly for 7 years (round to the nearest .1%)? a. 51.7% . 10.9% 8.What is the value of $750 invested at 7.5% quarterly for 4.5 years (round to nearest $1)? a. $1,048 b. $1,010 c. $1,038 d. $808 9.1f you put $900 in a savings account that yields 10% compounded semi-annually, how much money will you have in the account in three years (round to nearest dollar)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts