Question: 2 0 b 9 3 1 / pages / ae 2 9 6 a 0 4 af 8 a 2 2 0 1 6 2

bpagesaeaafaffebdabacuserPreferredTyperead

Summary: The Cost of Capital

a Tax rate

b Tax rate

c Tax rate

d Describe the relationship between changes in the rate of taxation and the WACC. Do you think higher or lower tax rates make debt financing more attractive? Why?

LG

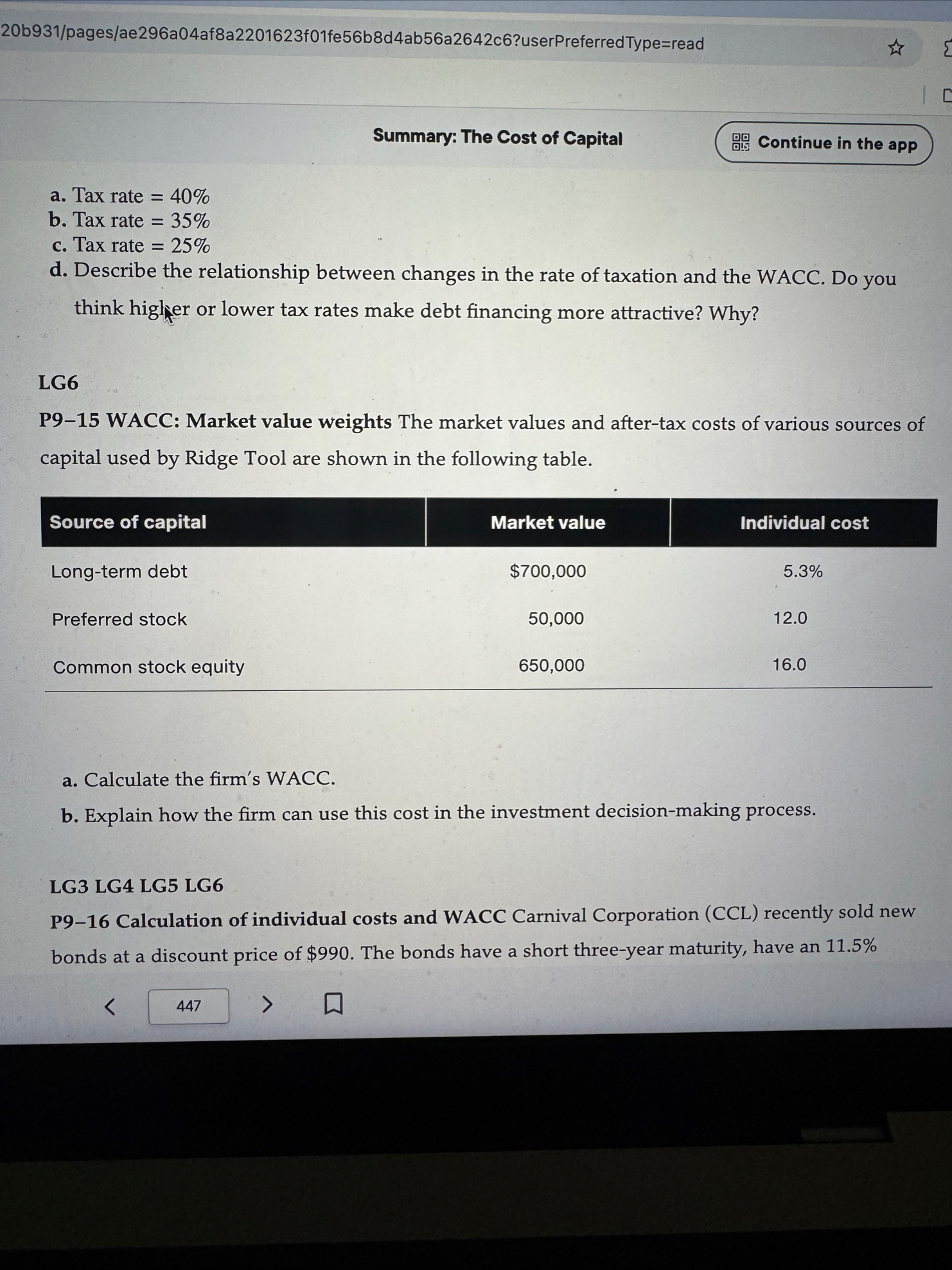

P WACC: Market value weights The market values and aftertax costs of various sources of capital used by Ridge Tool are shown in the following table.

tableSource of capital,Market value,Individual costLongterm debt,$Preferred stock,Common stock equity,

a Calculate the firm's WACC.

b Explain how the firm can use this cost in the investment decisionmaking process.

LG LG LG LG

P Calculation of individual costs and WACC Carnival Corporation CCL recently sold new bonds at a discount price of $ The bonds have a short threeyear maturity, have an

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock