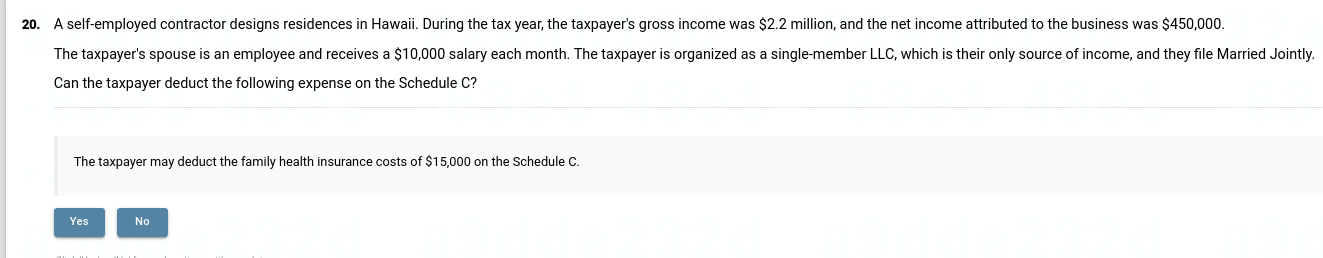

Question: 2 0 . A self - employed contractor designs residences in Hawaii. During the tax year, the taxpayer's gross income was ( $

A selfemployed contractor designs residences in Hawaii. During the tax year, the taxpayer's gross income was $ million, and the net income attributed to the business was $ The taxpayer's spouse is an employee and receives a $ salary each month. The taxpayer is organized as a singlemember LLC which is their only source of income, and they file Married Jointly. Can the taxpayer deduct the following expense on the Schedule C

The taxpayer may deduct the family health insurance costs of $ on the Schedule C

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock