Question: 1.What are the (a) discount yield, (b) true yield, (c) bond equivalent yield, and (d) effective annual return on a $1 million Treasury bill that

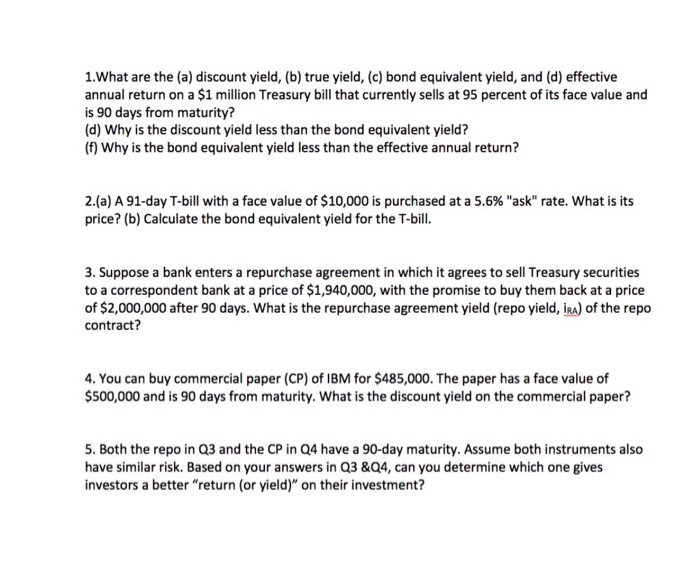

1.What are the (a) discount yield, (b) true yield, (c) bond equivalent yield, and (d) effective annual return on a $1 million Treasury bill that currently sells at 95 percent of its face value and is 90 days from maturity? (d) Why is the discount yield less than the bond equivalent yield? (f) Why is the bond equivalent yield less than the effective annual return? 2(a) A 91-day T-bill with a face value of $10,000 is purchased at a 5.6% "ask" rate, what is its price? (b) Calculate the bond equivalent yield for the T-bill. 3. Suppose a bank enters a repurchase agreement in which it agrees to sell Treasury securities to a correspondent bank at a price of $1,940,000, with the promise to buy them back at a price of $2,000,000 after 90 days. What is the repurchase agreement yield (repo yield, iRA) of the repo contract? 4. You can buy commercial paper (CP) of IBM for $485,000. The paper has a face value of 500,000 and is 90 days from maturity. What is the discount yield on the commercial paper? 5. Both the repo in Q3 and the CP in Q4 have a 90-day maturity. Assume both instruments also have similar risk. Based on your answers in Q3 &Q4, can you determine which one gives investors a better "return (or yield)" on their investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts