Question: 1.Using the supply and demand for bonds framework, show and explain what effect will a sudden increase in the expected inflation have on interest rates

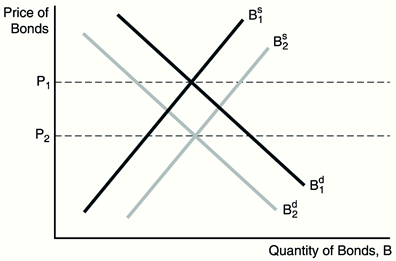

1.Using the supply and demand for bonds framework, show and explain what effect will a sudden increase in the expected inflation have on interest rates of bonds. Briefly explain and show the diagram.

2.If the interest rate is 5%, what is the present value of a security that pays you $1, 050 next year and $1,102.50 two years from now? If this security sold for $1900, is the yield to maturity greater or less than 5%?Why? Briefly explain your answer.

3.Why is a share of Microsoft common stock an asset for its owner and a liability for Microsoft? Fully explain your answer.

4.1.If a $10,000 face -value discount bond maturing in one year is selling for $5,000, then its yield to maturity is

A)5 percent.

B)10 percent.

C)50 percent.

D)100 percent.

\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts