Question: 1-You are Manager of the Kumar Campany and working on the campany's Capital Structure, The Kumar Corpotation, a firm in the 34% marginal taxbracket with

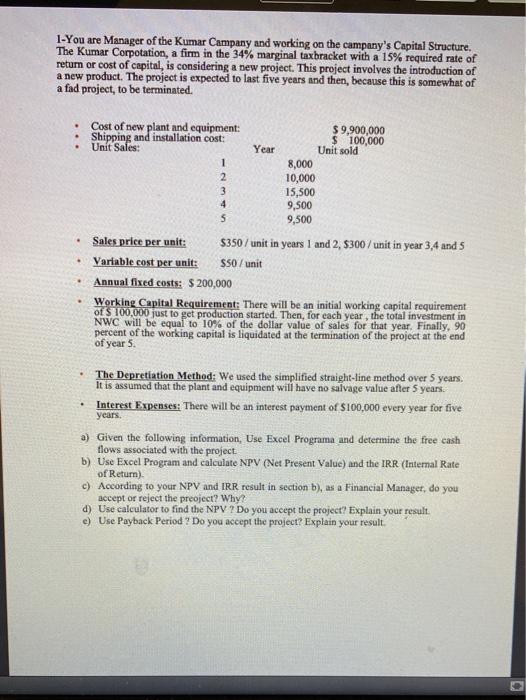

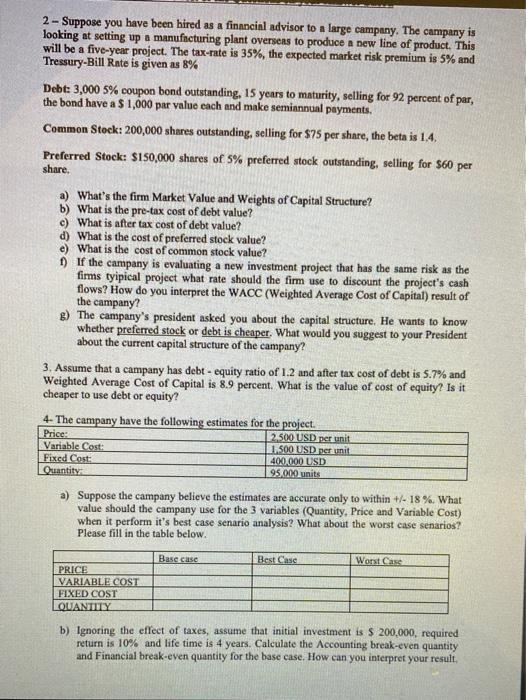

1-You are Manager of the Kumar Campany and working on the campany's Capital Structure, The Kumar Corpotation, a firm in the 34% marginal taxbracket with a 15% required rate of return or cost of capital, is considering a new project. This project involves the introduction of a new product. The project is expected to last five years and then, because this is somewhat of a fad project, to be terminated. Cost of new plant and equipment: Shipping and installation cost: Unit Sales: Year 1 2 $9,900,000 $ 100,000 Unit sold 8,000 10,000 15,500 9,500 9,500 3 4 5 Sales price per unit: $350 / unit in years 1 and 2, $300/unit in year 3,4 and 5 Variable cost per unit: SSO / unit Annual fixed costs: $ 200,000 Working Capital Requirement: There will be an initial working capital requirement of $ 100,000 just to get production started. Then, for each year, the total investment in NWC will be equal to 10% of the dollar value of sales for that year. Finally, 90 percent of the working capital is liquidated at the termination of the project at the end of year 5. years. The Depretation Method: We used the simplified straight-line method over 5 years. It is assumed that the plant and equipment will have no salvage value after 5 years. Interest Expenses: There will be an interest payment of $100,000 every year for five , a) Given the following information, Use Excel Programa and determine the free cash flows associated with the project b) Use Excel Program and calculate NPV (Net Present Value) and the IRR (Internal Rate of Return) c) According to your NPV and IRR result in section b), as a Financial Manager, do you accept or reject the preoject? Why? d) Use calculator to find the NPV ? Do you accept the project? Explain your result. c) Use Payback Period? Do you accept the project? Explain your result. 2-Suppose you have been hired as a financial advisor to a large campany. The campany is looking at setting up a manufacturing plant overseas to produce a new line of product. This will be a five-year project. The tax-rate is 35%, the expected market risk premium is 5% and Tressury-Bill Rate is given as 8% Debt: 3,000 5% coupon bond outstanding, 15 years to maturity, selling for 92 percent of par, the bond have a $1,000 par value each and make semiannual payments. Common Stock: 200,000 shares outstanding, selling for $75 per share the beta is 1.4, Preferred Stock: $150,000 shares of 5% preferred stock outstanding, selling for $60 per share, a) What's the firm Market Value and Weights of Capital Structure? b) What is the pre-tax cost of debt value? c) What is after tax cost of debt value? d) What is the cost of preferred stock value? e) What is the cost of common stock value? 1) If the campany is evaluating a new investment project that has the same risk as the firms typical project what rate should the firm use to discount the project's cash flows? How do you interpret the WACC (Weighted Average Cost of Capital) result of the campany? g) The campany's president asked you about the capital structure. He wants to know whether preferred stock or debt is cheaper. What would you suggest to your President about the current capital structure of the campany? 3. Assume that a campany has debt - equity ratio of 1.2 and after tax cost of debt is 5.7% and Weighted Average Cost of Capital is 8.9 percent. What is the value of cost of equity? Is it cheaper to use debt or equity? 4- The campany have the following estimates for the project. 2.500 USD per unit Variable Cost: 1.500 USD unit Fixed Cost: Quantity 95.000 units Price: 400.000 USD a) Suppose the campany believe the estimates are accurate only to within +/- 18%. What value should the campany use for the 3 variables (Quantity. Price and Variable Cost) when it perform it's best case senario analysis? What about the worst case senarios? Please fill in the table below. Base case Best Case Worst Case PRICE VARIABLE COST FIXED COST LOUANTITY b) Ignoring the effect of taxes, assume that initial investment is $ 200,000, required return is 10% and life time is 4 years. Calculate the Accounting break-even quantity and Financial break-even quantity for the base case. How can you interpret your result

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts