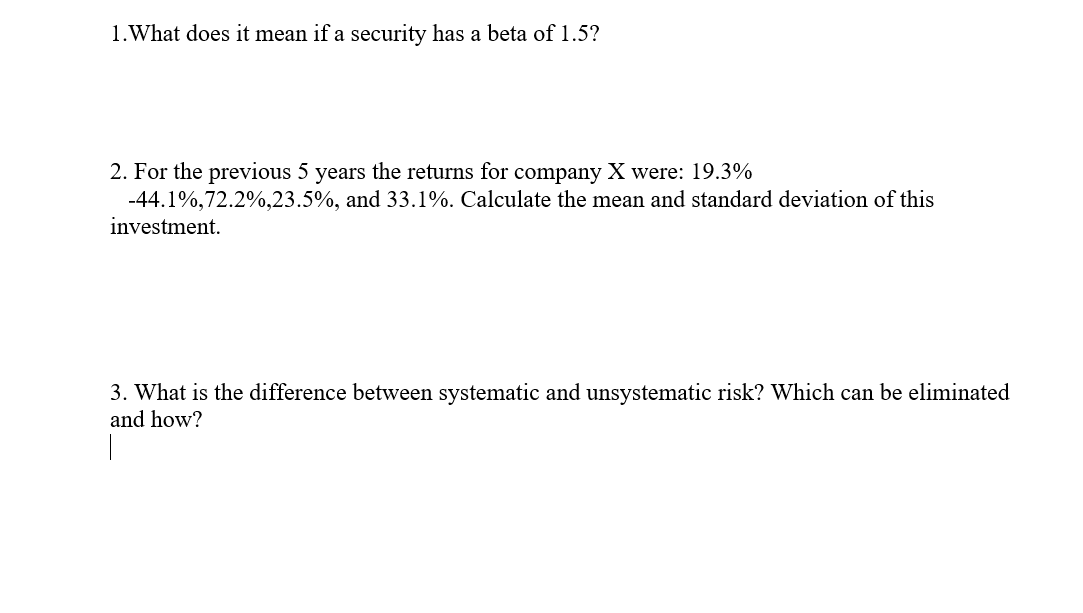

Question: 1.What does it mean if a security has a beta of 1.5 ? 2. For the previous 5 years the returns for company X were:

1.What does it mean if a security has a beta of 1.5 ? 2. For the previous 5 years the returns for company X were: 19.3% 44.1%,72.2%,23.5%, and 33.1%. Calculate the mean and standard deviation of this investment. 3. What is the difference between systematic and unsystematic risk? Which can be eliminated and how

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts