Question: 1-What can help negative operating cash flow in the Statement of cash flows? 2-For point A -what tools or guidance do we have for income

1-What can help negative operating cash flow in the Statement of cash flows?

2-For point A -what tools or guidance do we have for income determination given that it is not an exact science? Leading a company in a field such as technology where often the deliverable is not a tangible property what guidance do we have on earning revenue?

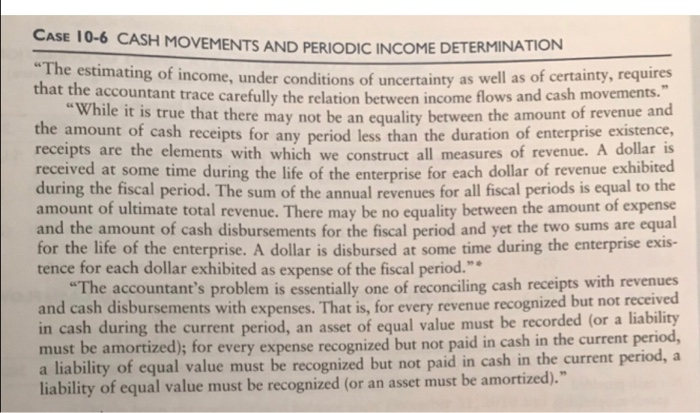

CASE 10-6 CASH MOVEMENTS AND PERIODIC INCOME DETERMINATI The estimating of income, under conditions of uncertainty as well as of come, under conditions of uncertainty as well as of certainty, requires that the accountant trace carefully the relation between income flows and cash movements While it is true that there may not be an equality between the amount of revenue an the amount of cash receipts for any period less than the duration of enterprise existence, receipts are the elements with which we construct all measures of revenue. A dollar is received at some time during the life of the enterprise for each dollar of revenue exnionc during the fiscal period. The sum of the annual revenues for all fiscal periods is equal to the and the amount of cash disbursements for the fiscal period and yet the two sums are equal for the life of the enterprise. A dollar is disbursed at some time during the enterprise exis- tence for each dollar exhibited as expense of the fiscal period." "The accountant's problem is essentially one of reconciling cash receipts with revenues and cash disbursements with expenses. That is, for every revenue recognized but not received in cash during the current period, an asset of equal value must be recorded (or a liability must be amortized); for every expense recognized but not paid in cash in the current period, a liability of equal value must be recognized but not paid in cash in the current period, a liability of equal value must be recognized (or an asset must be amortized)." CASE 10-6 CASH MOVEMENTS AND PERIODIC INCOME DETERMINATI The estimating of income, under conditions of uncertainty as well as of come, under conditions of uncertainty as well as of certainty, requires that the accountant trace carefully the relation between income flows and cash movements While it is true that there may not be an equality between the amount of revenue an the amount of cash receipts for any period less than the duration of enterprise existence, receipts are the elements with which we construct all measures of revenue. A dollar is received at some time during the life of the enterprise for each dollar of revenue exnionc during the fiscal period. The sum of the annual revenues for all fiscal periods is equal to the and the amount of cash disbursements for the fiscal period and yet the two sums are equal for the life of the enterprise. A dollar is disbursed at some time during the enterprise exis- tence for each dollar exhibited as expense of the fiscal period." "The accountant's problem is essentially one of reconciling cash receipts with revenues and cash disbursements with expenses. That is, for every revenue recognized but not received in cash during the current period, an asset of equal value must be recorded (or a liability must be amortized); for every expense recognized but not paid in cash in the current period, a liability of equal value must be recognized but not paid in cash in the current period, a liability of equal value must be recognized (or an asset must be amortized)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts