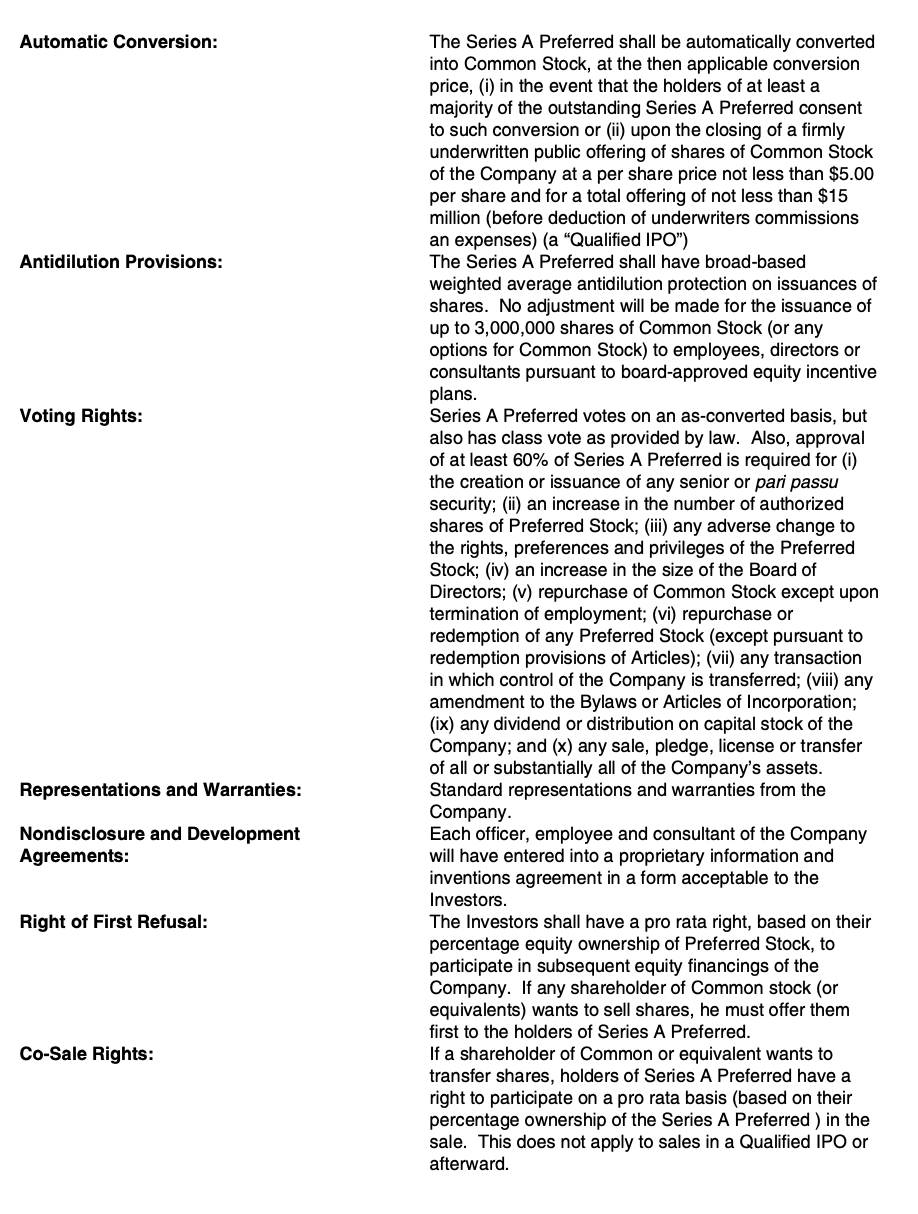

1.Using the template provided, compare exit scenarios (liquidation and IPO) for the two term sheets.In completing this template, assume the following:

a.No further investments after Series A

b.All options have been issued to employees

c.Enterprise value = equity value (i.e., no debt)

d.For Alpha:

i.Assume performance hurdles are met

ii.Assume no dividends are declared

e.For Mega:

i.Assume dividends are accrued equivalent to 25% of the Series A price

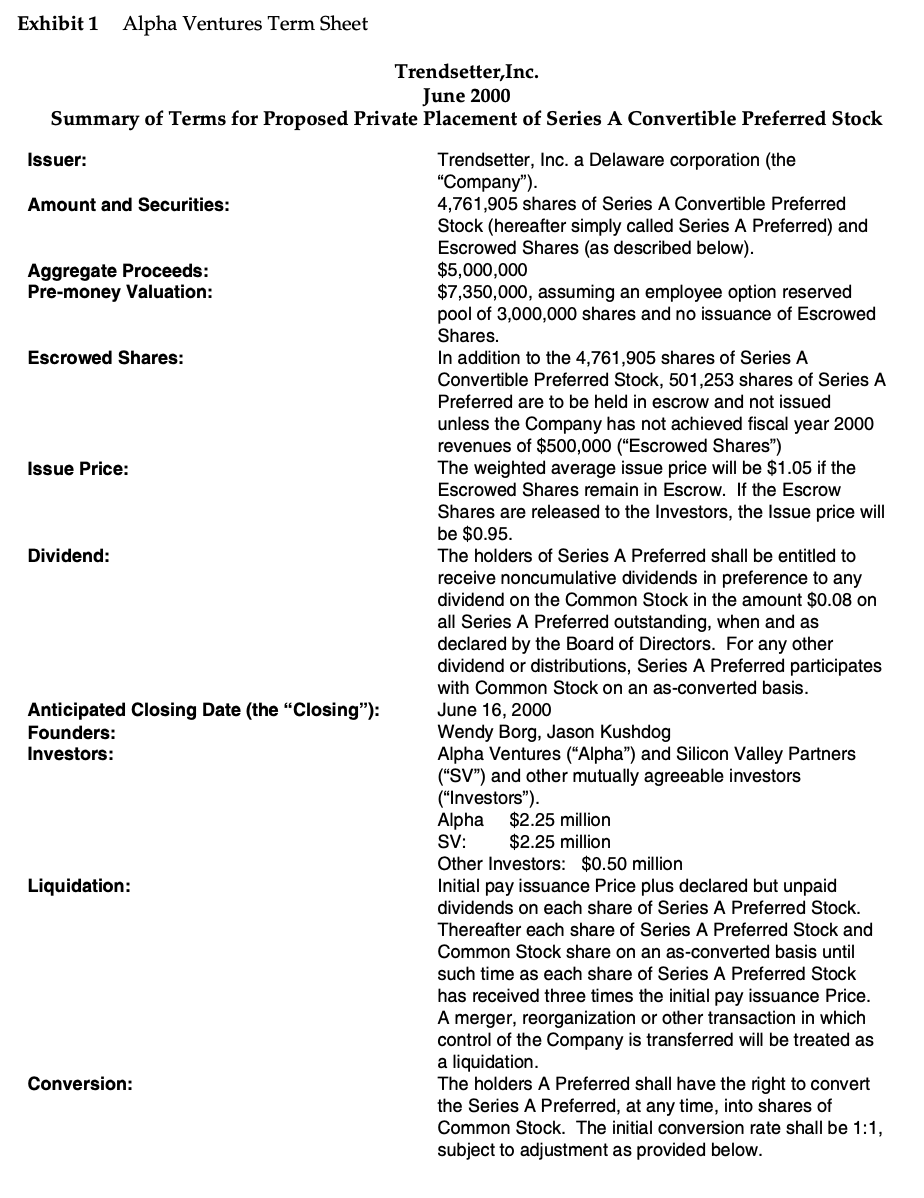

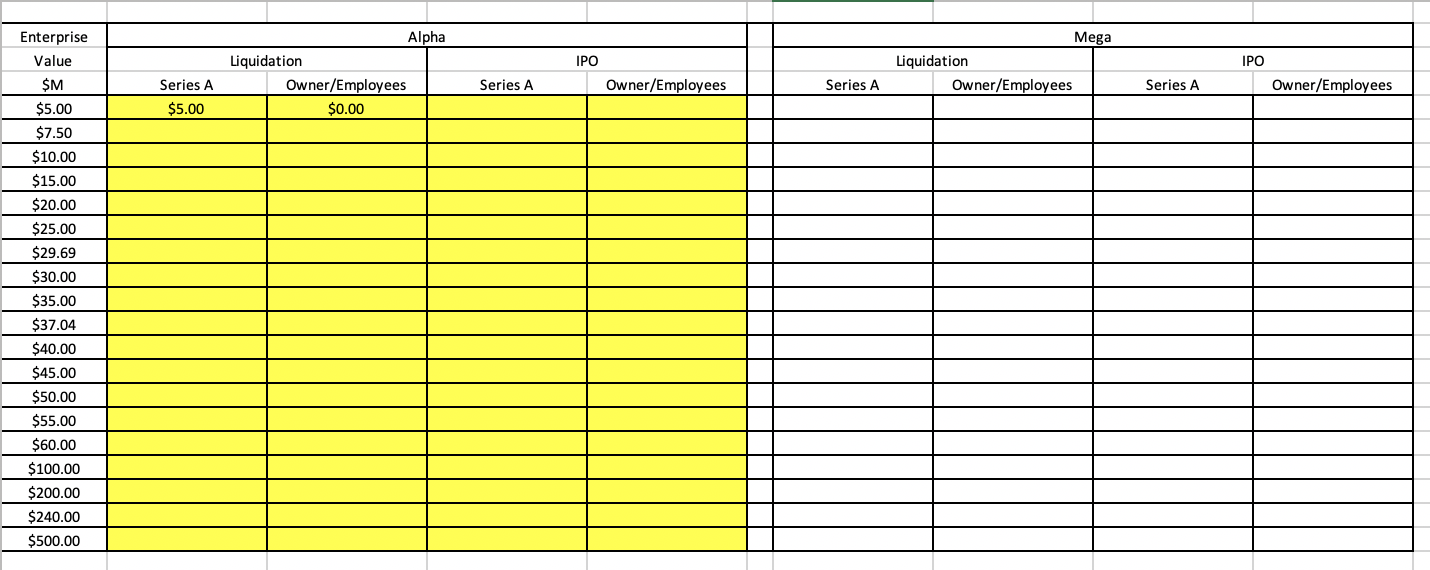

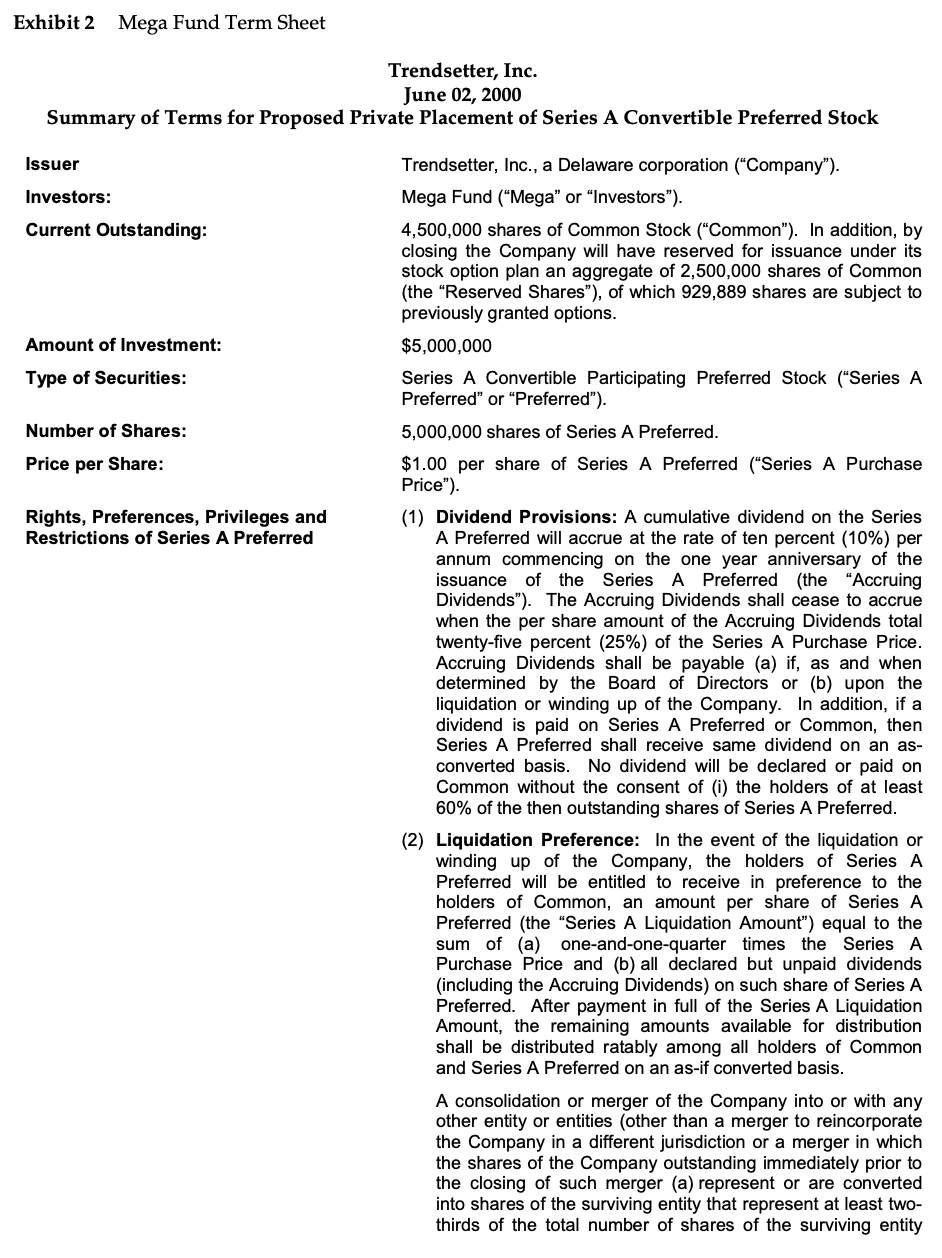

Exhibit 1 Alpha Ventures Term Sheet Trendsetter,lnc. June 2000 Summary of Terms for Proposed Private Placement of Series A Convertible Preferred Stock Issuer: Amount and Securities: Aggregate Proceeds: Pro-money Valuation: Escrowed Shares: Issue Price: Dividend: Anticipated Closing Date (the \"Closing"): Founders: Investors: Liquidation: Conversion: Trendsetter, Inc. a Delaware corporation (the "Company"). 4,761,905 shares of Series A Convertible Preferred Stock (hereafter simply called Series A Preferred) and Escrowed Shares (as described below). $5,000,000 $7,350,000, assuming an employee option reserved pool of 3,000,000 shares and no issuance of Escrowed Shares. In addition to the 4,761 ,905 shares of Series A Convertible Preferred Stock, 501,253 shares of Series A Preferred are to be held in escrow and not issued unless the Company has not achieved fiscal year 2000 revenues of $500,000 ("Escrowed Shares\") The weighted average issue price will be $1.05 if the Escrowed Shares remain in Escrow. If the Escrow Shares are released to the Investors, the Issue price will be $0.95. The holders of Series A Preferred shall be entitled to receive noncumulative dividends in preference to any dividend on the Common Stock in the amount $0.08 on all Series A Preferred outstanding, when and as declared by the Board of Directors. For any other dividend or distributions, Series A Preferred participates with Common Stock on an as-converted basis. June 16, 2000 Wendy Borg, Jason Kushdog Alpha Ventures (\"Alpha\") and Silicon Valley Partners ("3V\") and other mutually agreeable investors ("Investors"). Alpha $2.25 million SV: $2.25 million Other Investors: $0.50 million Initial pay issuance Price plus declared but unpaid dividends on each share of Series A Preferred Stock. Thereafter each share of Series A Preferred Stock and Common Stock share on an as-converted basis until such time as each share of Series A Preferred Stock has received three times the initial pay issuance Price. A merger, reorganization or other transaction in which control of the Company is transferred will be treated as a liquidation. The holders A Preferred shall have the right to convert the Series A Preferred, at any time, into shares of Common Stock. The initial conversion rate shall be 1:1, subject to adjustment as provided below. Automatic Conversion: Antidilution Provisions: Voting Rights: Representations and Warranties: Nondisclosure and Development Agreements: Right of First Refusal: Co-Sale Rights: The Series A Preferred shall be automatically converted into Common Stock, at the then applicable conversion price, (i) in the event that the holders of at least a majority of the outstanding Series A Preferred consent to such conversion or (ii) upon the closing of a firmly underwritten public offering of shares of Common Stock of the Company at a per share price not less than $5.00 per share and for a total offering of not less than $15 million (before deduction of underwriters commissions an expenses) (a \"Qualied IF'O") The Series A Preferred shall have broad-based weighted average antidilution protection on issuances of shares. No adjustment will be made for the issuance of up to 3,000,000 shares of Common Stock (or any options for Common Stock) to employees, directors or consultants pursuant to board-approved equity incentive plans. Series A Preferred votes on an asconverted basis, but also has class vote as provided by law. Also, approval of at least 60% of Series A Preferred is required for (i) the creation or issuance of any senior or part' passu security; (ii) an increase in the number of authorized shares of Preferred Stock; (iii) any adverse change to the rights, preferences and privileges of the Preferred Stock; (iv) an increase in the size of the Board of Directors; (v) repurchase of Common Stock except upon termination of employment; (vi) repurchase or redemption of any Preferred Stock (except pursuant to redemption provisions of Articles); (vii) any transaction in which control of the Company is transferred; (viii) any amendment to the Bylaws or Articles of Incorporation; (ix) any dividend or distribution on capital stock of the Company; and (at) any sale, pledge, license ortransfer of all or substantially all of the Company's assets. Standard representations and warranties from the Company. Each officer, employee and consultant of the Company will have entered into a proprietary information and inventions agreement in a form acceptable to the Investors. The Investors shall have a pro rata right, based on their percentage equity ownership of Preferred Stock, to participate in subsequent equity financings of the Company. If any shareholder of Common stock (or equivalents) wants to sell shares, he must offer them rst to the holders of Series A Preferred. If a shareholder of Common or equivalent wants to transfer shares, holders of Series A Preferred have a right to participate on a pro rata basis (based on their percentage ownership of the Series A Preferred ) in the sale. This does not apply to sales in a Qualified IPO or aflemrard. Enterprise Alpha Mega Value Liquidation IPO Liquidation IPO $M Series A Owner/Employees Series A Owner/Employees Series A Owner/Employees Series A Owner/Employees $5.00 $5.00 $0.00 $7.50 $10.00 $15.00 $20.00 $25.00 $29.69 $30.00 $35.00 $37.04 $40.00 $45.00 $50.00 $55.00 $60.00 $100.00 $200.00 $240.00 $500.00Exhibit 2 Mega. Fund Term Sheet Trendsetter, Inc. June 02, 2000 Summary of Terms for Proposed Private Placement of Series A Convertible Preferred Stock Issuer Investors: Current Outstanding: Amount of Investment: Type of Securities: Number of Shares: Price per Share: Rights, Preferences, Privileges and Restrictions of Series A Preferred Trendsetter, Inc., a Delaware corporation (\"Company"). Mega Fund (\"Mega" or \"Investors\"). 4,500,000 shares of Common Stock ("Common"). In addition, by closing the Company will have reserved for issuance under its stock option plan an aggregate of 2,500,000 shares of Common (the \"Reserved Shares\"), of which 929,889 shares are subject to previously granted options. $5,000,000 Series A Convertible Participating Preferred Stock (\"Series A Preferred\" or 'Preferred\"). 5,000,000 shares of Series A Preferred. $1.00 per share of Series A Preferred (\"Series A Purchase Price\"). (1) Dividend Provisions: A cumulative dividend on the Series A Preferred will accrue at the rate of ten percent (10%) per annum commencing on the one year anniversary of the issuance of the Series A Preferred (the \"Accruing Dividends\"). The Accruing Dividends shall cease to accrue when the per share amount of the Accruing Dividends total twenty-five percent (25%) of the Series A Purchase Price. Accruing Dividends shall be payable (a) if, as and when determined by the Board of Directors or (b) upon the liquidation or winding up of the Company. In addition, if a dividend is paid on Series A Preferred or Common, then Series A Preferred shall receive same dividend on an as- converted basis. No dividend will be declared or paid on Common without the consent of (i) the holders of at least 60% of the then outstanding shares of Series A Preferred. (2) Liquidation Preference: In the event of the liquidation or winding up of the Company, the holders of Series A Preferred will be entitled to receive in preference to the holders of Common, an amount per share of Series A Preferred (the \"Series A Liquidation Amount") equal to the sum of (a) oneaand-one-quarter times the Series A Purchase Price and (b) all declared but unpaid dividends (including the Accming Dividends) on such share of Series A Preferred. After payment in full of the Series A Liquidation Amount, the remaining amounts available for distribution shall be distributed ratably among all holders of Common and Series A Preferred on an as-if converted basis. A consolidation or merger of the Company into or with any other entity or entities (other than a merger to reincorporate the Company in a different jurisdiction or a merger in which the shares of the Company outstanding immediately prior to the closing of such merger (a) represent or are converted into shares of the surviving entity that represent at least two- thirds of the total number of shares of the surviving entity 801-358 (3) (4) (5) (5) (7) Term Sheet Negotiations for Trendsetter, Inc. that are outstanding or are reserved for issuance immediately after the closing of the merger and (b) have the power to elect at least two-thirds of the surviving corporation's directors) or the sale of 50% or more of the Company's assets or the acquisition in a single transaction or series of related transactions by any person or group of 50% or more of the Company's outstanding Common will be deemed to be a liquidation or winding up for purposes of the liquidation preference unless the holders of at least 70% of the then outstanding shares of Series A Preferred. voting together as a single classI elect not to treat any such event as a liquidation, dissolution or winding up. Redemption: The Series A Preferred shall be redeemed at (I) a redemption price that shall equal the sum of (a) the Series A Purchase Price and (b) any declared but unpaid dividends on such shares of Series A Preferred (including the Accruing Dividends) and (II) there shall be no redemption of Series A Preferred upon an acquisition of the Company or upon a Qualied Public Offering (as hereinafter dened). If the Series A Preferred are not redeemed as required then the Investors shall have the right to designate a majority of the directors. Antidllutlon Provisions: The Series A Preferred shall have weighted average antidilution rights on issuances of shares at a price less than 100% and greater than 50% of the Series A Purchase Price (except for the issuance of the Reserved Shares): provided if new shares are issued at a price less than or equal to 50% of the Series A Purchase Price then the adjustment will be full ratchet; provided, however, that with respect to a Designated Financing, this ratchet adjustment shall be made only if the holder of Series A Preferred invests its Pro Rata Share. A Designated Financing shall be an equity nancing of at least $100,000 made on a pro rata basis (based on ownership of Common) to all Investors that is designated by the Board as a Designated Financing. Each holder's Pro Rate Share equals a portion of the Designated Financing equal to the number of shares of Common owned by such holder divided by the number of shares of Common owned by all Investors. Voting Rights: The Series A Preferred will vote together with the holders of Common on an asif converted basis on all matters presented to the stockholders. In addition to any other required vote, the Series A Preferred will be entitled to vote as a separate series as described under \"Protective Provisions\" below. Protective Provisions: Consent of the holders of a super- majority of the Series A Preferred will be required for certain corporate actions, which actions and consent thresholds shall be agreed upon by the parties and shall be more specically set forth in the closing documents. Conversion: Each share of Series A Preferred may be converted by its holder at any time into a number of shares of Common equal to the Series A Purchase Price divided by the conversion price of the Series A Preferred. The conversion price will initially be equal to the SeriesA Purchase Price and will be subject to adjustment as Information Rights: Registration Rights: Use of Proceeds: Board Representation and Meetings Preemptive Rights: Reserved Shares: specied in paragraph 4 above. (0) Automatic Conversion: The Series A Preferred will be automatically converted into Common, at the then applicable conversion price, in the event of an undenrvritten public offering of shares of the Common at a public offering price per share that is no less than $20.00 (to be appropriately adjusted for any stock splits or stock dividends) in an offering with aggregate proceeds to the Company of not less than $25,000,000 (a "Qualied Public Offering\"). So long as any of the Series A Preferred is outstanding, the Company will deliver to each Investor annual, quarterly and monthly nancial statements, annual budgets and other information reasonably requested by an Investor. (a) Beginning on earlier of three years from closing, or six months after Qualified IPO, two demand registrations upon initiation by holders of at least 30% of outstanding Series A Preferred for aggregate proceeds in excess of $7,500,000. Expenses paid by Company. (b) Unlimited piggyback registration rights subject to pro rata cutback permitted at the underwriter's discretion. Full cutback upon a Qualied IPO: 30% minimum inclusion thereafter. Expenses paid by Company. (c) Unlimited S-3 Registrations of at least $750,000 each, with no more than two per year. Expenses paid by Company. No future registration rights may be granted without consent of a majority of Investors unless subordinate to Investors' rights. The proceeds from the sale of the Series A Preferred will be used for working capital. The charter will provide that the authorized number of directors is ve. The Board arrangements will include one member elected by the Common Stock (Ms. Borg as founders' representative and CEO), two Series A investor elected representatives, one outsider company nominated and one outsider company- nominated and acceptable to all. The Investors will be given preemptive rights to purchase securities issued by the Company (other than Reserved Shares) based on their percentage equity ownership of Preferred Stock. The integrated preemptive rights will be set forth in the Securities Purchase Agreement discussed below. The Reserved Shares will be issued from time to time to directors, ofcers, employees and consultants of the Company. Upon closing of the Offering, the Company will have reserved for issuance under its stock option plan an aggregate of 2,500,000 shares of Common (the \"Reserved Shares\"), of which 929,889 shares are subject to granted options. The Company shall not increase the number of Reserved Shares under the Incentive Plan or any similar stock option plan without the consent of the holders of a majority of the then outstanding Series A Preferred shares. Unless subsequently agreed to the contrary by the holders of 60% of the shares of outstanding Series A Preferred, any issuance of shares in excess of the Reserved Shares will be a dilutive event requiring the issuance of additional shares of Common as provided above in \"Antidilution Provisions" and will